- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

Starbucks (SBUX): Assessing Valuation After a 10% Monthly Share Price Gain

Reviewed by Simply Wall St

Starbucks (SBUX) shares have seen some movement lately, sparking fresh interest among investors weighing both the company’s fundamentals and its recent performance. The stock has gained about 10% over the past month, which has prompted renewed optimism.

See our latest analysis for Starbucks.

Starbucks’ recent surge is a sharp departure from its sluggish performance earlier in the year. This hints that positive momentum may finally be building behind the stock. While the 1-month share price return stands at a healthy 10.2%, the stock’s 1-year total shareholder return remains in negative territory, which suggests long-term holders are still waiting for a sustainable turnaround.

If you’re keen to see what’s catching investors' attention lately, broaden your search and discover fast growing stocks with high insider ownership

With shares rebounding sharply but long-term returns still lagging, the question now is whether Starbucks is trading below its true value or if recent gains mean the market is already pricing in a recovery. Is this a buying opportunity, or has future growth been fully accounted for?

Most Popular Narrative: 8.2% Undervalued

With the most recent consensus narrative assigning Starbucks a fair value of $94.17, the stock’s last close at $86.42 may present investors with room for upside. This highlights a sharp difference between the current price and what the narrative considers justified based on future earnings and growth.

The Back to Starbucks strategy and Green Apron model aim to enhance customer experience and reduce service times, increasing transactions and potential revenue. Expanding in growth markets and focusing on local execution, particularly in China, is expected to boost global revenue and mitigate risks.

Curious why this narrative values Starbucks above today’s price? The full analysis depends on ambitious sales growth, margin expansion, and a bold vision for market dominance. If you want to see which pivotal assumptions unlock this higher fair value and what the bullish or skeptical scenarios look like, now is the time to dive in.

Result: Fair Value of $94.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressures from labor costs and uncertainty surrounding consumer demand could quickly challenge the bullish outlook for Starbucks.

Find out about the key risks to this Starbucks narrative.

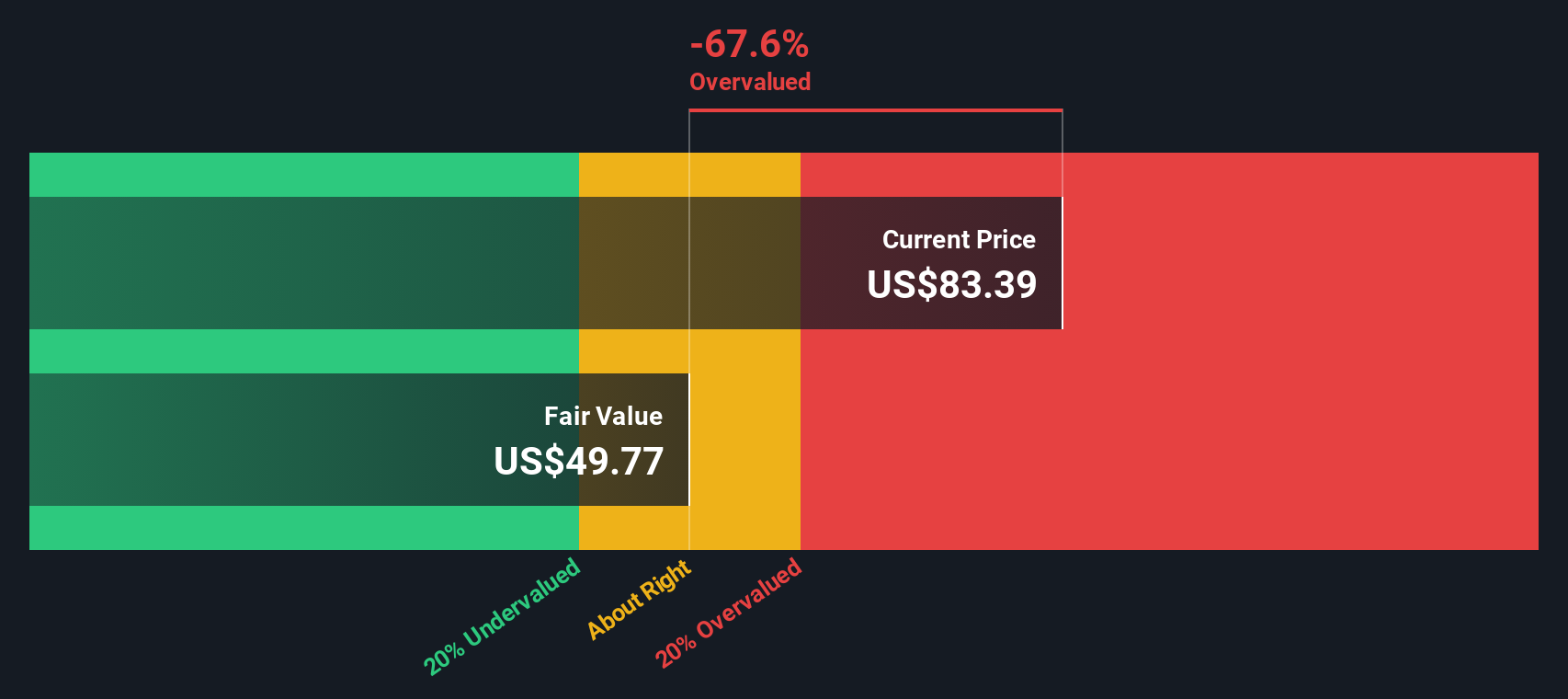

Another View: Discounted Cash Flow Model Tells a Different Story

While most analysts see upside, our SWS DCF model raises caution. According to this method, Starbucks is trading above its estimated fair value of $49.48, suggesting the shares may actually be overvalued at current prices. Are these long-term hurdles already being priced in, or is the DCF missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Starbucks for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 856 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Starbucks Narrative

If you see things differently or want to dig into the data yourself, you can craft your own Starbucks narrative in just a few minutes. Do it your way

A great starting point for your Starbucks research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Sharpen your portfolio and stay ahead of the curve by targeting opportunities that others might overlook. Make sure you catch these standouts before the crowd does.

- Seize the chance to benefit from stable income streams and growth by checking out these 15 dividend stocks with yields > 3% with yields above 3%.

- Spot tomorrow’s leaders in digital innovation and get an edge with these 25 AI penny stocks as they tap into artificial intelligence breakthroughs.

- Position yourself for big moves in the crypto economy and real blockchain applications by investigating these 82 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee worldwide.

Slight risk second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives