- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

Is Starbucks Share Price Justified After Leadership Changes and 9% Rebound?

Reviewed by Bailey Pemberton

- Curious if Starbucks stock is a smart buy at today’s price? You’re not alone. A closer look at the company’s real value might surprise you.

- After a bumpy start to the year, Starbucks shares have rebounded by 5.8% over the past week and 9.1% in the last month, though they are still down 10.0% over the last year.

- Recent headlines have highlighted Starbucks’ ongoing strategy shifts and new leadership efforts aimed at refreshing the brand and regaining momentum. These updates have caught investors’ attention and could be fueling optimism, even as the broader market weighs changing consumer trends and competition.

- Starbucks currently scores just 1 out of 6 on our undervaluation checks, suggesting most traditional value signals are not flashing green. Before taking these numbers at face value, let’s break down the approaches behind these scores and keep an eye out for an even smarter way to value a business, coming up at the end of this article.

Starbucks scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Starbucks Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its future cash flows and then discounting them back to their present value. This approach helps investors gauge what the business could be worth today, based on its ability to generate cash in the future.

For Starbucks, the current Free Cash Flow is $2.36 billion. Analysts have projected this figure to steadily increase, with forecasts reaching $3.47 billion by 2026 and $3.65 billion by 2028. Looking ahead a full ten years, Simply Wall St projects Free Cash Flow to grow to about $4.23 billion by 2035. The early years of this forecast rely on analyst estimates, while projections further out are extrapolated using best-guess industry assumptions.

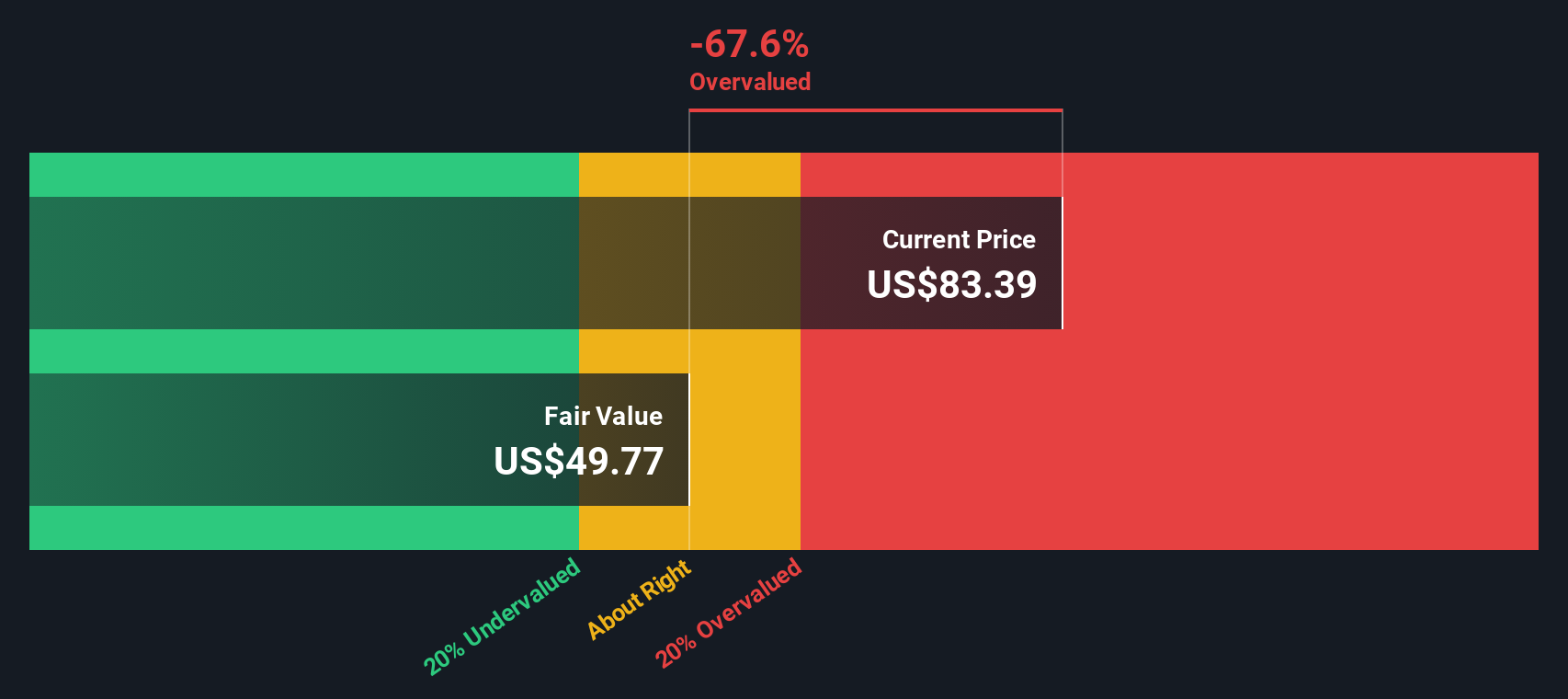

According to the DCF model, Starbucks’ estimated intrinsic value stands at $49.70 per share. Compared to the current market price, this implies that the stock is 72.2% overvalued based on today’s numbers and projected future performance.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Starbucks may be overvalued by 72.2%. Discover 875 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Starbucks Price vs Earnings (PE Ratio)

The price-to-earnings (PE) ratio is one of the most widely used valuation measures for profitable companies like Starbucks, because it shows how much investors are willing to pay today for a dollar of company earnings. For consistently profitable firms, the PE ratio can help investors quickly compare valuations across similar businesses.

Growth expectations and perceived risk play a big role in deciding whether a company's PE is justified. If investors expect Starbucks to grow its earnings faster than others or see it as a lower-risk investment, a higher PE ratio can be reasonable. Conversely, a lower growth outlook or higher risks would suggest a lower PE is warranted.

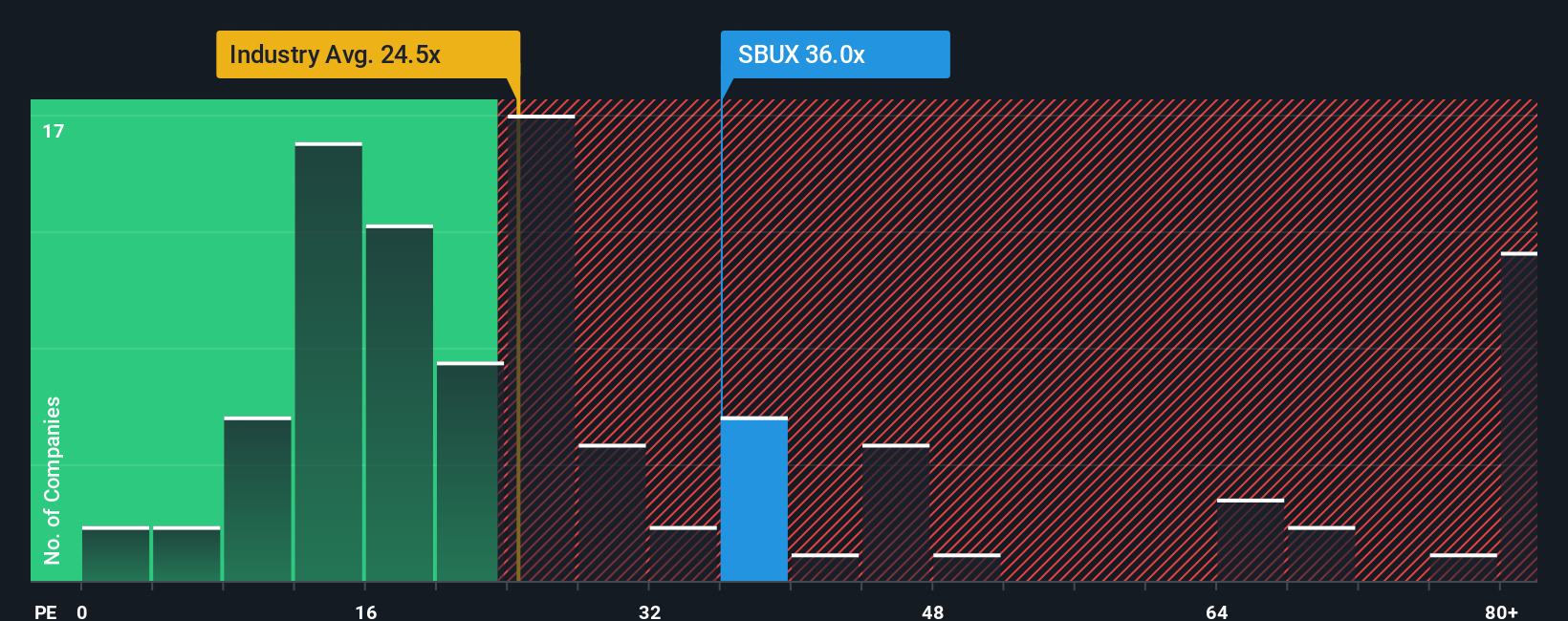

Currently, Starbucks trades at a PE ratio of 37x. This is much higher than the hospitality industry average of 21.2x and its peer average of 45.6x. However, a simple comparison to these benchmarks does not tell the full story.

That is where Simply Wall St's “Fair Ratio” comes in. The Fair Ratio for Starbucks is 31.8x, which reflects a blend of the company’s expected earnings growth, profit margins, business risks, industry, and market capitalization. Because it weighs these key factors, the Fair Ratio sets a far more tailored benchmark for assessing value than simply looking at peers or the broad industry.

When we compare Starbucks’ actual PE ratio to its Fair Ratio, the stock appears a little overvalued at 37x compared to a Fair Ratio of 31.8x. This suggests the shares are trading at a premium to what these fundamentals imply.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Starbucks Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Put simply, a Narrative is your unique story about Starbucks, where you connect the dots between its strategy, risks, opportunities, and the numbers you believe in for future revenue, earnings, and margins. Instead of relying solely on formulas like PE or DCF, Narratives let you explain why you think Starbucks is undervalued or overvalued, tying together the company’s real-world context with your financial forecast and a fair value estimate.

This approach bridges the gap between numbers and insights, letting investors go beyond the averages to reflect their own outlook and priorities. Narratives are available on Simply Wall St's Community page, making them both accessible and dynamic as they update automatically whenever new news, earnings, or forecasts are released. By comparing your Narrative’s Fair Value to the Share Price, you instantly see whether your story signals a buy, hold, or sell, and you can also weigh your stance against other investors’ perspectives.

For example, some investors believe Starbucks can be worth as much as $115 per share if international growth and operational changes exceed expectations, while others take a more cautious view with a fair value of just $73 due to concerns over competition and margins.

Do you think there's more to the story for Starbucks? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee worldwide.

Slight risk second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives