- United States

- /

- Diversified Financial

- /

- NasdaqGS:DLO

Did dLocal's (DLO) Unified BNPL Platform Just Redefine Its Merchant Appeal in Emerging Markets?

Reviewed by Sasha Jovanovic

- In recent days, dLocal launched BNPL Fuse, a unified Buy Now, Pay Later aggregator for emerging markets, and partnered with Kueski to bring flexible payment options to Mexican consumers via this new platform.

- This marks the first effort to centralize multiple local BNPL providers through a single API and contract, streamlining access for merchants across Latin America, Africa, the Middle East, and Asia.

- We'll look at how consolidating BNPL providers into a single platform could influence dLocal's merchant appeal and future growth prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

DLocal Investment Narrative Recap

To be a shareholder in dLocal, you need to believe in the company's ability to keep expanding its payments platform across fast-growing emerging markets, with products tailored for local needs. The recent launch of BNPL Fuse could help differentiate dLocal among merchants and support near-term growth, but the company remains highly exposed to a handful of major clients, and this concentration risk likely keeps customer churn as the most important concern for now.

The new partnership with Kueski, Mexico's largest BNPL provider, directly integrates into dLocal’s BNPL Fuse platform, giving international merchants easier access to Mexican e-commerce buyers through flexible payment options, and strengthening the relevance of dLocal’s solution suite as a growth driver. However, as dLocal continues to centralize payment methods, it will need to balance merchant demand for innovation with the risks of sustaining pricing power in a competitive market.

But with competitor pressure and merchant concentration still in focus, investors should watch for...

Read the full narrative on DLocal (it's free!)

DLocal's outlook points to $1.7 billion in revenue and $346.3 million in earnings by 2028. This is based on a projected annual revenue growth rate of 25.7% and a $200.4 million increase in earnings from the current $145.9 million level.

Uncover how DLocal's forecasts yield a $16.61 fair value, a 11% upside to its current price.

Exploring Other Perspectives

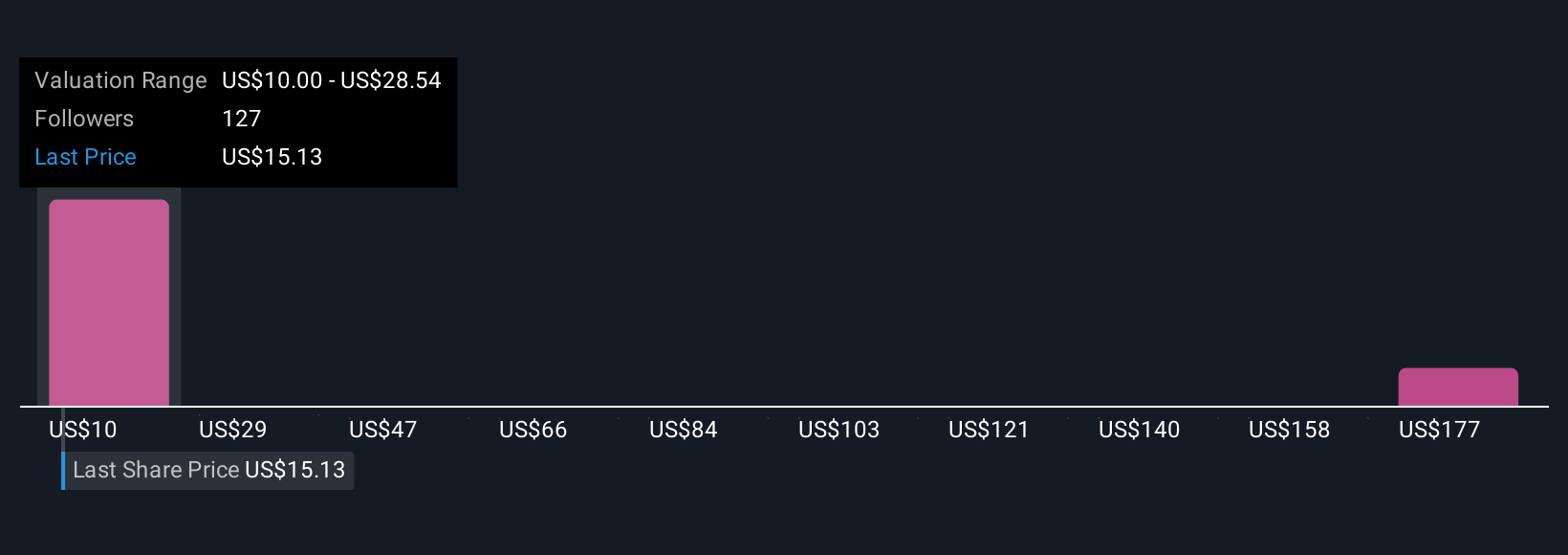

Private fair value forecasts from 21 Simply Wall St Community members range from as low as US$10 to US$195.39, reflecting sharply opposing views. While some anticipate upside, ongoing customer concentration could weigh heavily on dLocal's future predictability so it pays to study several perspectives before making up your mind.

Explore 21 other fair value estimates on DLocal - why the stock might be a potential multi-bagger!

Build Your Own DLocal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DLocal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DLocal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DLocal's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLO

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives