- United States

- /

- Capital Markets

- /

- NasdaqGM:GCMG

GCM Grosvenor (GCMG): Is the Stock Undervalued After Recent Share Price Fluctuations?

Reviewed by Simply Wall St

GCM Grosvenor (GCMG) has seen its stock fluctuate over the past month, with a slight decline of roughly 2 percent, even as the company has maintained steady revenue growth. Investors might be watching for catalysts that could shift momentum.

See our latest analysis for GCM Grosvenor.

Zooming out, GCM Grosvenor's share price has been fairly stable compared to some peers. However, the one-year total shareholder return of -1.77 percent points to fading momentum lately, despite a solid 59.9 percent gain over three years. Recent price moves seem to reflect a more cautious risk appetite from investors as they weigh the company's long-term growth prospects against near-term headwinds.

If you’re open to fresh ideas beyond GCM Grosvenor, now is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading well below analyst targets and strong multi-year gains in the rearview mirror, the key question is whether GCM Grosvenor is undervalued, or if the market has already priced in future growth. Investors may ask whether there is a genuine buying opportunity, or if everything has already been accounted for.

Most Popular Narrative: 25.6% Undervalued

With GCM Grosvenor closing at $11.63, the most popular narrative puts fair value much higher, pointing to a sizeable disconnect between the stock’s last close and where analysts believe it could go. This pricing gap reflects ambitious forward expectations built into the narrative.

Successful expansion into infrastructure and alternative strategies, including the launch of innovative products (for example, infrastructure interval fund, partnership with Wilshire Indexes, new AI-driven efficiency initiatives), is unlocking higher-margin, long-duration revenue streams that support net margin expansion and long-term earnings growth.

Want to decode the reasoning behind this eye-catching valuation? The blueprint driving this price includes bold bets on future growth, shifts in business mix, and key margin assumptions. Curious about the forecasts that justify such optimism? See what lies behind the numbers and what could push the stock even higher.

Result: Fair Value of $15.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing fee pressures and slow retail fund growth could erode margins and test the optimistic long-term outlook that investors are currently pricing in.

Find out about the key risks to this GCM Grosvenor narrative.

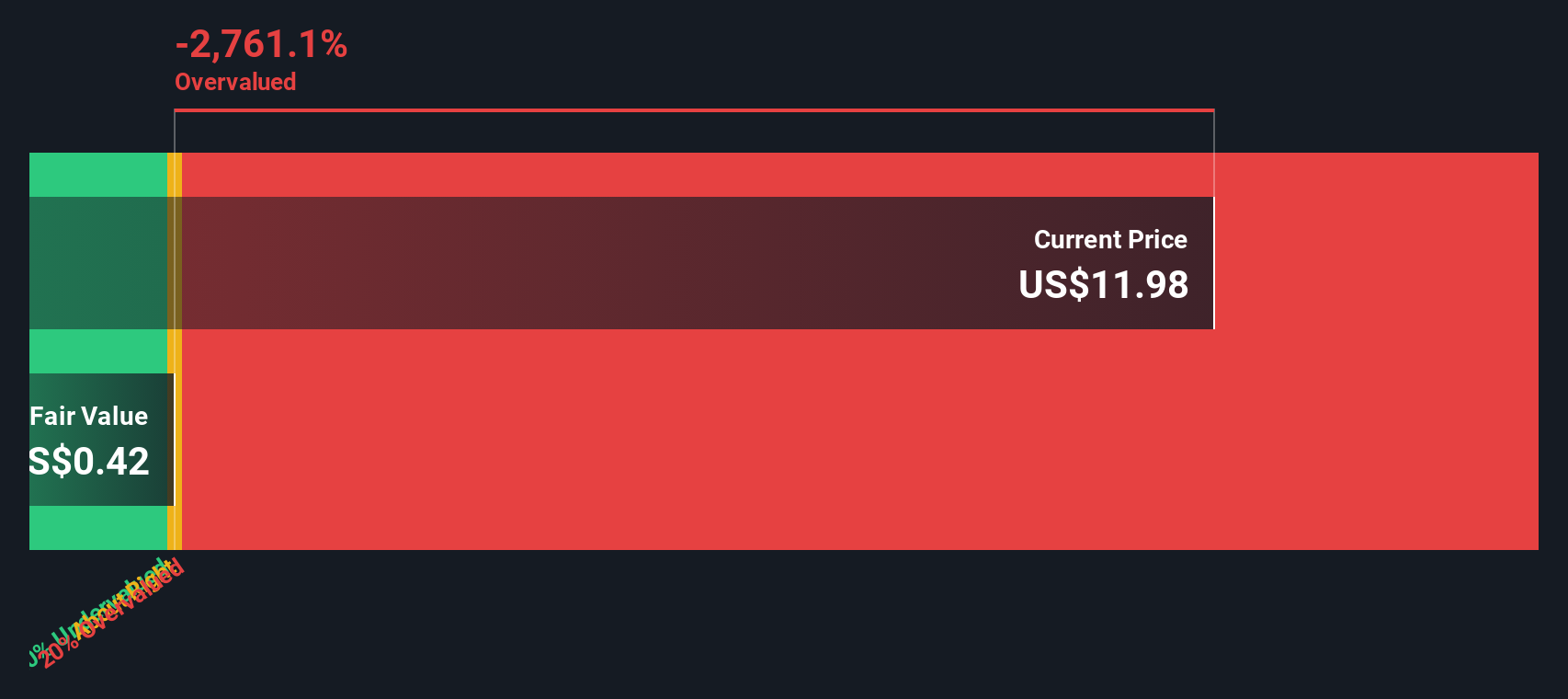

Another View: SWS DCF Model Shows a Different Picture

While analyst consensus points to significant undervaluation, our DCF model tells a more muted story for GCM Grosvenor. According to the SWS DCF approach, the stock is currently trading above its calculated fair value. This raises the question: is optimism about future earnings already reflected in the share price, or is there still hidden upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GCM Grosvenor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 838 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GCM Grosvenor Narrative

If the numbers or narratives above do not quite line up with your own research, you can test your perspective in just a few minutes and Do it your way

A great starting point for your GCM Grosvenor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want a real edge, now is your moment to check out investment ideas that could power your portfolio forward. Don’t let these opportunities pass you by. See which strategies match your style and future goals.

- Find hidden value as you tap into rapidly growing companies by using these 838 undervalued stocks based on cash flows with strong potential for outperformance.

- Strengthen your income strategy and target solid payouts by checking out these 20 dividend stocks with yields > 3% with yields above the market average.

- Capitalize on game-changing trends in artificial intelligence and spot tomorrow’s leaders early by browsing these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GCMG

GCM Grosvenor

GCM Grosvenor Inc. is global alternative asset management solutions provider.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives