- United States

- /

- Consumer Services

- /

- NYSE:BFAM

Bright Horizons Family Solutions (BFAM): Assessing Valuation After Strong Back-Up Care Performance and Upgraded Outlook

Reviewed by Simply Wall St

Bright Horizons Family Solutions (BFAM) lifted its outlook for 2025 after reporting a 26% jump in back-up care revenue and 38% segment margins for Q3. This is an important update for investors tracking profitability improvements.

See our latest analysis for Bright Horizons Family Solutions.

Despite stronger back-up care results and a more upbeat 2025 forecast, Bright Horizons Family Solutions’ share price has struggled this year, closing at $97.59 with a year-to-date share price return of -11.72%. Over the longer term, the three-year total shareholder return stands at a solid 34.63%. However, recent momentum has clearly faded alongside near-term price declines and shifting market sentiment.

If the turnaround in Bright Horizons' key segment got your attention, it could be worth broadening your watchlist and discovering fast growing stocks with high insider ownership

With shares still down for the year and analyst price targets pointing significantly higher than current levels, the key question is whether Bright Horizons remains undervalued or if the brighter outlook is already reflected in its share price. This creates either a buying opportunity or a signal that the market has priced in future growth.

Most Popular Narrative: 24.6% Undervalued

According to the most widely followed narrative, Bright Horizons Family Solutions’ fair value estimate sits notably above the latest closing price of $97.59. This creates a potentially attractive gap for investors to explore. The narrative’s fair value is grounded in assumptions and projections that could shift how the company is perceived in the coming years.

The expansion of employer-sponsored childcare and growing demand from large corporate clients such as McKesson and Centene point to a resilient pipeline for Bright Horizons, as employers increasingly view high-quality childcare as a critical employee benefit to attract and retain talent. This is likely to drive recurring B2B revenue growth and improve customer retention, positively impacting the company's top-line and earnings visibility.

Curious about the numbers fueling this outlook? The most popular narrative is built around aggressive profit margin improvements, ambitious long-term growth expectations, and a future valuation multiple that stands out from the average. Which bold targets are packed into the details? Read the full narrative to discover what’s really driving this valuation.

Result: Fair Value of $129.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if enrollment growth remains sluggish or if ongoing center closures persist, these factors could challenge the optimistic outlook and limit margin expansion.

Find out about the key risks to this Bright Horizons Family Solutions narrative.

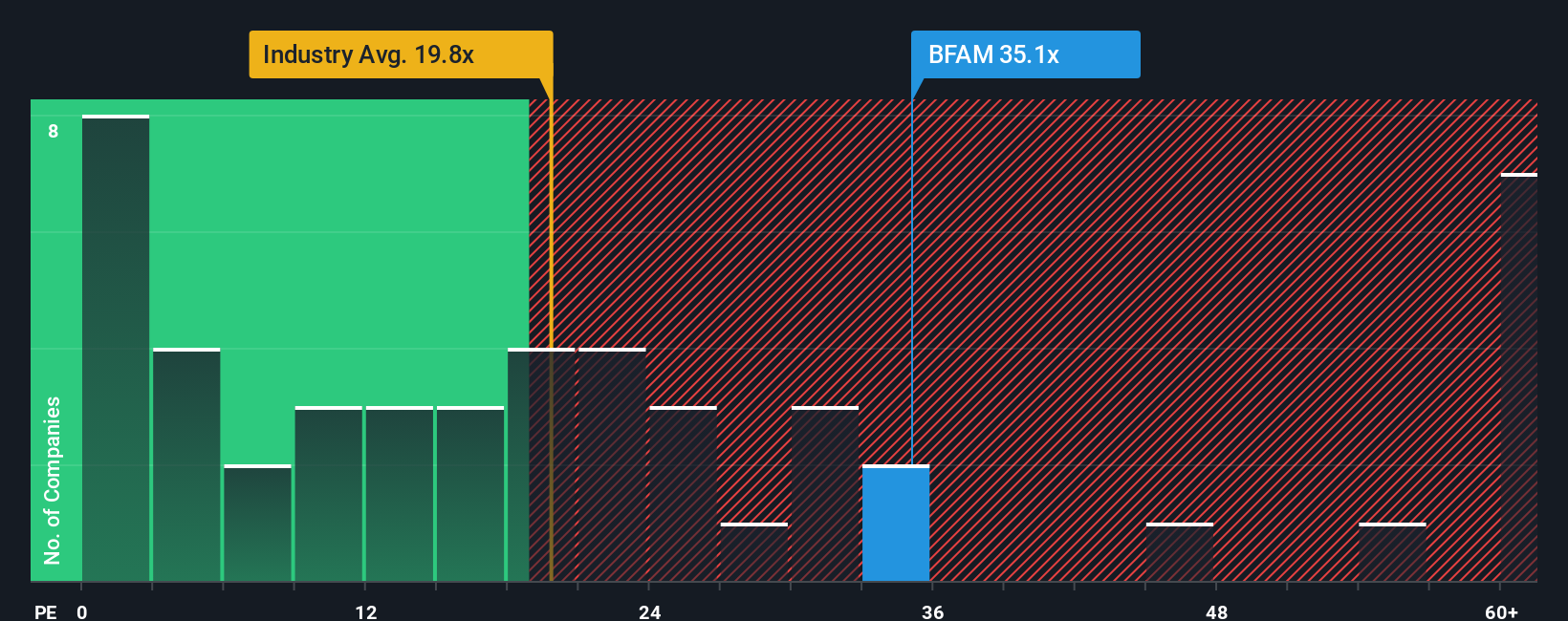

Another View: Earnings Multiples Paint a Different Picture

While many see Bright Horizons’ current share price as undervalued based on future potential, a closer look at its earnings multiple tells a different story. The company trades at a ratio of 27.5x, which is higher than both the Consumer Services industry average of 15.8x and its own fair ratio of 22.5x. This gap suggests investors may be paying a premium for growth that is already factored in, raising questions about near-term upside versus long-term expectations. Will the market eventually adjust this premium, or does the company truly have more runway ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bright Horizons Family Solutions Narrative

If the analysis above doesn't line up with your view or you'd rather reach your own conclusions, the tools are here to help you build a custom narrative in just minutes. Do it your way

A great starting point for your Bright Horizons Family Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity slip by. Upgrade your research and strengthen your portfolio by jumping into handpicked groups of stocks with high growth or market-beating potential.

- Capture tomorrow's innovation by examining these 25 AI penny stocks, where leading-edge artificial intelligence businesses are pushing the boundaries of what's possible.

- Boost your returns with steady income. Target reliable yields through these 16 dividend stocks with yields > 3% and see which companies are delivering strong, consistent payouts over 3%.

- Get ahead of market trends by scanning these 81 cryptocurrency and blockchain stocks, bringing together forward-thinking companies at the forefront of cryptocurrency and blockchain advancement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bright Horizons Family Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFAM

Bright Horizons Family Solutions

Provides early education and childcare, back-up care, educational advisory, and other workplace solutions services for employers and families in the United States, Puerto Rico, the United Kingdom, the Netherlands, Australia, and India.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives