- United States

- /

- Capital Markets

- /

- NasdaqGS:CME

CME Group (CME): Evaluating Valuation as Crypto Product Expansion Fuels Investor Interest

Reviewed by Simply Wall St

CME Group (CME) has sparked investor interest with its recent rollout of options on Solana and XRP futures, as well as by introducing 24/7 trading for swap-based event contracts tied to cryptocurrencies and major economic data.

See our latest analysis for CME Group.

CME Group’s flurry of crypto initiatives and its global expansion in Dubai have come during a period of solid momentum for shareholders. While Q3 results showed a minor dip in quarterly revenues, the company’s longer-term performance speaks for itself. CME delivered a stellar 24% total shareholder return over the past year, with its 3-year and 5-year total returns coming in at nearly 80% and 118% respectively. These growth figures, paired with resilient profits and expanding product lines, have helped sustain positive sentiment around the stock even as some contract volumes fluctuated in recent months.

If CME’s push into new asset classes has you curious about what else is out there, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With CME’s momentum, product innovation and shareholder returns, investors face a key question: is CME Group undervalued given its forward-looking moves, or is future growth already fully reflected in today’s share price?

Most Popular Narrative: 3.9% Undervalued

With CME Group’s last close at $271.09 and the most widely-followed narrative tagging fair value at $282.11, the valuation sits just above current market pricing. This hints at moderate upside potential if the narrative’s outlook proves correct.

Robust international expansion, with record-breaking double-digit ADV growth across EMEA and APAC, and rising participation from both institutional and retail clients globally, broadens CME's addressable market and underpins future volume and revenue growth. The rapid acceleration of retail engagement, highlighted by a 56% increase in new retail traders and five consecutive quarters of double-digit retail client acquisition growth, diversifies CME's client base and supports both volume and transaction-based revenue growth.

Want to see what’s powering this optimism? The fair value math stacks up only if future expansion, rising margins, and a bold earnings leap actually materialize. Which metric could move the market most? Dive in to unravel the forecast shaping this price target.

Result: Fair Value of $282.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged calm in global markets or accelerated adoption of decentralized finance could weaken demand for CME’s products and challenge this growth story.

Find out about the key risks to this CME Group narrative.

Another View: Looking at Valuation Through Multiples

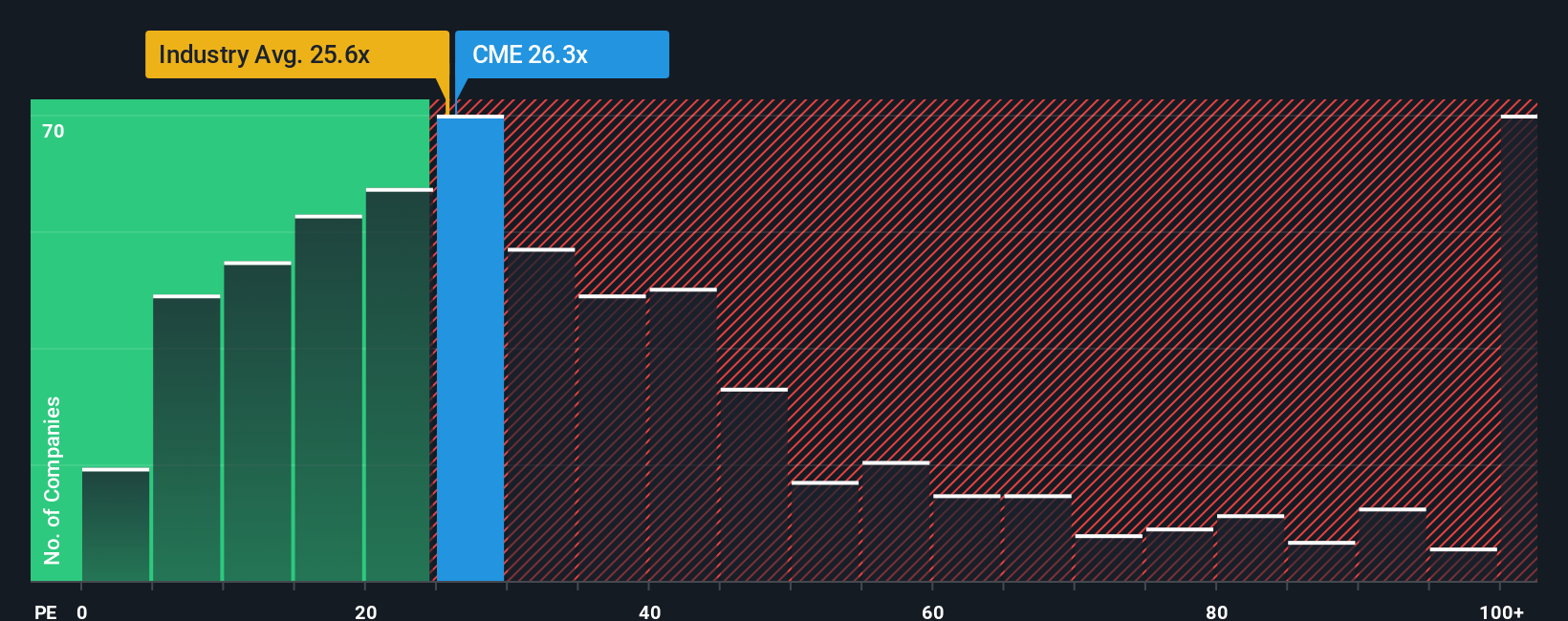

Switching gears from fair value estimates, let's look at how CME trades compared to peers using the price-to-earnings ratio. CME shares currently trade at 26.3x earnings, which is just below the US Capital Markets industry average (27x) and well below the peer group average (35x). However, compared to the calculated fair ratio of 17.8x, CME appears expensive and this highlights potential valuation risk if market expectations recalibrate. Which approach gives investors the better read?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CME Group Narrative

If you see things differently or want to chart your own course with the numbers, you can generate your own viewpoint in just a few minutes: Do it your way

A great starting point for your CME Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait on the sidelines while the next big opportunity takes shape. There is a world of smart investing plays at your fingertips with Simply Wall Street.

- Capitalize on high-yield opportunities when you check out these 19 dividend stocks with yields > 3% with stable returns that can power up your portfolio.

- Spot innovative trends and tap into future growth by exploring these 27 AI penny stocks that are reshaping industries worldwide.

- Take advantage of market mispricings by seizing these 870 undervalued stocks based on cash flows before they are widely recognized by others.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CME

CME Group

Operates contract markets for the trading of futures and options on futures contracts worldwide.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives