- United States

- /

- Hospitality

- /

- NYSE:ARMK

Aramark (ARMK): A Fresh Look at Valuation After Recent Steady Performance

Reviewed by Simply Wall St

Aramark (ARMK) shares edged slightly higher in the latest trading session, reflecting modest interest from investors. The movement comes as the food service and facilities giant continues to show steady fundamentals, particularly in annual revenue and net income growth.

See our latest analysis for Aramark.

The stock's latest uptick follows a period of muted share price momentum, with a year-to-date share price return of just 2.2%. While Aramark’s 1-year total shareholder return is slightly negative, the three-year and five-year total returns of nearly 40% and over 62% show that long-term shareholders have been rewarded even as recent gains have cooled. Long-term performance remains a positive anchor as the company steadies through ongoing industry shifts.

If this steadier growth profile has you interested in other sectors, now is the perfect moment to explore fast growing stocks with high insider ownership.

This raises a key question for investors: Is Aramark’s recent lackluster stock movement a sign of hidden value, or has the market already factored in all its future growth potential?

Most Popular Narrative: 16.2% Undervalued

Aramark’s last close at $37.80 sits well below the narrative consensus fair value estimate of $45.10, suggesting upside if future expectations play out. This latest narrative brings together recent growth drivers, sector trends, and new earnings assumptions.

Expansion in international markets, with double-digit organic growth in regions like the U.K., Chile, and Spain, and strategic wins in healthcare and entertainment sectors demonstrate a deliberate move to diversify and lower cyclicality. This approach could bolster overall revenue and earnings stability.

Want to know what’s fueling this bullish price target? The narrative is pinned on ambitious forecasts for sales growth, higher margins, and a lower future profit multiple. Only a deep dive reveals whether these bold projections add up to the lofty valuation on offer.

Result: Fair Value of $45.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost pressures and increased competition remain key risks that could limit Aramark’s ability to achieve its anticipated margin gains.

Find out about the key risks to this Aramark narrative.

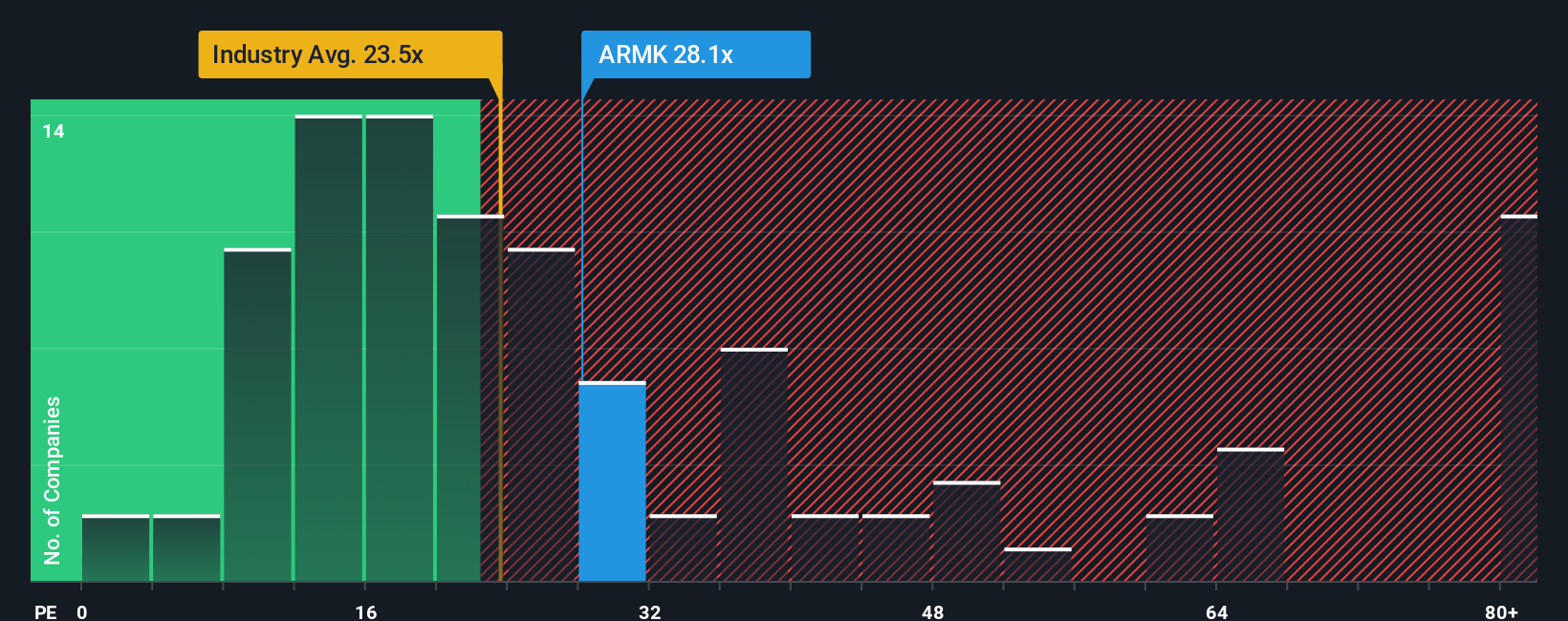

Another View: Earnings Multiple Tells a Different Story

Looking at Aramark’s valuation through its earnings multiple, the company trades at 27.5 times earnings, which is much higher than the US Hospitality industry average of 21.4 times. Notably, this is also above its fair ratio of 25.9 times, hinting that investors may be paying a premium for future growth. Could the market be too optimistic about what lies ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aramark for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aramark Narrative

If you think there’s more to the story or want to shape your own perspective, it takes just a few minutes to build your own view from the data. Do it your way.

A great starting point for your Aramark research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game by tackling sectors and opportunities that often get overlooked. Uncover attractive stocks others miss and build a smarter, more resilient portfolio now.

- Boost your income with generous yields and prioritize stability by checking out these 16 dividend stocks with yields > 3%, which delivers over 3% returns even as markets fluctuate.

- Capitalize on the booming field of artificial intelligence when you scan these 24 AI penny stocks to find game-changers in smart automation and learning technologies.

- Seize pricing missteps and maximize upside with these 870 undervalued stocks based on cash flows, a tool that spotlights companies the market may be underestimating right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARMK

Aramark

Provides food and facilities services to education, healthcare, business and industry, sports, leisure, and corrections clients in the United States and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives