- United States

- /

- Consumer Services

- /

- NYSE:NRDY

Take Care Before Jumping Onto Nerdy, Inc. (NYSE:NRDY) Even Though It's 29% Cheaper

Unfortunately for some shareholders, the Nerdy, Inc. (NYSE:NRDY) share price has dived 29% in the last thirty days, prolonging recent pain. Longer-term, the stock has been solid despite a difficult 30 days, gaining 20% in the last year.

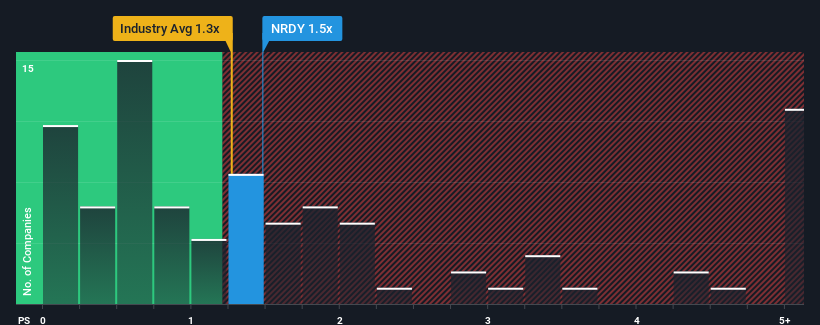

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Nerdy's P/S ratio of 1.5x, since the median price-to-sales (or "P/S") ratio for the Consumer Services industry in the United States is also close to 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Nerdy

How Has Nerdy Performed Recently?

Recent revenue growth for Nerdy has been in line with the industry. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Keen to find out how analysts think Nerdy's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Nerdy's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen an excellent 73% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 22% per year during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 17% per annum, which is noticeably less attractive.

With this information, we find it interesting that Nerdy is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

With its share price dropping off a cliff, the P/S for Nerdy looks to be in line with the rest of the Consumer Services industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Nerdy currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Nerdy that you need to be mindful of.

If you're unsure about the strength of Nerdy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nerdy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NRDY

Undervalued with excellent balance sheet.

Market Insights

Community Narratives