- United States

- /

- Consumer Services

- /

- NasdaqCM:SDA

Some Confidence Is Lacking In SunCar Technology Group Inc.'s (NASDAQ:SDA) P/S

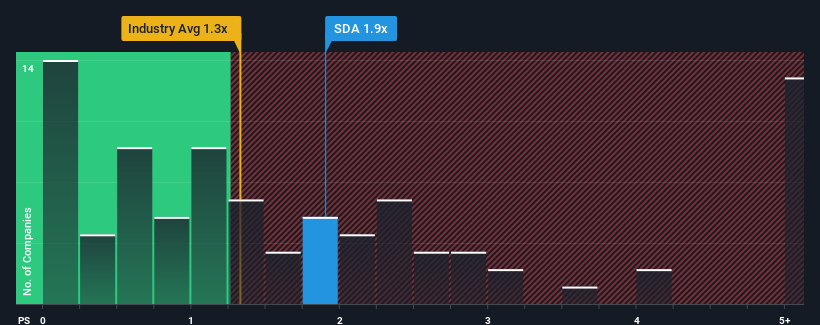

When you see that almost half of the companies in SunCar Technology Group Inc.'s ( NASDAQ:SDA ) industry have price-to-sales ratios (or "P/S") below 1.3x, SunCar looks to be giving off some sell signals with its 1.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for SunCar Technology Group

What Does SunCar Technology Group's Recent Performance Look Like?

Revenue has risen firmly for SunCar Technology Group recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on SunCar Technology Group's earnings, revenue and cash flow.

How Is SunCar Technology Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as SunCar Technology Group's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 29% last year. The strong recent performance means it was also able to grow revenue by 52% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 16% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it interesting that SunCar Technology Group is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of SunCar Technology Group revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - SunCar Technology Group has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SDA

SunCar Technology Group

Through its subsidiaries, provides cloud and mobile app-based auto eInsurance, technology, and auto services in the People’s Republic of China.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives