- United States

- /

- Consumer Services

- /

- NYSE:GHC

Graham Holdings (GHC): Assessing Valuation Following Strong Q3 Earnings and Segment Growth

Reviewed by Simply Wall St

Graham Holdings (GHC) just posted third quarter earnings that caught attention, thanks to double-digit increases in both revenue and net income compared to last year. Key growth drivers included the healthcare, Kaplan, and manufacturing segments.

See our latest analysis for Graham Holdings.

Graham Holdings’ solid third quarter capped off a year of steady momentum. The share price climbed over 21% year-to-date and the company notched a 10% total shareholder return over the past twelve months. While management continues to balance growth with select buybacks and occasional asset impairments, investors appear to be rewarding the company’s diversified earnings stream and resilience across market cycles.

If strong, steady growth stories get you thinking about what else is out there, now’s the perfect time to discover fast growing stocks with high insider ownership

With such strong recent performance, the big question is whether Graham Holdings' impressive run has already been fully factored into its share price, or if current levels still leave room for patient investors to gain from future growth.

Price-to-Earnings of 6.3x: Is it justified?

At a price-to-earnings (P/E) ratio of 6.3x, Graham Holdings looks attractively valued compared to its industry and peers, given the last close at $1,049.49.

The P/E ratio measures what investors are willing to pay today for a dollar of current earnings. For a company like Graham Holdings, which has demonstrated consistent earnings growth, a lower P/E could suggest the market is underestimating its future potential.

Graham Holdings’ current multiple stands out as a bargain versus the US Consumer Services industry average of 15.9x and a peer group average of 21.4x. The significant discount could catch the attention of value-focused investors, especially given the company’s recent strong performance and robust profit growth.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.3x (UNDERVALUED)

However, it's worth noting that analyst price targets are below current levels. Future growth could slow if industry conditions shift unexpectedly.

Find out about the key risks to this Graham Holdings narrative.

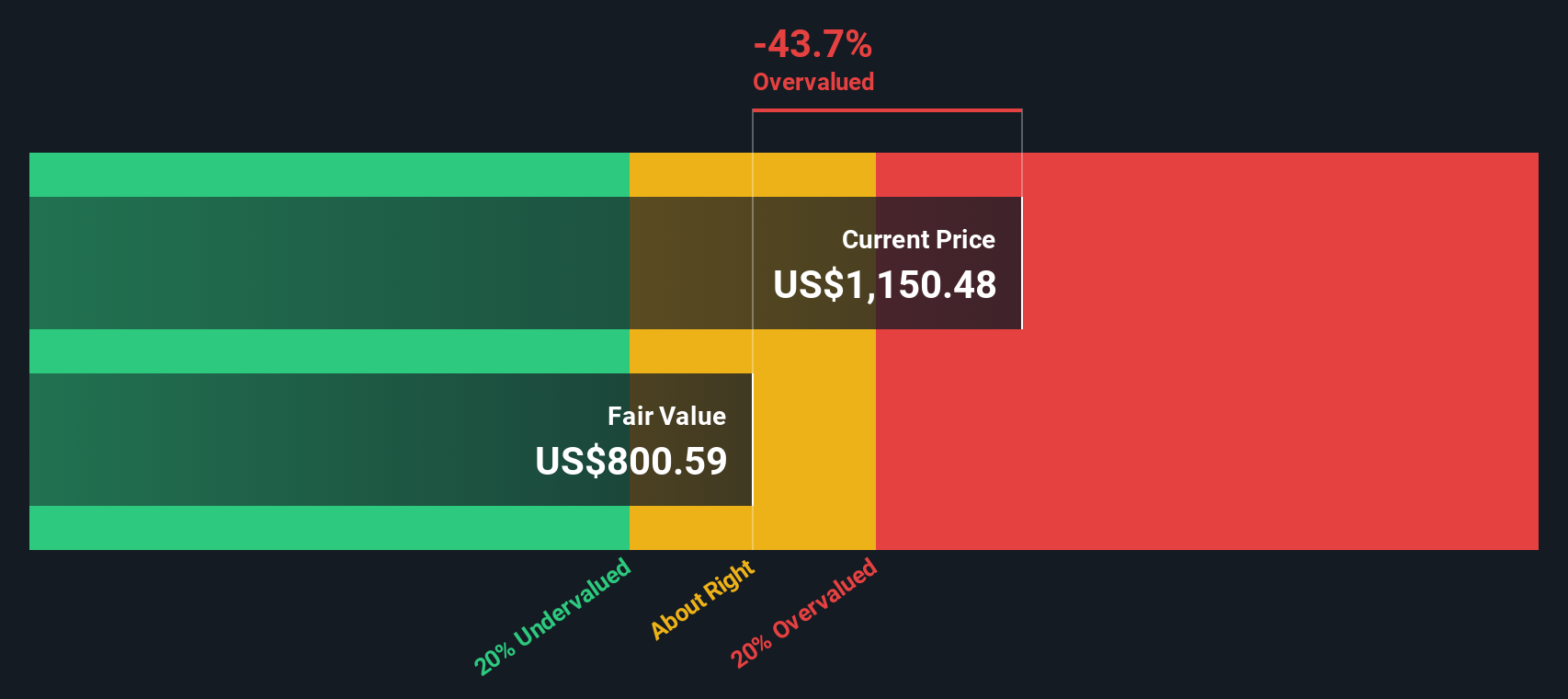

Another View: What Does the DCF Model Tell Us?

Switching gears from earnings multiples, our SWS DCF model values Graham Holdings at $1,070.23, just slightly higher than the current price. This suggests that, despite recent outperformance, the stock is trading just below fair value. Is this a true bargain or a signal to tread carefully?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Graham Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Graham Holdings Narrative

If you see things differently, or would rather reach your own insights, you can quickly build your personal narrative from scratch in just a few minutes with Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Graham Holdings.

Looking for more investment ideas?

Remember, the smartest investors seize opportunities beyond the obvious winners. Let Simply Wall St’s powerful screeners help you find the next breakout before the rest of the market does.

- Tap into the potential of artificial intelligence by checking out these 25 AI penny stocks, where innovative companies are building the future.

- Capture reliable income streams and grow your portfolio with these 16 dividend stocks with yields > 3%, offering yields above 3%.

- Seize the chance to uncover overlooked value by researching these 874 undervalued stocks based on cash flows, powered by cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GHC

Graham Holdings

Through its subsidiaries, operates as a diversified holding company in the United States and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives