- United States

- /

- Capital Markets

- /

- NasdaqGS:DHIL

Diamond Hill (DHIL) Profit Margin Reaches 31.7%, Challenging Discounted Valuation Narratives

Reviewed by Simply Wall St

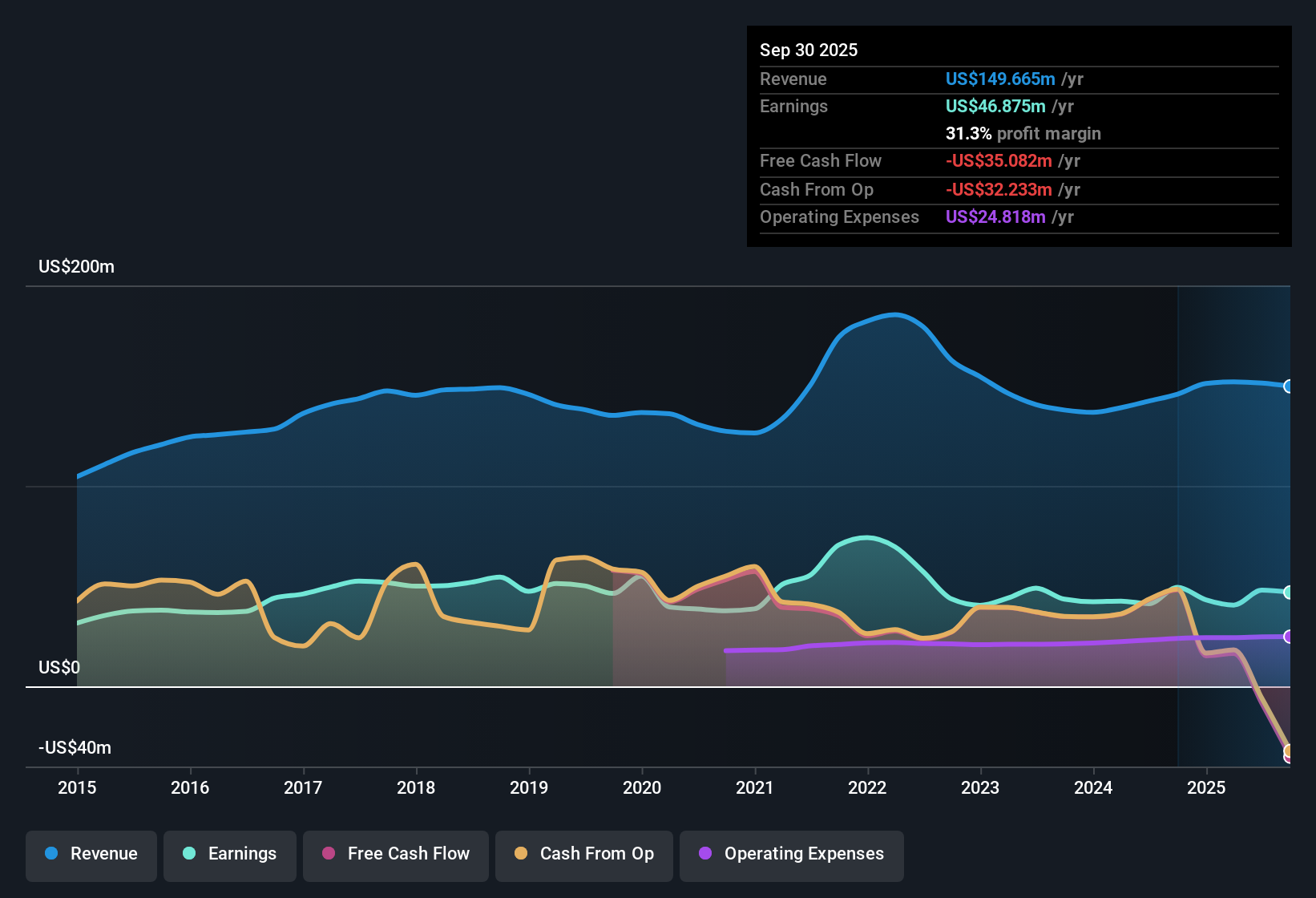

Diamond Hill Investment Group (DHIL) reported a net profit margin of 31.7%, up from 29% the previous year, and posted 16.3% earnings growth year-over-year. This result is well above its five-year average decline of 5% per year. The company is trading at a Price-to-Earnings ratio of 7.2x, notably below both the US Capital Markets industry average of 25.2x and its peer average of 44.2x. Shares closed at $126.29, which remains under the estimated fair value of $183.16. The combination of improved profitability and seemingly attractive valuation multiples presents an intriguing picture for investors, especially given DHIL's high-quality earnings profile and the single concern related to dividend sustainability.

See our full analysis for Diamond Hill Investment Group.Next, we'll see how these headline results stack up against the current narratives. Some expectations could be confirmed, while others might prompt new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Hit Multi-Year High

- Net profit margin reached 31.7% for the year, marking a clear improvement over last year’s 29% and well above the company’s five-year average. Over the past five years, the company experienced a -5% annual earnings decline.

- Strong bottom-line performance directly supports the perspective that current results are high quality,

- Recent margin expansion underscores confidence in the company’s operational discipline and outpaces the long-run trend of declining earnings.

- While bulls see this as a sign that DHIL is benefiting from positive operating leverage, the figures show that the margin uplift is unusually strong compared to its five-year history.

Value Gap Widens Versus Peers

- The Price-to-Earnings ratio for DHIL stands at 7.2x, which is far below both the US Capital Markets industry average of 25.2x and the peer group average of 44.2x.

- This unusually low multiple highlights a value opportunity,

- Investors viewing the current 7.2x P/E in the context of the company’s improved margin may find the discount especially noteworthy given that the share price of $126.29 is also trading well below the DCF fair value of $183.16.

- The data challenges any narrative that Diamond Hill is “cheap for a reason,” as strong recent profitability suggests fundamental support for a potential re-rating.

Dividend Sustainability Now On Watch

- Dividend sustainability is the single risk explicitly identified in the latest filings, with no other major risks or red flags flagged in the report itself.

- Despite the strong margin improvement and low P/E, investors may want to dig into the dividend detail,

- If the quality of earnings can be maintained at these higher levels, the lone risk would be that future payouts could come under pressure if growth slows or if cash needs shift in the coming years.

- The risk section serves as a reality check for bullish investors, reminding them that a seemingly strong headline figure can sometimes mask long-term payout vulnerabilities.

If you want to see how numbers like these fit into the bigger picture, don't miss the full Consensus Narrative for Diamond Hill Investment Group, which weighs the strengths and risks in greater depth. 📊 Read the full Diamond Hill Investment Group Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Diamond Hill Investment Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Diamond Hill’s margin gains and low valuation, the primary concern remains whether its dividends are sustainable, as payout pressures could emerge if growth slows.

If reliable income is a priority, check out these 2003 dividend stocks with yields > 3% to discover companies with yields over 3% that may offer more secure and consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DHIL

Diamond Hill Investment Group

Through its subsidiary, Diamond Hill Capital Management, Inc., provides investment advisory and fund administration services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives