- United States

- /

- Consumer Services

- /

- NYSE:HRB

Assessing H&R Block After a 5% Drop and Digital Tax Competition News

Reviewed by Bailey Pemberton

- Wondering if H&R Block is a hidden deal or just another stock on your watchlist? Let's get straight to the facts as we dig into what really matters for value-minded investors.

- Shares have dipped recently, with a 5.1% decline in the past week and a 3.9% drop over the last month. If you zoom out, H&R Block is still up an impressive 221.7% over five years, highlighting a big-picture growth story.

- Much of the recent movement ties back to shifts in the competitive landscape and broader market sentiment around consumer financial services. News about evolving digital tax platforms and changing regulations has added some uncertainty, but it has also raised new questions about where H&R Block fits in the future of tax preparation.

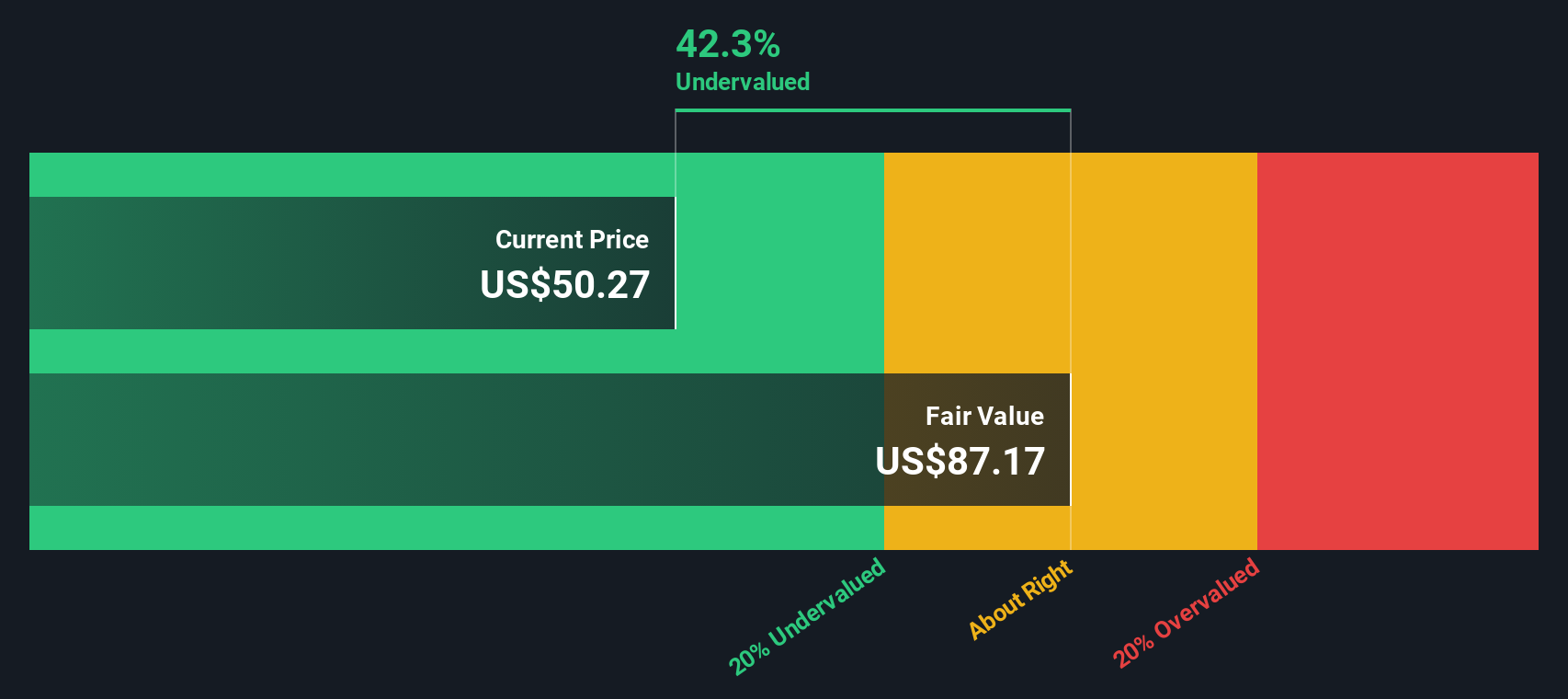

- When it comes to valuation, H&R Block scores a 5 out of 6 on our valuation checks, meaning it ticks nearly every box for being undervalued. Next, we will break down what approaches go into that score and why the real secret to smart investing might go even deeper.

Find out why H&R Block's -15.2% return over the last year is lagging behind its peers.

Approach 1: H&R Block Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s value. For H&R Block, this approach begins with the company’s most recent Free Cash Flow, reported at $606 million over the last twelve months. Projections indicate modest annual fluctuations, with Free Cash Flow expected around $585 million in 2026 and gradually rising to about $665 million by 2035. These forecasts rely on available analyst estimates for the next five years, while later years are extrapolated to complete the ten-year view.

All cash flows are reported in US dollars, which is also the currency of H&R Block’s share price. Using the 2 Stage Free Cash Flow to Equity model, the DCF calculation results in an intrinsic value of $89.74 per share. This valuation suggests the stock is trading at a 44.6% discount compared to its intrinsic worth.

In other words, the current price reflects a significant undervaluation based on expected future cash generation. For investors seeking value, the DCF points to meaningful upside if these projections hold.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests H&R Block is undervalued by 44.6%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

Approach 2: H&R Block Price vs Earnings

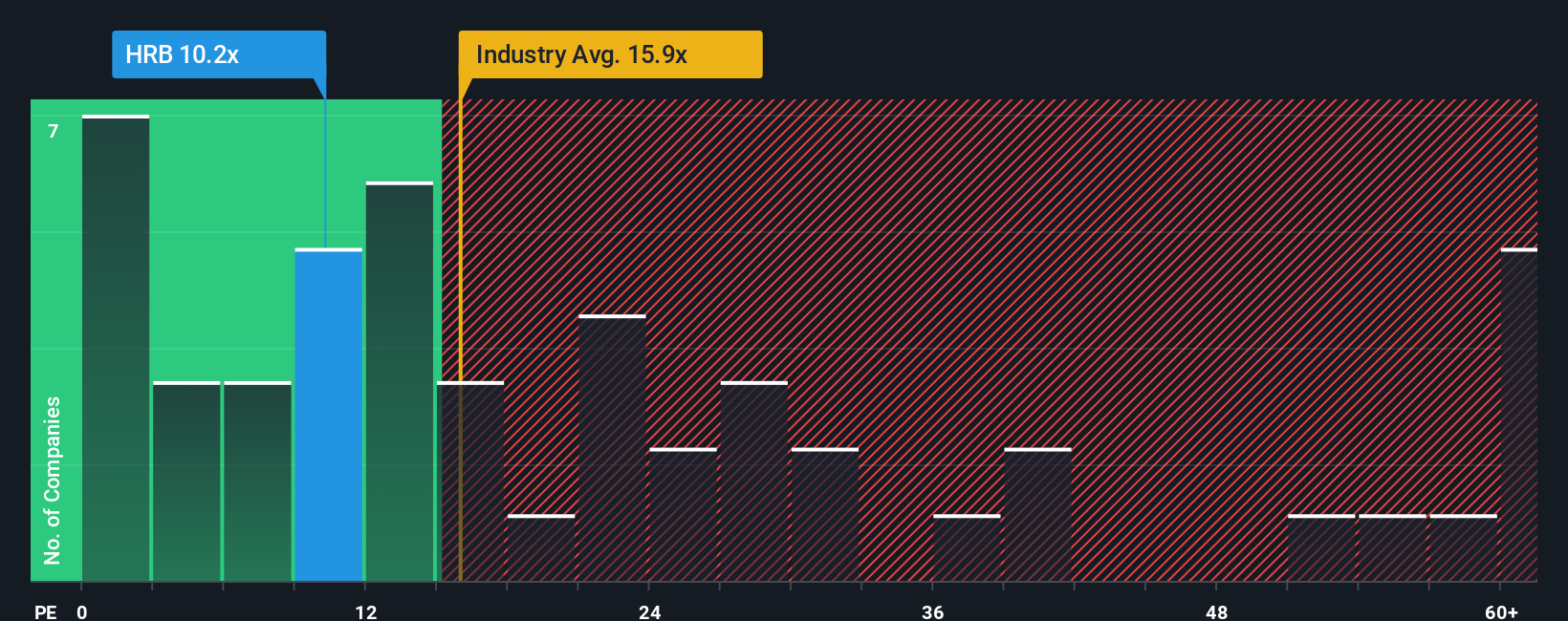

For profitable companies like H&R Block, the Price-to-Earnings (PE) ratio offers one of the most direct ways to value the stock. It expresses what investors are willing to pay for a dollar of current earnings, making it a widely respected yardstick among value-focused investors.

A "normal" or "fair" PE ratio can vary based on how quickly a business is growing, perceived stability or risk, and wider market sentiment. Higher expected growth or lower risk typically justify a higher PE, while the opposite brings it down. For H&R Block, its current PE stands at 10.5x, which is significantly lower than both the industry average of 18.8x and the average among listed peers at 18.0x.

Diving deeper, Simply Wall St’s proprietary “Fair Ratio” estimates the multiple a company deserves by factoring in growth prospects, risk profile, profit margins, industry trends, and market capitalization. This provides a tailored benchmark. In this case, H&R Block's Fair PE is calculated at 17.4x, suggesting what a truly reasonable valuation should look like, compared to the "one size fits all" industry or peer averages. Because H&R Block’s current PE is much lower than its Fair Ratio, it indicates the company is trading at a meaningful discount to its justified earnings value.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your H&R Block Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story, your unique perspective or investment thesis, about where H&R Block is heading and why, combined with your own fair value and expectations for future revenue, earnings, and margins.

Rather than just crunching numbers, Narratives connect the dots between a company’s story and the financial forecast that underpins what you believe its shares are worth. This makes the math personal, transparent, and actionable for every investor. Narratives are available to everyone on Simply Wall St’s Community page, where millions of investors share and update their outlooks in real time as the news changes or earnings come out, keeping your decision-making grounded in the current reality.

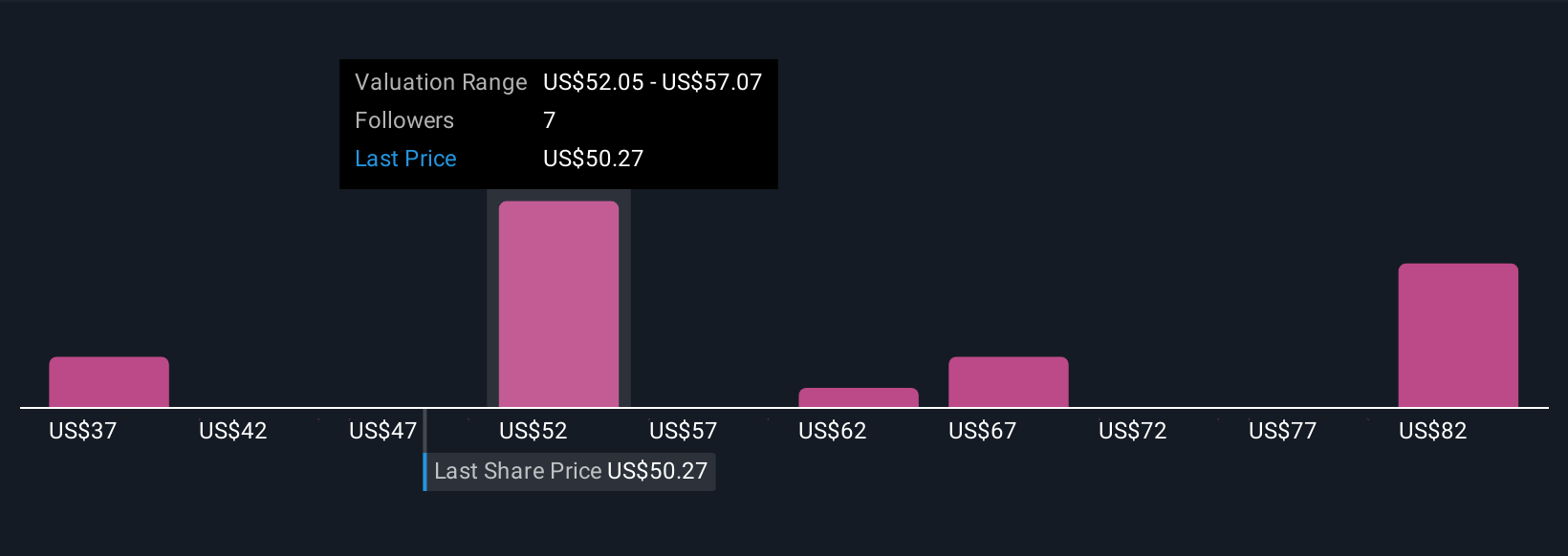

This approach means you can see precisely when your story, your fair value, and the latest price suggest an opportunity to buy, sell, or hold. This makes every investment choice smarter and more dynamic. For example, some investors may believe H&R Block’s expansion into digital tax and small business services will accelerate growth and justify a bullish price target of $62 per share. Others, concerned that digital disruption could slow progress, may see $48 per share as fair value. Both are valid perspectives shaped by their own forecasts and risk tolerance.

Do you think there's more to the story for H&R Block? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H&R Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRB

H&R Block

Through its subsidiaries, provides assisted and do-it-yourself (DIY) tax return preparation services in the United States, Canada, and Australia.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives