- United States

- /

- Hospitality

- /

- NYSE:BROS

Dutch Bros (BROS): Evaluating Valuation After Steady Share Momentum and Strong Annual Returns

Reviewed by Simply Wall St

Dutch Bros (BROS) shares have seen steady momentum this month, catching the attention of many investors. With its revenue and net income both on the rise year over year, the company’s performance offers a lot to consider.

See our latest analysis for Dutch Bros.

After a strong run earlier this year, Dutch Bros has settled into a stretch of more modest price movement, posting a 1-month share price return of nearly 10%. Its total shareholder return over the past year sits at a robust 68%. All this comes amid a wave of positive sentiment and ongoing growth in profits, suggesting momentum could be building again.

If this surge in performance has you wondering what else is out there, broaden your search horizons and discover fast growing stocks with high insider ownership

With Dutch Bros trading nearly 40% below the average analyst price target and showing strong growth in both revenue and earnings, the question remains: Is the stock undervalued, or has all the good news already been priced in?

Most Popular Narrative: 28.8% Undervalued

With Dutch Bros’ fair value estimate set at $78.06 and shares last closing at $55.54, the narrative suggests the stock might offer notable upside potential relative to its current price. Investors are weighing ambitious growth assumptions and the company’s unique position in the beverage sector.

"Strategic expansion, digital innovation, and menu enhancements aim to capture consumer trends, improve customer value, and drive sustained sales and margin growth. Operational efficiency, focus on company-owned stores, and cost management are supporting margin improvement and scalable long-term earnings growth."

Curious how aggressive store openings and digital tactics might transform Dutch Bros? Discover which bold financial forecasts anchor this surprising valuation. Only the full narrative reveals the ambitious targets and assumptions underlying this fair value call.

Result: Fair Value of $78.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost pressures or a slowdown in same-store sales could quickly challenge the optimistic outlook surrounding Dutch Bros’ growth narrative.

Find out about the key risks to this Dutch Bros narrative.

Another View: High Multiples Signal Caution

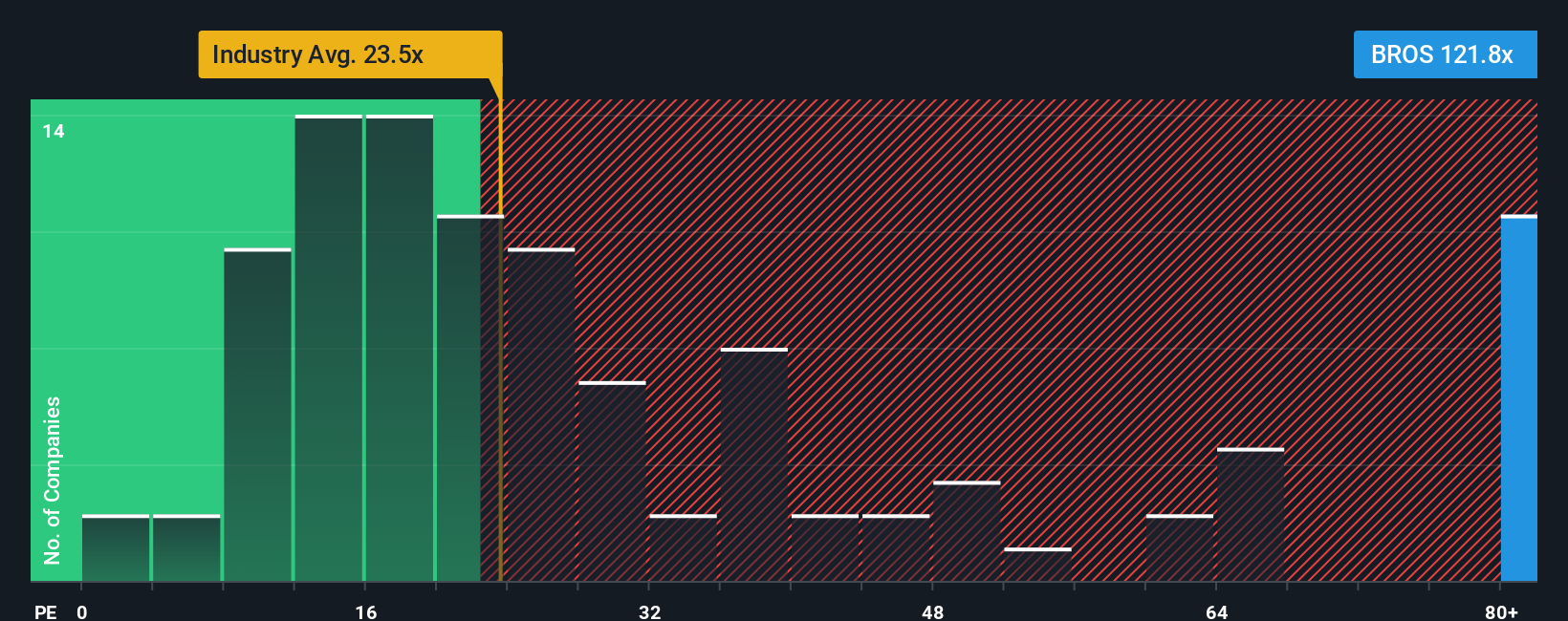

Looking from another angle, Dutch Bros stands out as expensive when measured by its price-to-earnings ratio, trading at 123 times earnings compared to 33 times for its peers and a fair ratio estimate of 34.4. This wide premium highlights significant valuation risk if growth expectations come up short. Can robust momentum alone justify such a steep price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dutch Bros Narrative

If you want to challenge these perspectives or simply prefer digging into the numbers on your own terms, it only takes a few minutes to put together your own view. Do it your way

A great starting point for your Dutch Bros research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Uncover new potential winners right now in key market trends using our latest tools and screeners below.

- Capitalize on the next tech wave by spotting up-and-coming innovators. Start with these 27 AI penny stocks to find businesses breaking ground in artificial intelligence.

- Maximize returns with steady income options and secure yields by scanning these 20 dividend stocks with yields > 3%, known for strong dividend performance over 3%.

- Position yourself for long-term value by identifying hidden gems using these 845 undervalued stocks based on cash flows, focused on companies trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BROS

Dutch Bros

Operates and franchises drive-thru shops in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives