- United States

- /

- Consumer Services

- /

- NasdaqGS:MCW

Mister Car Wash (MCW) Margin Improvement Reinforces Bullish Narratives Despite Valuation Concerns

Reviewed by Simply Wall St

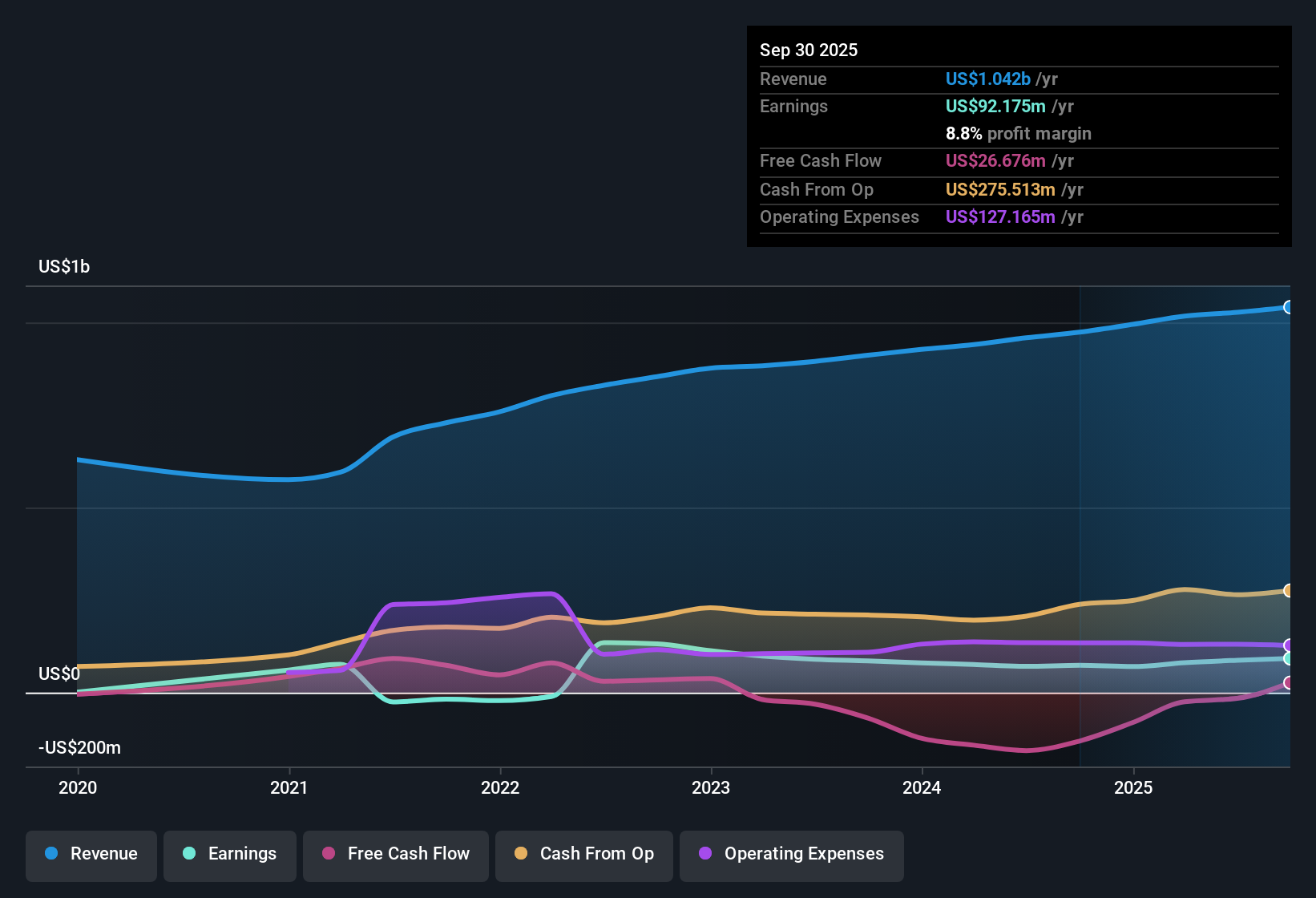

Mister Car Wash (MCW) delivered an improved net profit margin of 8.8%, up from last year’s 7.5%, and posted 25.5% earnings growth over the past year, outpacing its five-year average annual rate of 18.3%. Looking ahead, earnings are forecast to grow by 22.5% per year, faster than the broader US market’s 15.7%, while revenue growth is expected to be a more modest 6.4% per year. With high earnings quality and solid profit growth anticipated, some investors may see a favorable setup, even as MCW trades at a discount to its fair value based on discounted cash flow analysis. However, valuation concerns remain because the P/E stands above industry and peer averages.

See our full analysis for Mister Car Wash.Next, we will see how these results compare to the leading market narratives. This will reveal which stories are confirmed and which might need a second look.

See what the community is saying about Mister Car Wash

Subscription Sales Now Drive 75% of Revenue

- The Unlimited Wash Club (UWC) membership program accounts for about 75% of Mister Car Wash’s total sales, indicating a substantial reliance on recurring revenue from subscriptions rather than single purchases.

- The analysts' consensus view highlights both opportunity and risk in this heavy subscription focus:

- This focus boosts margin stability, as subscription members have shown high retention. Initiatives such as the Titanium tier have lifted per-member spending and margins over time.

- However, high concentration in one stream leaves Mister Car Wash exposed if memberships stall or customers become more price sensitive. In a market downturn, revenue could be weighed down more heavily than at competitors with diverse income sources.

- What stands out is how closely future earnings durability is tied to membership trends. Outperformance or underperformance in UWC growth could materially swing both near-term results and long-term share value.

Operating Costs Pressure Margins, Despite Expansion

- Operating expenses, including rising labor rates and higher utilities and repair costs, increased by 200 basis points year-over-year. This has put pressure on margin expansion despite overall improvement.

- Analysts' consensus view notes two crosscurrents playing out in Mister Car Wash's story:

- Rising average revenue per member and disciplined site selection support higher profitability even as some locations ramp up more slowly, with margins forecast to reach 14.3% from 8.5% today over three years.

- Yet, increased competition as stores near new competitors saw negative low-single-digit comps suggests that higher costs may not be fully offset by pricing power, and margin progress could be at risk if competitive pressure intensifies further.

Valuation: DCF Upside but P/E Still Elevated

- Mister Car Wash trades at a share price of $5.64, which is below its DCF fair value of $9.14, signaling potential upside on a discounted cash flow basis. However, it carries a P/E of 20x, higher than the US Consumer Services industry average of 17.2x and the peer average of 19x.

- According to the analysts' consensus view, this duality at the heart of Mister Car Wash’s valuation is key:

- The discounted cash flow model supports a constructive take, as Mister Car Wash could offer material upside to intrinsic value if projected annual earnings growth of 22.5% over the medium term is achieved.

- Bears counter that the above-average P/E ratio means much of this growth is already priced in. If the company falls short or sector sentiment turns more cautious, Mister Car Wash shares could remain rangebound until multiples reset or new catalysts emerge.

- Momentum hinges on growth delivering as forecast, with the market needing to see not just improvement but continued outperformance to justify the valuation gap.

- If you want the full investor debate—including what drives bulls, bears, and the neutral crowd—be sure to explore all sides in the consensus breakdown.

- See how strong membership growth and valuation tension shape the consensus view in the full narrative. 📊 Read the full Mister Car Wash Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mister Car Wash on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a different take on the figures? Shape your perspective and create your own narrative in just a few minutes. Do it your way

A great starting point for your Mister Car Wash research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Mister Car Wash faces ongoing valuation concerns due to its premium P/E ratio and relies heavily on continued high membership growth for future momentum.

If you want to find companies with more compelling valuations and growth potential, check out these 848 undervalued stocks based on cash flows where you can spot investments offering better value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCW

Mister Car Wash

Provides conveyorized car wash services in the United States.

Proven track record and fair value.

Market Insights

Community Narratives