- United States

- /

- Capital Markets

- /

- NasdaqCM:FRHC

FRHC Net Income Slides Despite Stable Revenue Could Margin Pressures Reshape Freedom Holding’s Story?

Reviewed by Sasha Jovanovic

- Freedom Holding Corp. released its second quarter and six-month earnings results for the period ended September 30, 2025, showing second quarter revenue of US$526.11 million and net income of US$38.72 million, both lower than the same period a year earlier.

- Despite revenue holding relatively steady, the company experienced a sharp drop in net income and earnings per share, highlighting increased cost pressures or margin contraction during the quarter.

- We'll explore how the significant year-over-year decline in profitability influences Freedom Holding's investment narrative and future prospects.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is Freedom Holding's Investment Narrative?

For anyone considering Freedom Holding as an investment, the big-picture story has always revolved around its ambitious international growth, expansion into adjacent sectors, and strong brand presence in emerging markets. The company’s second-quarter report, however, signals that rising expenses and significantly lower profits are now more than a passing concern. Unlike in prior quarters where revenue growth could mask underlying profitability issues, this time net income and margins have seen a steep year-over-year drop despite overall sales holding steady. This sharp shift might reset some assumptions about near-term catalysts, particularly around the payoff from costly expansions like the telecom move in Kazakhstan or the latest brokerage in Turkey. Risks tied to compliance and audit delays, already highlighted by past SEC and Nasdaq notices, also remain front of mind and could carry greater weight given tough earnings. While share prices have recently pulled back, it’s the confluence of cost pressure and regulatory hurdles that now dominate the short-term investment picture.

On the flip side, regulatory compliance issues are something investors shouldn’t overlook.

Exploring Other Perspectives

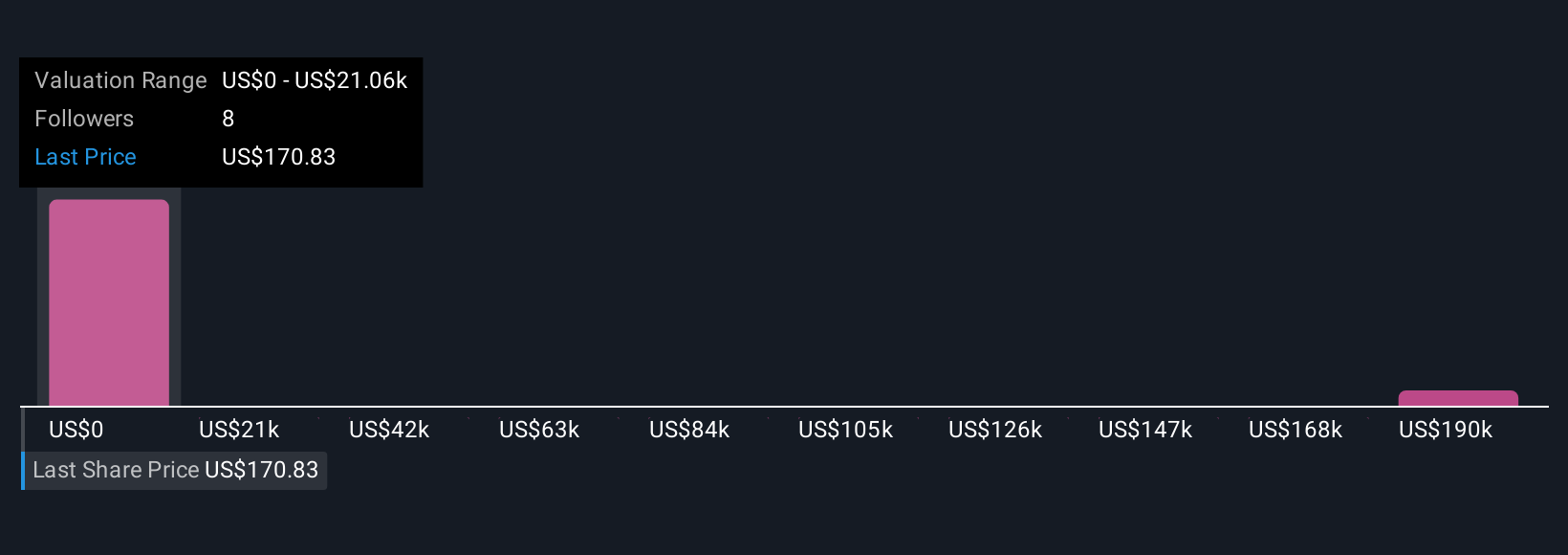

Explore 5 other fair value estimates on Freedom Holding - why the stock might be a potential multi-bagger!

Build Your Own Freedom Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freedom Holding research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Freedom Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freedom Holding's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FRHC

Freedom Holding

Through its subsidiaries, provides securities brokerage, securities dealing, market making, investment research, investment counseling, retail and commercial banking, and insurance products.

Questionable track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives