- United States

- /

- Consumer Services

- /

- NYSE:EDU

New Oriental (EDU): Margin Decline Challenges Bullish Sentiment Despite Strong 5-Year Profit Growth

Reviewed by Simply Wall St

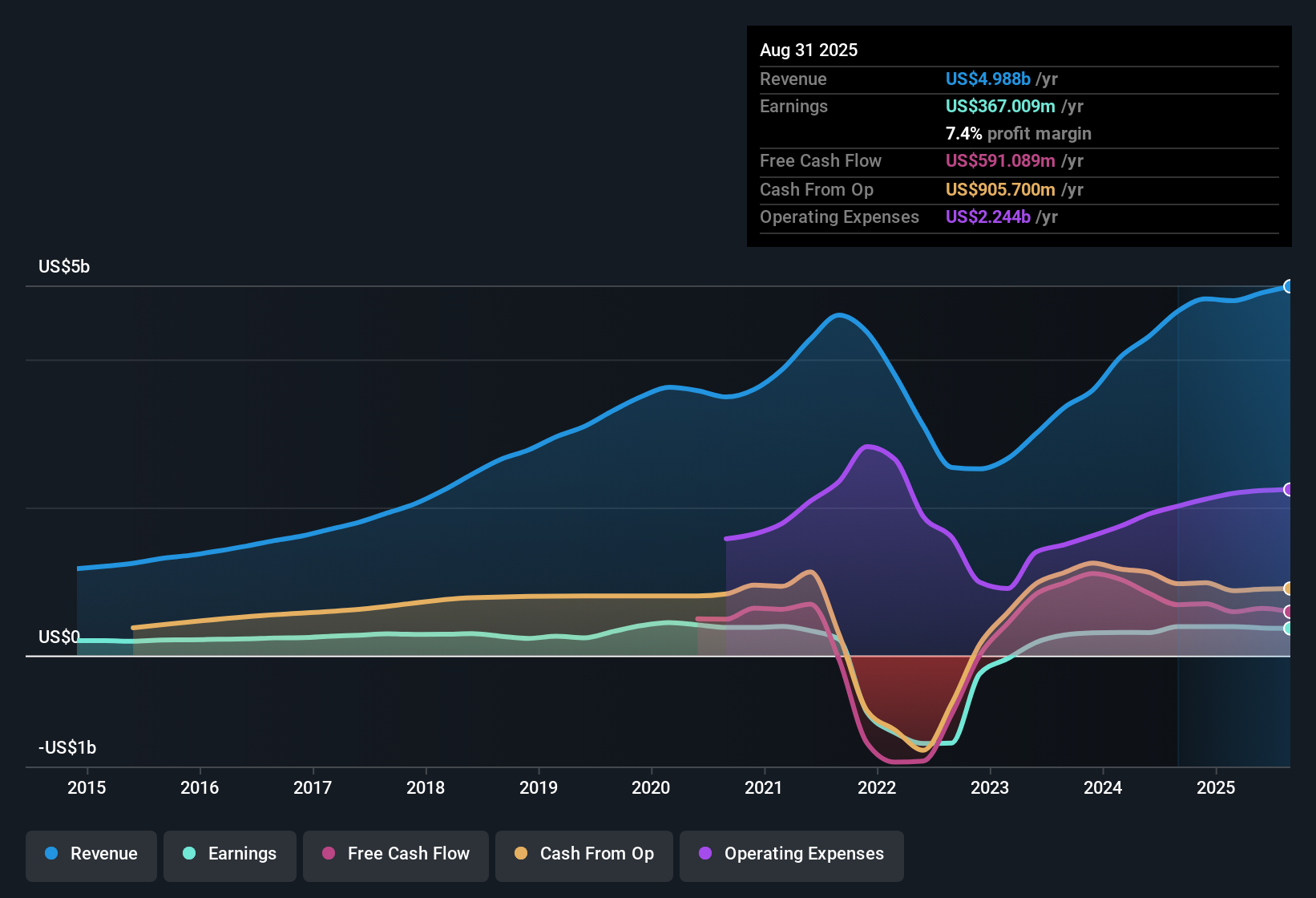

New Oriental Education & Technology Group (EDU) posted 22.9% average annual earnings growth over the past five years and is forecast to grow EPS by 16.1% per year, outpacing the broader US market's expected 15.6%. However, profit margins have tightened, with net margin declining to 7.4% from last year's 8.4%, and revenue is projected to increase by 8.7% per year, which is slower than the US market average of 10.2%. With shares trading at a Price-To-Earnings Ratio of 25.1x, below the peer average but ahead of the industry, investors see good value. Still, recently narrowing margins and lagging revenue growth add some caution to the outlook.

See our full analysis for New Oriental Education & Technology Group.Next, we will see how these numbers hold up when set against the dominant market narratives and analyst expectations. The surprises, warnings, and confirmations are just ahead.

See what the community is saying about New Oriental Education & Technology Group

Capital Returns Backed by Declining Share Count

- Analysts expect the number of shares outstanding to decrease by 3.68% per year over the next 3 years, signaling ongoing commitment to buybacks and capital returns.

- According to the analysts' consensus view, this projected decline in share count is expected to support continued earnings per share growth and shareholder value creation.

- The company’s three-year capital return plan is set to allocate at least 50% of net income to buybacks and dividends, directly linking profitability to future capital returns.

- Resilient demand, evident in deferred revenue and customer prepayments rising nearly 10% year-over-year, reinforces forward visibility and helps underpin the ambitious capital allocation strategy.

- Curious how the numbers align with the street’s balanced view? See how analysts debate the direction in our deep dive. 📊 Read the full New Oriental Education & Technology Group Consensus Narrative.

Future Margin Expansion Faces Competitive Pressures

- Analysts project net profit margin will rise from 7.6% today to 9.7% in 3 years, but note that any margin expansion will likely be incremental at just 100 to 150 basis points annually due to rising competitive intensity.

- The consensus narrative highlights both upside drivers and major risks for this margin outlook:

- Strong momentum in non-academic tutoring and AI-powered services is expected to help margin gains, as scale efficiencies and cross-selling increase retention and blended profitability.

- However, management flags intensifying competition in K-12 and non-academic segments, which may raise customer acquisition costs, suppress further margin expansion, and pose threats to long-term earnings growth.

Stock Trades at a Discount to Peers But Below DCF Fair Value

- Shares currently trade at $57.80, which is below the DCF fair value estimate of $134.19 and also below the peer group average Price-To-Earnings ratio (25.1x vs 54x), but above the US Consumer Services industry average of 19.3x.

- Analysts’ consensus sees this valuation gap as an opportunity but urges investors to scrutinize the assumptions:

- For the current price to converge toward DCF value or the $61.23 analyst target, investors would need to believe in 9.7% annual revenue growth and rising margins, as well as a future PE of 16.7x by 2028.

- Skeptics may focus on the slower revenue growth forecast compared to the US market and the potential cap on margin gains, meaning the valuation discount reflects real risks as well as upside.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for New Oriental Education & Technology Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these results? Take a moment to shape your perspective and share your view with the community in just minutes. Do it your way.

A great starting point for your New Oriental Education & Technology Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While New Oriental Education & Technology Group offers attractive capital returns, slowing revenue growth and only gradual margin expansion present challenges in maintaining momentum.

If you want to focus on companies consistently growing at a steadier pace, check out stable growth stocks screener (2126 results) and spot those delivering reliable performance across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Oriental Education & Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EDU

New Oriental Education & Technology Group

New Oriental Education & Technology Group Inc.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives