- United States

- /

- Hospitality

- /

- NYSE:MSC

Studio City International Holdings (NYSE:MSC) adds US$206m to market cap in the past 7 days, though investors from five years ago are still down 52%

Studio City International Holdings Limited (NYSE:MSC) shareholders should be happy to see the share price up 19% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been disappointing. The share price has failed to impress anyone , down a sizable 52% during that time. So we're hesitant to put much weight behind the short term increase. Of course, this could be the start of a turnaround.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for Studio City International Holdings

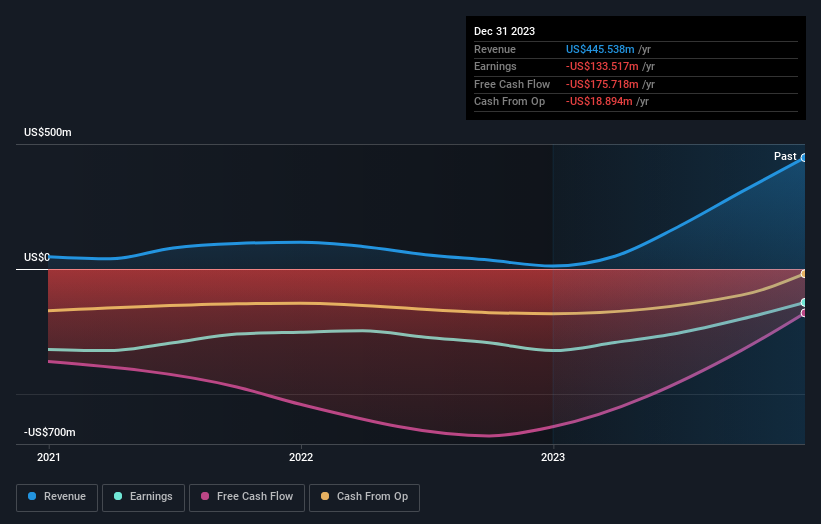

Studio City International Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade Studio City International Holdings reduced its trailing twelve month revenue by 36% for each year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 9% (annualized) in the same time period. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Studio City International Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Studio City International Holdings provided a TSR of 16% over the last twelve months. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 9% per year, over five years. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Studio City International Holdings (2 make us uncomfortable!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MSC

Studio City International Holdings

Operates an entertainment resort in Macau.

Low with imperfect balance sheet.