- United States

- /

- Capital Markets

- /

- NasdaqGS:CSWC

Can Capital Southwest’s (CSWC) Diversification Push Lead to Sustainable Growth and Stronger Financial Flexibility?

Reviewed by Sasha Jovanovic

- Capital Southwest Corporation announced its second quarter 2026 results, reporting quarterly revenue of US$56.95 million and net income of US$25.62 million, both up from the prior year, alongside a US$350 million unsecured notes issuance used to redeem near-term debt.

- An interesting aspect is management's stated intention to monetize the company’s investment platform and generate additional fee income, pointing to ongoing efforts to diversify revenue sources and support long-term growth.

- We'll examine how Capital Southwest's revenue and income growth, combined with a stronger balance sheet, influences its current investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Capital Southwest Investment Narrative Recap

To be a Capital Southwest shareholder is to believe in the company’s ability to capitalize on lower middle market lending opportunities, while navigating margin pressures and sustaining dividends. The recent revenue and income growth, aided by the US$350 million unsecured notes issuance and stronger balance sheet, reinforces confidence in their growth catalyst but does not materially change the primary near-term risk of spread compression and earnings variability from competitive lending dynamics.

One recent announcement of particular relevance is Capital Southwest’s completion of a US$350 million unsecured notes offering, which was used to redeem near-term debt. This move aligns with management’s focus on balance sheet strength and maintaining conservative leverage. Enhanced financial flexibility may help the company support new investments and withstand competitive loan pricing pressures, a key issue for lenders in this segment.

Yet, despite these improvements, investors should be aware that continued pressure on net interest margins poses a risk if...

Read the full narrative on Capital Southwest (it's free!)

Capital Southwest's narrative projects $283.9 million revenue and $196.4 million earnings by 2028. This requires 10.7% yearly revenue growth and a $113.9 million earnings increase from $82.5 million.

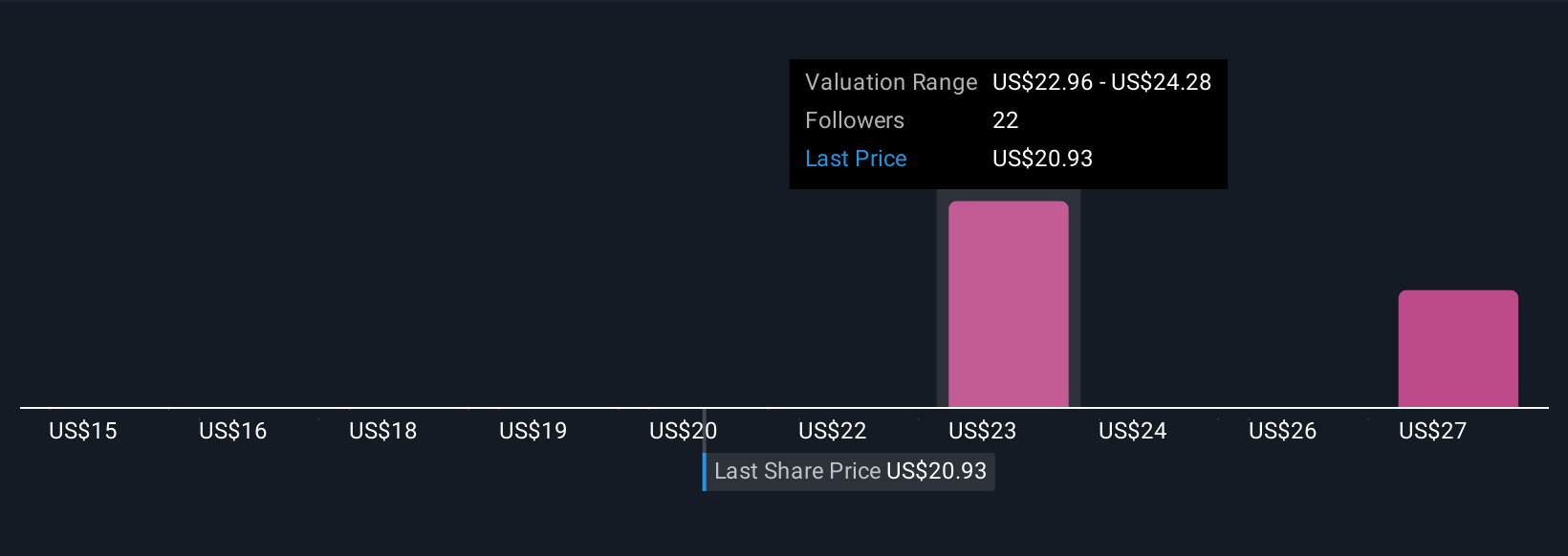

Uncover how Capital Southwest's forecasts yield a $24.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for Capital Southwest range from US$18.95 to US$28.26, based on six independent views from the Simply Wall St Community. With this much variation, and competitive forces still pressuring net interest margins, it’s worth exploring a range of opinions on where the company could go next.

Explore 6 other fair value estimates on Capital Southwest - why the stock might be worth 9% less than the current price!

Build Your Own Capital Southwest Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital Southwest research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Capital Southwest research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital Southwest's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSWC

Capital Southwest

Specializes in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, industry consolidation, recapitalizations and growth capital investments.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives