- United States

- /

- Hospitality

- /

- NasdaqGS:MLCO

Melco Resorts & Entertainment (NasdaqGS:MLCO): Valuation Insights Following Studio City’s Integrated Resort Hospital Launch

Reviewed by Simply Wall St

Melco Resorts & Entertainment (NasdaqGS:MLCO) has officially opened the world’s first integrated resort hospital inside Studio City, partnering with iRad to launch this advanced medical facility. The new hospital highlights Melco’s push into non-gaming ventures, a move that closely tracks Macau’s broader strategy to diversify its economy.

See our latest analysis for Melco Resorts & Entertainment.

Melco’s innovative push into healthcare comes as investors have seen the 2025 year-to-date share price jump more than 50%, a sharp contrast to recent pullbacks. Even after a near 13% slide in the last month, the one-year total shareholder return stands at an impressive 23.6%. This signals that momentum has picked up overall, even as some short-term volatility remains that long-term holders are used to. Add in a recent string of community initiatives, and it is clear Melco is working to reshape its broader narrative in Macau’s evolving market.

If Melco's transformation has you thinking about what else could be next, broaden your search and discover fast growing stocks with high insider ownership

With major non-gaming expansions and a recent rally in the stock, is Melco Resorts & Entertainment still trading at a discount, or is the market already pricing in its next phase of growth?

Price-to-Earnings of 57.3x: Is it justified?

Melco Resorts & Entertainment’s shares are trading at a price-to-earnings (P/E) ratio of 57.3x, which is dramatically higher than both peers and broader industry averages. At a last close price of $8.32, the stock does not look cheap on earnings alone.

P/E ratios compare a company’s current share price to its earnings per share, serving as a shorthand for how the market values future profitability. For Melco, this rich multiple suggests investors are pricing in high expectations for continued earnings growth, far outstripping historical sector trends.

What stands out is just how high the bar is. The P/E of 57.3x towers over the US Hospitality industry average of 23.9x, which is more than double. Not only that, it also exceeds the estimated fair P/E ratio for Melco itself, which stands at 36.7x. This implies the market could be overvaluing near-term growth prospects compared to both similar companies and what underlying fundamentals suggest is reasonable. If prices were to normalize, the multiple could compress toward these lower benchmarks.

Explore the SWS fair ratio for Melco Resorts & Entertainment

Result: Price-to-Earnings of 57.3x (OVERVALUED)

However, slowing revenue growth and past share price volatility could quickly dampen the current optimism if fundamentals fail to deliver as expected.

Find out about the key risks to this Melco Resorts & Entertainment narrative.

Another View: What Does the SWS DCF Model Say?

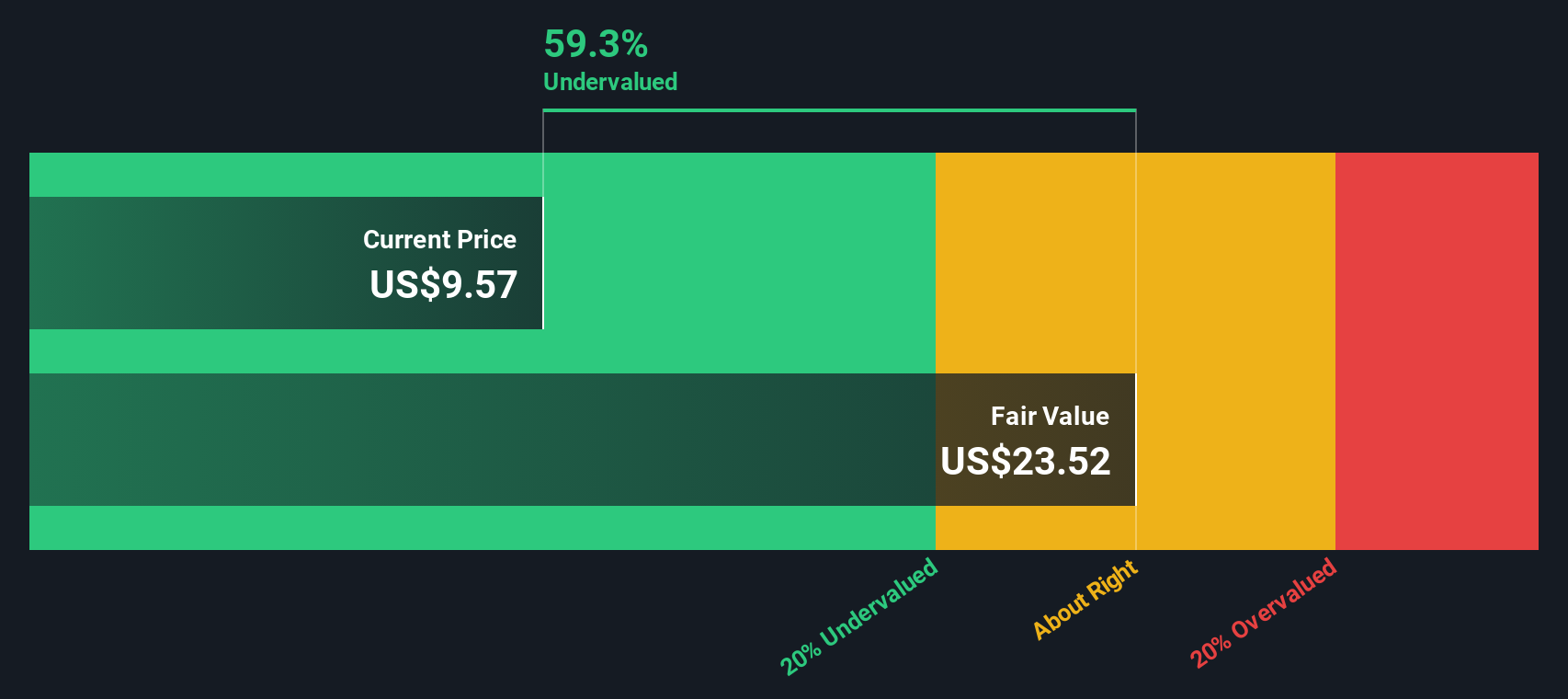

While the market’s high price-to-earnings ratio signals overvaluation, the SWS DCF model presents a very different perspective. According to our DCF model, Melco’s current share price of $8.32 trades far below its estimated fair value of $21.95. This suggests the stock is actually undervalued by a wide margin. How should investors weigh this sharp difference between market sentiment and intrinsic worth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Melco Resorts & Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Melco Resorts & Entertainment Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly put together your own take in just a few minutes, and Do it your way.

A great starting point for your Melco Resorts & Entertainment research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for smarter returns by seizing the most promising themes in today’s market. Don't let opportunities pass you by when it just takes a click.

- Unlock potential growth by checking out these 27 AI penny stocks that are reshaping entire industries through artificial intelligence and automation breakthroughs.

- Target strong cash flow opportunities as you browse these 877 undervalued stocks based on cash flows, featuring companies trading below what their fundamentals suggest they're worth.

- Boost your income stream by exploring these 17 dividend stocks with yields > 3%, which offers generous yields above 3% from companies with steady track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLCO

Melco Resorts & Entertainment

Develops, owns, and operates casino gaming and resort facilities in Asia and Europe.

Good value with reasonable growth potential.

Market Insights

Community Narratives