- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Could Coinbase (COIN) Partnerships Reveal a New Long-Term Edge in Institutional Digital Assets?

Reviewed by Sasha Jovanovic

- Recently, Eightco Holdings Inc. revealed that Coinbase has joined the pilot of INFINITY Authentication, a platform aimed at providing secure and AI-resistant authentication for the financial services sector, while Coinbase also expanded institutional offerings through partnerships, including with Citi and Galaxy Digital.

- Coinbase’s ongoing moves, including reported late-stage acquisition talks for stablecoin infrastructure startup BVNK and a growing focus on security and institutional clients, underscore how the company is targeting rapid adaptation in the evolving digital asset landscape.

- Next, we’ll explore how expanded institutional partnerships, particularly Citi’s collaboration, could influence Coinbase's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Coinbase Global Investment Narrative Recap

To own shares in Coinbase Global, you need to believe that institutional adoption of crypto, broader blockchain integration, and growing demand for secure digital asset management will offset short-term volatility and regulatory uncertainty. The recent INFINITY Authentication pilot with Eightco strengthens Coinbase's security posture, but does not appear to materially change the most important near-term catalyst: sustaining or growing trading volumes amid market shifts; nor does it meaningfully reduce ongoing cybersecurity risks.

Among recent announcements, Coinbase's partnership with Citi stands out as most relevant: it directly supports the company’s efforts to expand institutional payment capabilities. This collaboration, announced just days before the INFINITY pilot, aligns with Coinbase’s intention to enable more seamless crypto-to-fiat transactions, a core area for future revenue diversification if trading activity moderates.

By contrast, investors should be aware that despite these partnership advances, the concentration of revenues in trading activity still means that ...

Read the full narrative on Coinbase Global (it's free!)

Coinbase Global's narrative projects $8.5 billion revenue and $2.1 billion earnings by 2028. This requires 8.3% yearly revenue growth and a $0.8 billion decrease in earnings from the current $2.9 billion.

Uncover how Coinbase Global's forecasts yield a $382.56 fair value, a 24% upside to its current price.

Exploring Other Perspectives

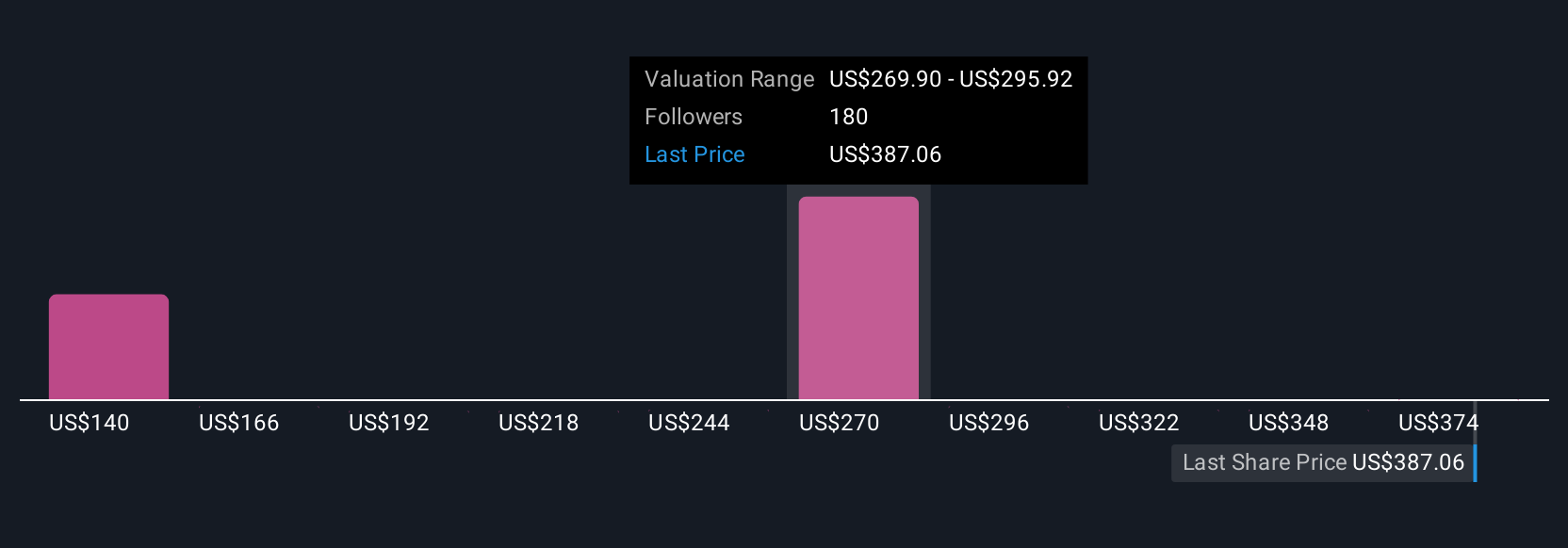

The Simply Wall St Community’s 29 fair value estimates for Coinbase Global range from US$136 to US$510 per share, reflecting significant differences in outlook. While some see opportunity in institutional partnerships and product expansion, others emphasize the uncertainties posed by fluctuating crypto trading volumes and evolving competition; consider how widely investor opinions can differ and explore several analyses before concluding.

Explore 29 other fair value estimates on Coinbase Global - why the stock might be worth less than half the current price!

Build Your Own Coinbase Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coinbase Global research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Coinbase Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coinbase Global's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives