- United States

- /

- Consumer Services

- /

- NasdaqCM:SUPX

Could Dr. Huang’s Leadership Signal a New Strategic Chapter for SuperX AI Technology (SUPX)?

Reviewed by Sasha Jovanovic

- SuperX AI Technology Limited has announced that Dr. Chenhong Huang will become Chairman of the Board, Executive Director, and CEO effective December 1, 2025, bringing with him over 30 years of leadership across major global technology firms.

- This leadership transformation aligns with SuperX's ambitions to scale its modular AI factory and expand proprietary infrastructure solutions on a global stage.

- We'll explore how Dr. Huang’s extensive experience in scaling complex technology operations could influence the company’s investment narrative moving forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is SuperX AI Technology's Investment Narrative?

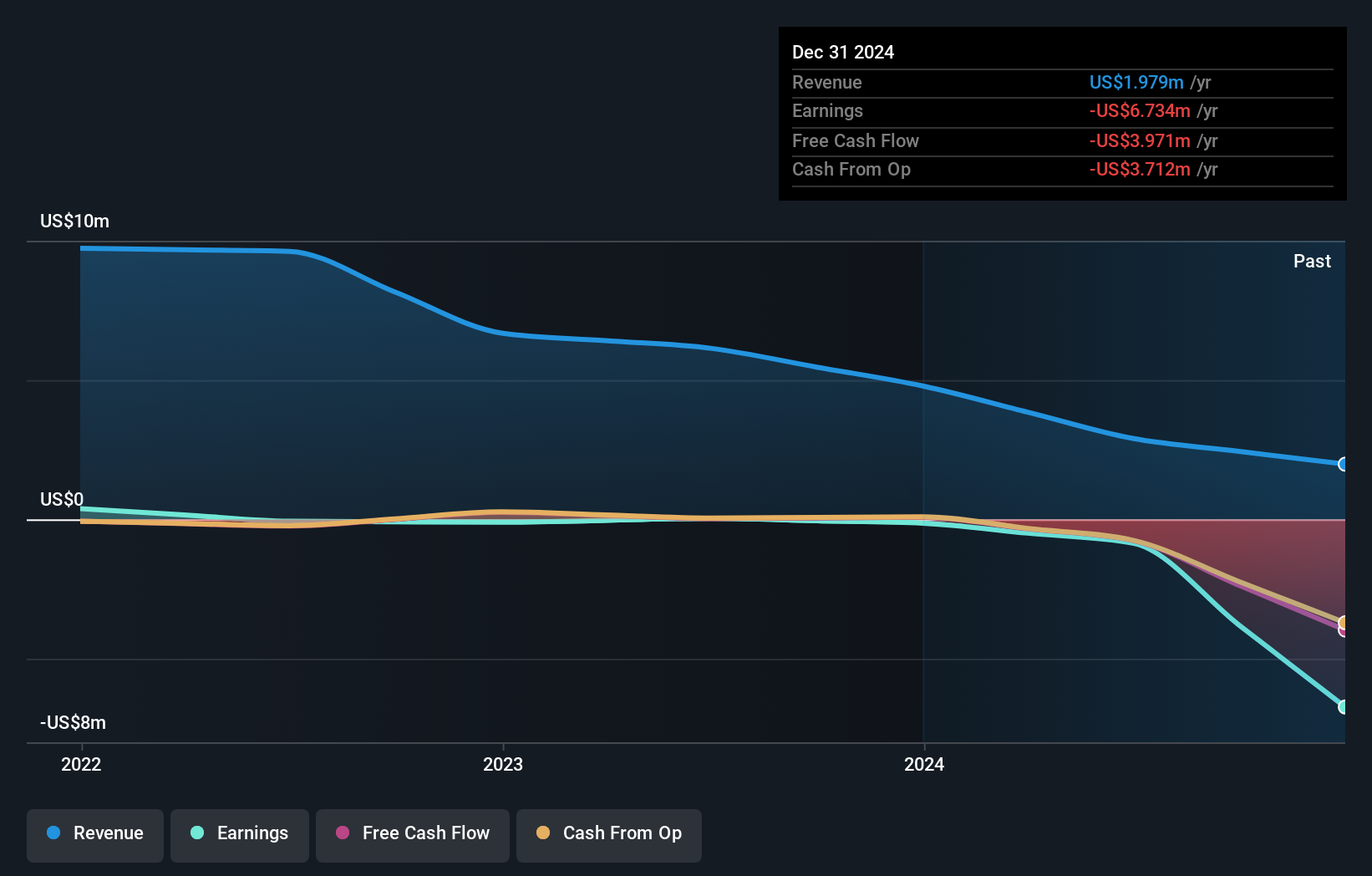

If you’re looking at SuperX AI Technology as a potential investment, you need to believe in the company’s vision for upscaling AI-infrastructure, despite mounting losses and continuing dilution. Recent results show US$3.6 million in revenue but a significant net loss of US$21.21 million, while new products, joint ventures, and expansion into the US and Japan have all attempted to drum up growth. Share price gains over the past year have been very large, but the stock has also been highly volatile and still trades at a steep premium to book value. The company’s board and management were notably inexperienced prior to the recent leadership overhaul. The appointment of Dr. Chenhong Huang as Chairman and CEO is a meaningful development, aimed at addressing execution and governance concerns. It may well shift the short-term catalysts and risks, as investors will be watching for clear operational progress under his experienced leadership. However, the risks tied to ongoing losses, competition, and need for substantial, proven revenue growth remain crucial in the near term, management change by itself cannot resolve structural issues overnight.

But with ongoing losses and dilution, governance is only one piece of the broader risk picture. Our expertly prepared valuation report on SuperX AI Technology implies its share price may be too high.Exploring Other Perspectives

Explore 2 other fair value estimates on SuperX AI Technology - why the stock might be worth as much as $0.12!

Build Your Own SuperX AI Technology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SuperX AI Technology research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free SuperX AI Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SuperX AI Technology's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SUPX

SuperX AI Technology

Through its subsidiary, OPS Interior Design Consultant Limited, provides interior design, fit-out, and maintenance services to residential and commercial clients in the interior design market in Hong Kong.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success