- United States

- /

- Hospitality

- /

- NasdaqGS:WYNN

Wynn Resorts (WYNN): Assessing Valuation After Recent Share Price Rally

Reviewed by Simply Wall St

Wynn Resorts (WYNN) shares have gained some ground recently, up 3% over the past month and about 19% in the past 3 months. This performance has sparked new conversations around how the market is currently viewing this casino and hospitality giant.

See our latest analysis for Wynn Resorts.

Wynn Resorts has enjoyed a surge in momentum, with its share price up over 50% so far this year. Investors appear more upbeat following the latest run, especially as Wynn’s one-year total shareholder return of 51% comfortably outpaces the broader market. This hints at both recovery and underlying optimism in the casino space.

If you want to see what else is gaining traction beyond the obvious headlines, now is a great moment to discover fast growing stocks with high insider ownership

With shares riding a strong rally and analyst targets just out of reach, the pressing question is whether Wynn Resorts still trades at a discount or if the market already reflects expectations for future growth and recovery.

Most Popular Narrative: 6.4% Undervalued

The standout narrative values Wynn Resorts at $134.74 per share, which is about $8 higher than its recent close of $126.14. This signals investor debate over what really underpins the current price level.

The imminent launch of Wynn Al Marjan Island, with first-mover advantage and limited near-term competition in a potentially multi-billion-dollar new market, is a major forward catalyst that is currently underappreciated by investors and could drive a meaningful step-change in both consolidated revenue and EBITDAR.

Why does the narrative lean bullish? The answer hinges on a combination of expansion bets, profit margin ambitions, and what analysts believe about future earnings power. Find out which of these swinging assumptions really move the fair value needle. There might be surprises waiting in the numbers behind the headline target.

Result: Fair Value of $134.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained headwinds in Macau or escalating operational costs could undermine the bullish outlook. This could shift attention to mounting financial and regulatory risks ahead.

Find out about the key risks to this Wynn Resorts narrative.

Another View: Caution from a Market Comparison

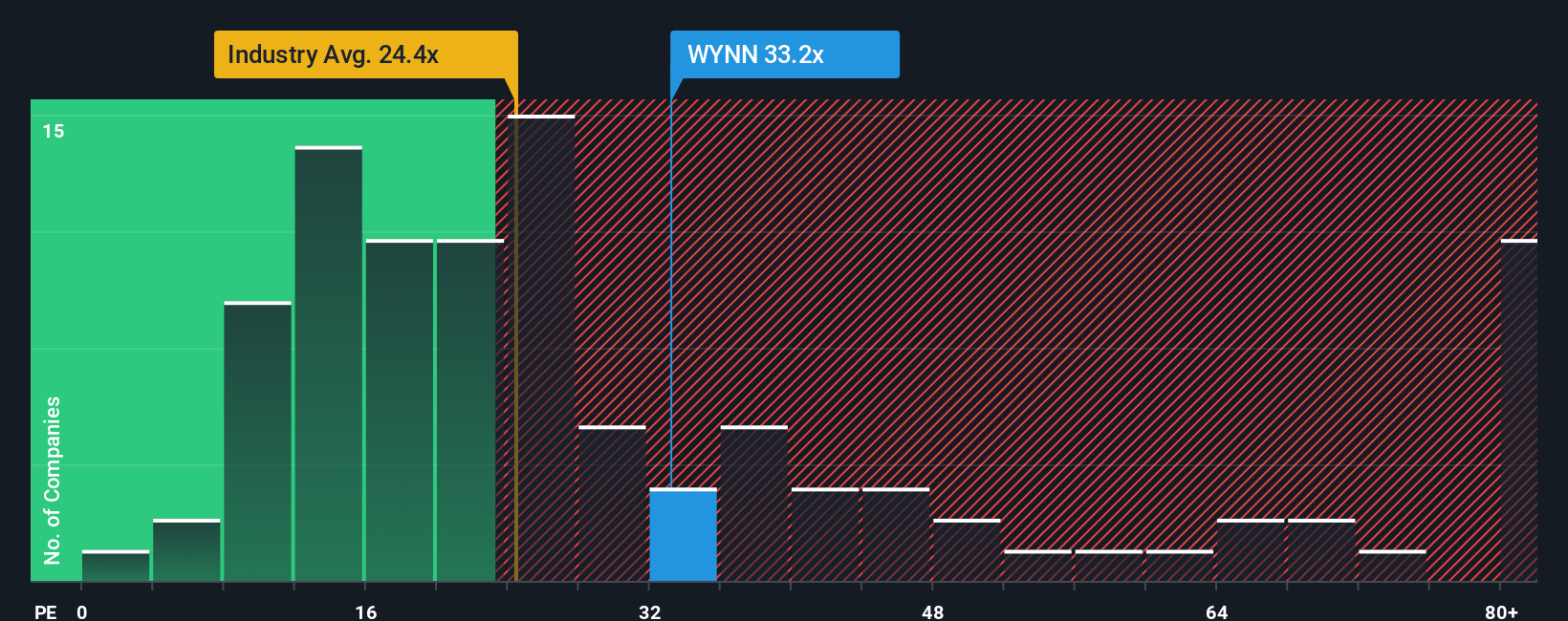

Looking at Wynn Resorts through the lens of its earnings ratio versus peers and the broader industry presents a more cautious perspective. The company trades at 25.8 times earnings, which is below its peer average of 59.4, but above the US Hospitality industry at 21.4. Its current ratio is higher than the fair ratio of 22.9, suggesting the market could seek a lower multiple if sentiment changes. With numbers this close, does Wynn offer true value or could market expectations begin to cool?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wynn Resorts for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wynn Resorts Narrative

If you want to dig deeper or think a different story is hidden in the numbers, you can generate your own analysis for Wynn Resorts in just minutes, and Do it your way.

A great starting point for your Wynn Resorts research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Missed opportunities do not wait. Tap into new growth trends, steady income streams, or the next breakout stock using the powerful Simply Wall Street Screener below.

- Amplify your returns with these 870 undervalued stocks based on cash flows currently trading at significant discounts compared to their true worth.

- Capture future disruptive trends by starting with these 24 AI penny stocks selected for true leadership in artificial intelligence innovation.

- Boost your portfolio with reliable income from these 16 dividend stocks with yields > 3% offering yields above 3% on a consistent basis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wynn Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WYNN

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives