- United States

- /

- Consumer Services

- /

- NasdaqGS:LAUR

How Investors May Respond To Laureate Education (LAUR) Raising 2025 Revenue Guidance and Share Buyback

Reviewed by Sasha Jovanovic

- Laureate Education recently raised its full-year 2025 revenue guidance to between US$1.68 billion and US$1.69 billion following strong third quarter results, while also increasing its share buyback authorization by US$150 million to a total of US$250 million.

- The company highlighted robust enrollment growth in Peru’s online programs and steady gains in Mexico, signaling momentum in digital expansion and confidence in its business outlook.

- We'll examine how the raised revenue guidance and expanded buyback program could influence Laureate Education's investment narrative going forward.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Laureate Education Investment Narrative Recap

To be a Laureate Education shareholder means believing in the company's ability to capitalize on rising demand for private higher education in Latin America while effectively expanding its digital and campus offerings. The recent boost in full-year guidance and share buyback authorization supports the story of ongoing digital growth and market strength in Peru and Mexico, but these updates do not significantly reduce the key short-term risk: heavy capital spending tied to expansion could pressure margins if student demand falls short.

Among recent announcements, the increase in Laureate’s share buyback plan to US$250 million stands out. This move signals ongoing focus on capital returns while the business maintains its growth trajectory, reinforcing confidence around cash flow and management’s belief in the company's underlying value, even as revenue growth remains tightly linked to trends in its two largest markets.

In contrast, investors should be aware of the potential impact if enrollment growth slows or market conditions shift unexpectedly in Mexico or Peru, as...

Read the full narrative on Laureate Education (it's free!)

Laureate Education's narrative projects $2.0 billion revenue and $343.9 million earnings by 2028. This requires 8.4% yearly revenue growth and a $89.7 million earnings increase from $254.2 million today.

Uncover how Laureate Education's forecasts yield a $34.20 fair value, a 10% upside to its current price.

Exploring Other Perspectives

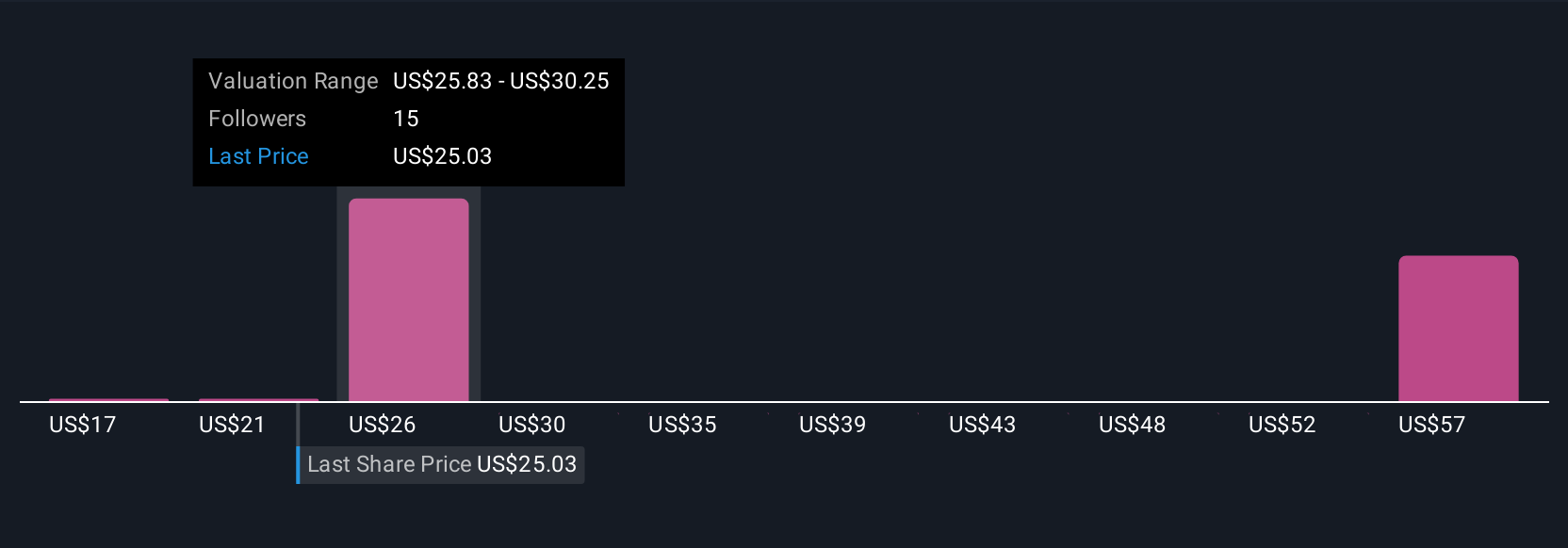

Five views from the Simply Wall St Community place Laureate Education’s fair value between US$17 and US$55.41 per share. With growth tied closely to demand in Peru and Mexico, you could see performance outcomes diverge, check out how community perspectives might compare to your outlook.

Explore 5 other fair value estimates on Laureate Education - why the stock might be worth 45% less than the current price!

Build Your Own Laureate Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Laureate Education research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Laureate Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Laureate Education's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LAUR

Laureate Education

Offers higher education programs and services to students through a network of universities and higher education institutions.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives