- United States

- /

- Hospitality

- /

- NasdaqGS:WYNN

Wynn Resorts (NASDAQ:WYNN) Funds a Middle-East Expansion Through Leaseback

Few sectors experienced as many difficulties as the hospitality sector in the recent past. With the worst of the COVID-19 pandemic behind us, companies like Wynn Resorts (NASDAQ: WYNN) are looking to turn around – selling some assets yet diving into some of the most ambitious projects in their history.

See our latest analysis for Wynn Resorts

Q4 Earnings and Developments

- Non-GAAP EPS: -US$1.37 (miss by US$0.19)

- Revenue: US$1.05b (beat by US$55.92m)

- Revenue Growth: +51.1% Y/Y

Wynn agreed with the real estate giant Realty Income (NYSE:O) to sell and leaseback the Encore Boston Harbor real estate for US$1.7b in cash.

This move has profound implications for both companies. For Realty Income, it provides exposure to the gambling sector, while for Wynn, it untangles the resources from real estate while continuing to operate under favorable financing circumstances.

Speaking of untangled resources, Wynn now has a fresh capital to put into new projects, like a multi-billion dollar resort at Ras Al Khaimah – the first beach resort developed by Wynn globally. The project's scope so far includes a 1000+ room hotel, high-end shopping mall, convention facilities, an exclusive spa, a dozen restaurants and lounges, and of course, a gaming area. It should be the largest such project in the emirate's hospitality sector, with a completion target in 2026.

Does Wynn Resorts Have A Long Cash Runway?

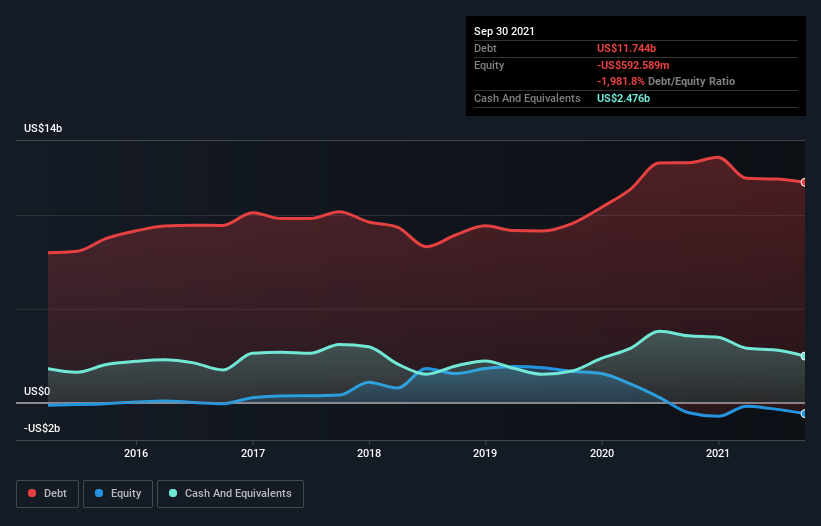

A company's cash runway is calculated by dividing its cash hoard by its cash burn. Its cash burn was US$770m over the trailing twelve months. Back then, it had US$2.5b in cash, enough for around 2.5y of operations, but we have to consider that the latest asset sale was an all-cash transaction.

You can see how its cash balance has changed over time in the image below.

How Well Is Wynn Resorts Growing?

We reckon the fact that Wynn Resorts managed to shrink its cash burn by 30% over the last year is somewhat encouraging. Revenue also improved during the period, increasing by 11%.

On balance, we'd say the company is improving over time. While the past is always worth studying, it is the future that matters most. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Wynn Resorts Raise Cash?

We are impressed with Wynn Resorts' progress over the last year, but it is also worth considering how costly it would be to raise more cash to fund faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages of publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalization, we understand how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Wynn Resorts' cash burn of US$770m is about 7.0% of its US$11b market capitalization. That's a reasonably low proportion, so we figure the company would be able to raise more cash to fund growth, with a bit of dilution, or even to borrow some money. Unfortunately for shareholders, our data indicates substantial dilution, as total shares outstanding grew by 51.5% in the last year.

Cash Burn Ain't a Concern at the Moment.

With the latest developments, we're relatively comfortable with the way Wynn Resorts is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending.

While revenue growth might be a weak point, we understand that the circumstances of the last 2 years have been extraordinary. Overall, it seems like the decision to convert some real estate value into cash through a deal with Realty Income will allow the company to focus on the project in the Emirates and diversify its operations beyond the U.S and Macau.

After considering a range of factors in this article, we're pretty relaxed about its cash burn since the company seems to be in a good position to continue to fund its growth. An in-depth examination of risks revealed 2 warning signs for Wynn Resorts that readers should consider before committing capital to this stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if Wynn Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:WYNN

Very undervalued with solid track record.