- United States

- /

- Consumer Services

- /

- NYSE:SCI

How SCI’s Canadian Expansion Plans and Cremation Strategy Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Service Corporation International recently presented at the Stephens Annual Investment Conference 2025 in Nashville, outlining its plans to adapt to consumer preferences and potential expansion into Canada.

- A particularly material development is the company’s emphasis on stabilizing cremation trends while targeting a significant market share increase through disciplined acquisitions.

- We’ll examine how SCI’s focus on market share expansion and acquisition strategy could influence its investment outlook moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Service Corporation International Investment Narrative Recap

To believe in Service Corporation International as a shareholder today, you need confidence in its ability to gain market share and drive earnings growth through acquisition and service innovation in the evolving North American deathcare market. The recent focus at the Stephens Investment Conference on disciplined acquisitions and stabilizing cremation trends aligns directly with this thesis, and while these initiatives address the most important near-term catalysts, they do not materially change the principal risk: continued pressure from higher cremation rates weighing on margins and organic revenue growth.

Among recent announcements, SCI's interest in a potential expansion into Canada through an acquisition of Arbor Memorial stands out. This move directly supports the company’s goal of increasing market share by up to 30 percent, reinforcing its acquisition-led growth strategy and tying into the company’s short-term ambitions, albeit with the attendant risk of integration complexity and market execution.

By contrast, investors should be aware that as cremation trends stabilize, other factors such as the unpredictability of preneed and large cemetery sales may still...

Read the full narrative on Service Corporation International (it's free!)

Service Corporation International's outlook anticipates $4.7 billion in revenue and $656.4 million in earnings by 2028. This is based on an annual revenue growth rate of 3.5% and reflects a $121.5 million earnings increase from the current $534.9 million.

Uncover how Service Corporation International's forecasts yield a $95.40 fair value, a 21% upside to its current price.

Exploring Other Perspectives

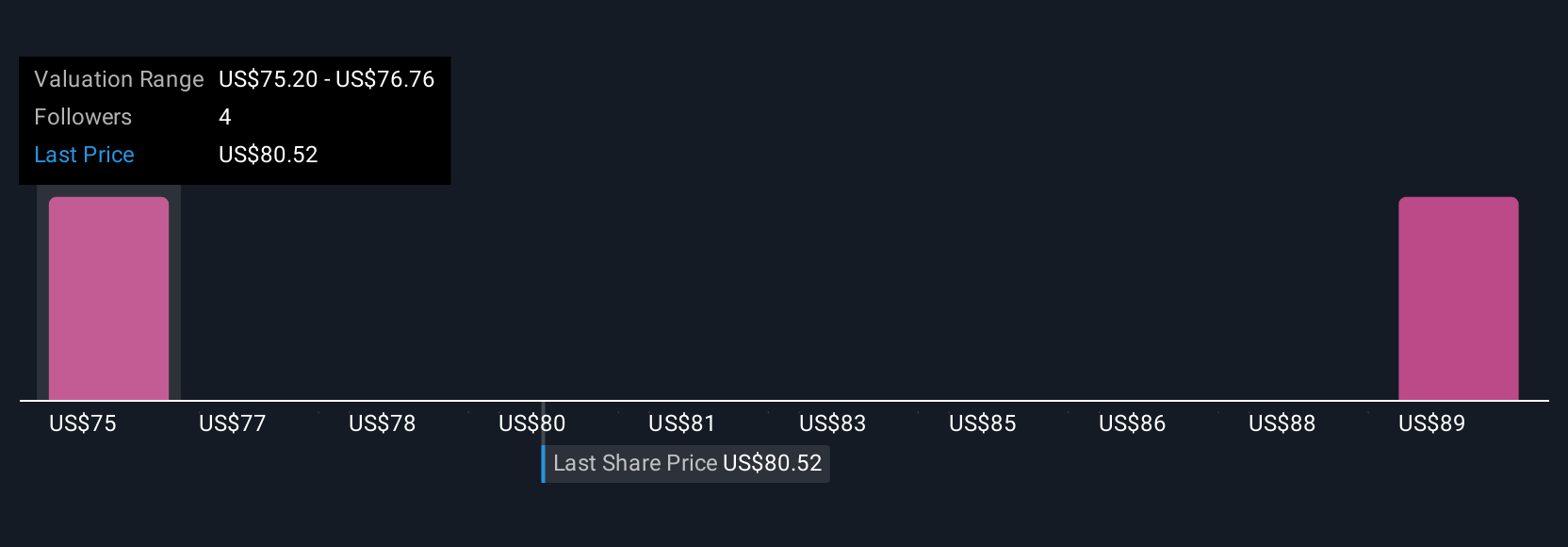

Simply Wall St Community members provide two fair value estimates for SCI between US$95.40 and US$102.74 per share. While investors’ outlooks vary, the risk of acquisition-driven growth facing integration and execution hurdles could play a significant role in future returns.

Explore 2 other fair value estimates on Service Corporation International - why the stock might be worth as much as 30% more than the current price!

Build Your Own Service Corporation International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Service Corporation International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Service Corporation International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Service Corporation International's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCI

Service Corporation International

Provides deathcare products and services in the United States and Canada.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives