- United States

- /

- Diversified Financial

- /

- NasdaqGS:EEFT

Is Money Transfer Growth and Digital Expansion Altering the Investment Case for Euronet Worldwide (EEFT)?

Reviewed by Sasha Jovanovic

- Earlier this week, Euronet Worldwide reported strong momentum in its Money Transfer segment, reflecting continued demand for its diverse electronic payment solutions across multiple markets.

- An important takeaway is that Euronet's ongoing expansion into emerging markets and its digital transformation projects are fueling optimism despite increased regulatory and compliance demands.

- We will now explore how the robust performance of Euronet's Money Transfer segment may influence its broader investment outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Euronet Worldwide Investment Narrative Recap

To be a shareholder in Euronet Worldwide, you need conviction in the company’s ability to harness growth in digital money transfer and electronic payments, particularly in emerging markets, while successfully navigating regulatory and compliance pressures. The latest update on the Money Transfer segment reinforces a key catalyst: broad product reach and international expansion. However, while this strong segment performance affirms near-term optimism, it does not fundamentally alter the ongoing risk from heightened regulation, which remains Euronet’s most pressing challenge right now.

Among recent announcements, the collaboration with Visa to expand digital payouts is particularly relevant. By enabling access to 4 billion Visa cards for cross-border transfers, Euronet strengthens its digital infrastructure, supporting its primary short-term growth driver. This development underscores the company’s focus on capturing the digital migration in money movement and scaling new platforms that may offset the margin pressures from legacy business decline.

But even as Euronet accelerates digital initiatives, investors should be aware that risks tied to new remittance taxes and shifting compliance standards could...

Read the full narrative on Euronet Worldwide (it's free!)

Euronet Worldwide's narrative projects $5.2 billion revenue and $476.3 million earnings by 2028. This requires 8.2% yearly revenue growth and a $143.6 million increase in earnings from $332.7 million.

Uncover how Euronet Worldwide's forecasts yield a $117.43 fair value, a 63% upside to its current price.

Exploring Other Perspectives

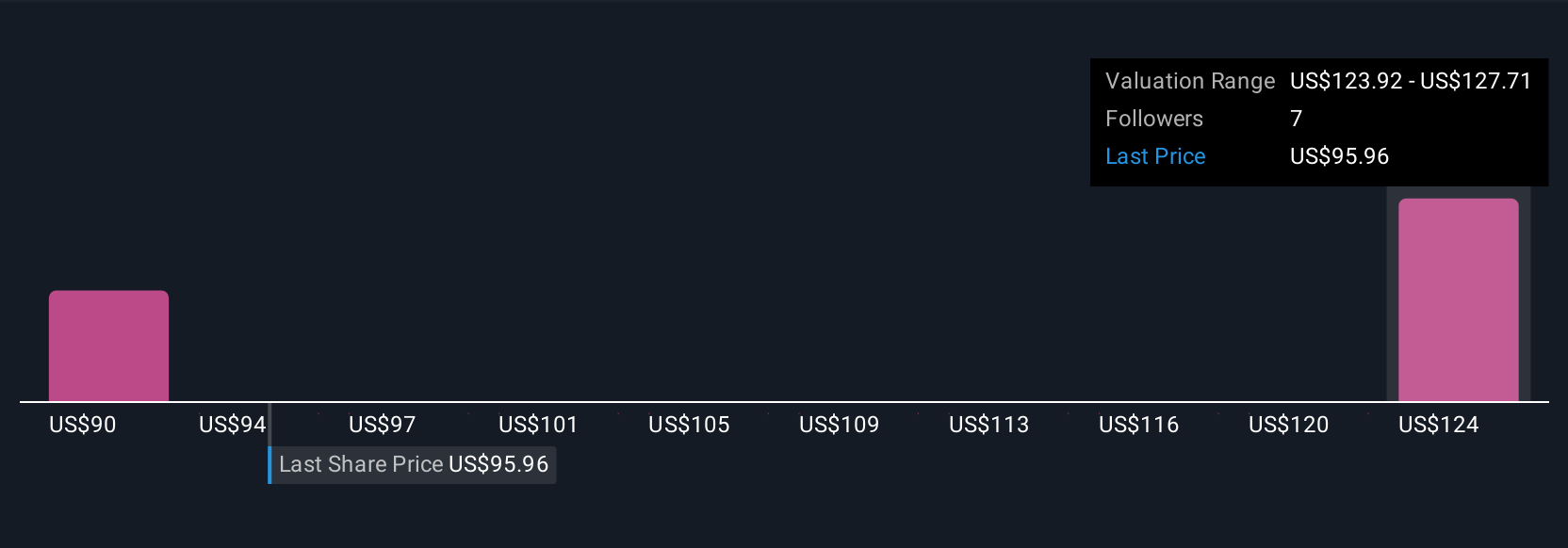

Simply Wall St Community members currently estimate Euronet’s fair value between US$92.51 and US$117.43 from three independent viewpoints. Intense regulatory and tax pressures remain at the forefront, prompting many to re-examine the sustainability of segment margins in global markets.

Explore 3 other fair value estimates on Euronet Worldwide - why the stock might be worth as much as 63% more than the current price!

Build Your Own Euronet Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Euronet Worldwide research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Euronet Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Euronet Worldwide's overall financial health at a glance.

No Opportunity In Euronet Worldwide?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Euronet Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EEFT

Euronet Worldwide

Provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives