- United States

- /

- Consumer Services

- /

- NasdaqCM:OSW

OneSpaWorld (OSW) Margin Gains Reinforce Bull Narratives Despite Expensive Valuation

Reviewed by Simply Wall St

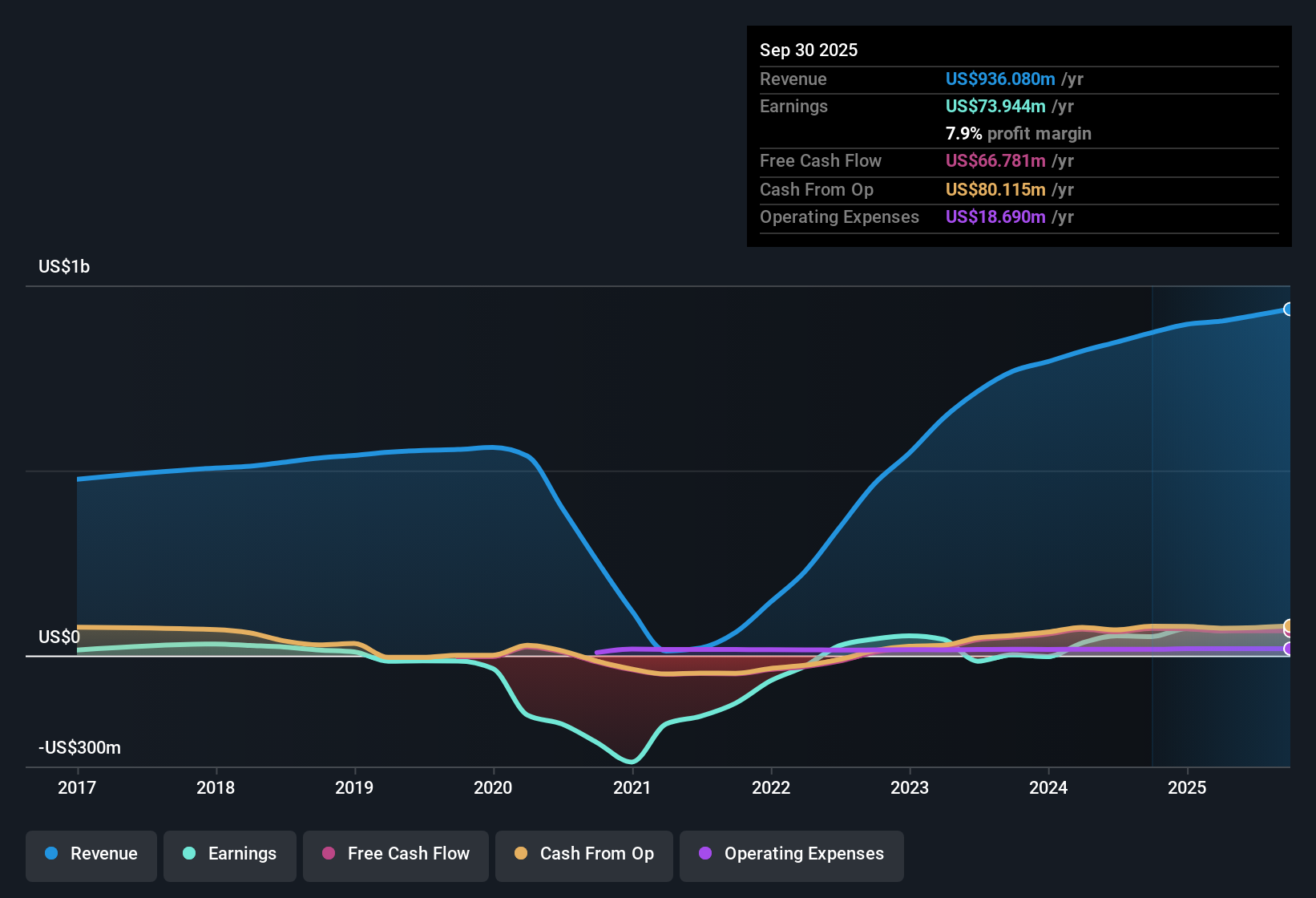

OneSpaWorld Holdings (OSW) posted a significant step up in profitability, reporting net profit margins of 7.9% compared to last year’s 5.9%. Annual earnings grew 44.5% this cycle, although that falls short of the recent five-year average growth rate of 74.6% per year, and earnings are projected to climb 14.45% annually going forward. Revenue growth is expected at 8.7% each year, which trails broader US market benchmarks, but profit quality earned a high rating as the company cemented its move into consistent profitability over the past five years.

See our full analysis for OneSpaWorld Holdings.The next section puts these headline numbers in context, comparing them directly to what the market’s narratives say about OneSpaWorld’s outlook and valuation to see where the stories align and where they might break from expectations.

See what the community is saying about OneSpaWorld Holdings

Margin Expansion Supported by Asset-Light Model

- Operating margins reached 7.9%, up from 5.9% a year ago. This outpaces typical sector performance and demonstrates the positive effects of OneSpaWorld's cost-efficient, asset-light business structure.

- According to the analysts' consensus view, the company’s enhanced efficiency is driven by newer technology and pre-cruise booking. Together, these factors position OneSpaWorld to capture more onboard spending as passenger volumes rise.

- Margin improvement coincides with robust demand for premium wellness services and higher onboard spend by guests. This fuels confidence in further margin expansion as new cruise partnerships ramp up.

- This upbeat outlook, however, is tempered by increasing costs tied to regulation and compliance. Such costs could put future margin gains at risk if not managed carefully.

To see how bulls and bears rate these strengths, dive into the full consensus narrative for a balanced view of the forces driving OneSpaWorld’s profitability.

📊 Read the full OneSpaWorld Holdings Consensus Narrative.

Valuation Premium Looms Over Growth Forecasts

- The current share price of $23.32 puts OneSpaWorld at a 32.4x PE ratio, well above both the US Consumer Services industry average of 17.2x and the peer group at 15.9x. This raises questions given revenue growth is expected at just 8.7% per year.

- Consensus narrative notes that even with earnings projected to reach $110.6 million by 2028, analysts assume OneSpaWorld would need to de-rate to a PE of 26.8x to justify their $25.50 target, keeping it above industry norms.

- Margin and profit improvements have not translated into faster acceleration on the top line, so the premium pricing relies on confidence in continued high-quality profit delivery and share buybacks reducing outstanding shares by 1.24% each year.

- If the sector faces a growth slowdown or valuation multiples compress more than expected, the current premium could quickly become a headwind rather than a halo.

Risks Tied to Cruise Industry Reliance

- Analysts highlight OneSpaWorld’s dependence on cruise partnerships as a key risk, with over-reliance leaving the company exposed to external shocks such as travel restrictions and slow growth in new brands like Aroya and Mitsui.

- Consensus narrative flags the bullish case that growing cruise passenger volumes and premium wellness demand should support resilient revenue, but warns that any downturn, whether from rising costs, stricter regulations, or cruise disruptions, could quickly pressure both growth and margins.

- OneSpaWorld’s asset-light approach boosts returns during upcycles but could amplify losses if shipboard labor costs remain fixed during periods of reduced guest spend or cruise cancellations.

- The anticipated lift from next-gen technology and AI-driven initiatives may take longer to materialize than bulls hope, meaning the risk/reward balance could shift if these benefits are delayed or muted.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for OneSpaWorld Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different interpretation of the figures? It takes just a few minutes to share your unique perspective and shape your own narrative: Do it your way.

A great starting point for your OneSpaWorld Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite robust profit margins, OneSpaWorld’s premium valuation faces challenges from moderate future growth and vulnerability to broader market downswings.

If you want better value for money and upside potential, discover these 848 undervalued stocks based on cash flows with compelling fundamentals trading below fair value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OSW

OneSpaWorld Holdings

Operates health and wellness centers onboard cruise ships and at destination resorts in the United States and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives