- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Is Duolingo a Smart Opportunity After This Week’s 13% Slide?

Reviewed by Bailey Pemberton

- Wondering if Duolingo might be undervalued or set to soar? Let's dig into what the numbers and broader trends suggest about its current stock price.

- Despite Duolingo's wild 239.0% return over the past three years, the stock is down 13.3% this past week and has dropped 17.0% so far this year. This hints at some recent volatility and shifting market sentiment.

- Recent headlines have focused on Duolingo's continued push into new languages and AI-powered features, generating buzz among both learners and investors. This innovative drive provides crucial context to the recent share price swings and could shape future growth prospects.

- Currently, Duolingo scores just 2 out of 6 on our value checks, which suggests there is more to consider than meets the eye. Stick around as we break down the usual ways investors attempt to value the company and reveal an even smarter approach you won't want to miss.

Duolingo scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Duolingo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and then discounting them back to today's dollars. This helps investors understand what the business might be worth based on expectations of how much cash it can generate.

For Duolingo, the latest reported Free Cash Flow (FCF) is $315 million. Looking ahead, analysts forecast steady growth, with FCF expected to reach over $640 million by 2027. Beyond that, longer-term projections, extrapolated by Simply Wall St, suggest FCF could rise to nearly $1.2 billion by 2035. These numbers are based on both analyst inputs for the next few years and longer-run estimated growth rates.

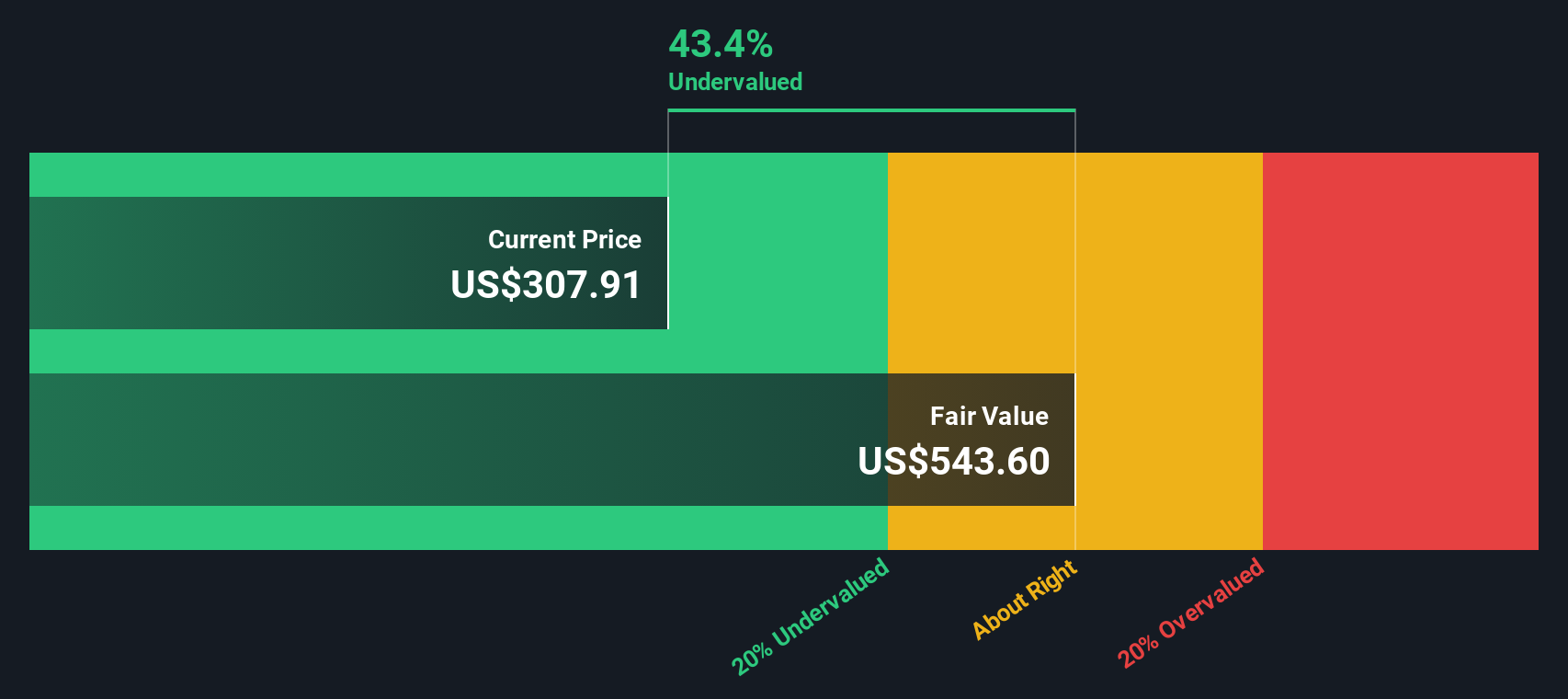

All those projected cash flows are factored into the DCF formula, then discounted back to today to account for risk and the time value of money. This process puts Duolingo’s intrinsic value at $482 per share in US dollars.

At current prices, this means Duolingo is trading at a 43.9% discount to its calculated fair value, which suggests the stock is significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Duolingo is undervalued by 43.9%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Duolingo Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies like Duolingo. It tells investors how much they are paying for each dollar of earnings, making it a key reference point when a business is already generating solid profits.

However, what counts as a “normal” or “fair” PE ratio depends on the company’s growth prospects and the risks it faces. Fast-growing, innovative businesses typically command higher PE multiples, as investors are willing to pay more now in anticipation of bigger future profits. On the other hand, higher risk or slower growth tends to push the PE down.

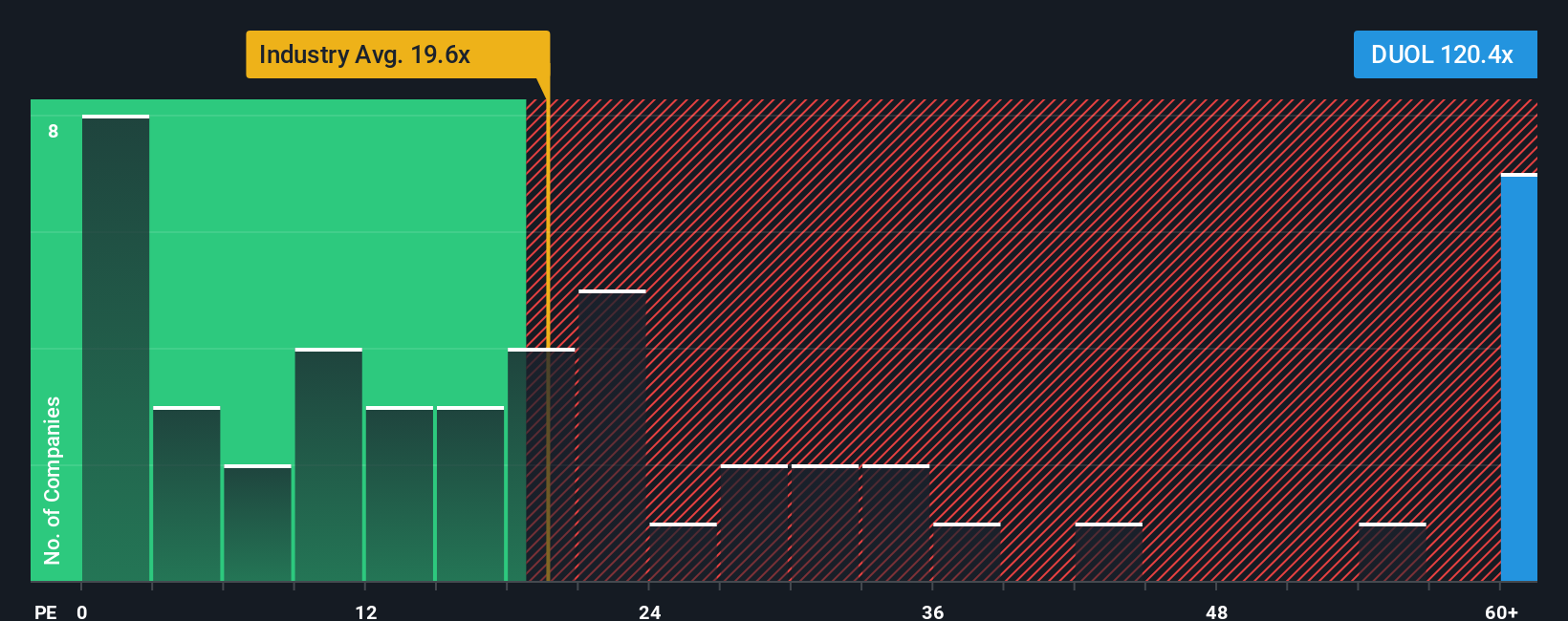

Right now, Duolingo trades at a PE ratio of 105.83x. That is much higher than the Consumer Services industry average of 18.83x, as well as the average for its listed peers at 28.47x. At first glance, this steep premium might make the stock look expensive.

Simply Wall St's proprietary "Fair Ratio" shines here, offering a more tailored benchmark. The Fair Ratio for Duolingo is 37.79x, calculated using company-specific factors like growth rates, profit margins, risks, industry trends and market cap. This approach is more useful than peer or industry averages because it accounts for what actually sets Duolingo apart: rapid growth, unique business model, and emerging risks.

Comparing the Fair Ratio (37.79x) to Duolingo’s current PE (105.83x), the stock appears to be significantly overvalued at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Duolingo Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives: a smarter, more holistic approach that goes beyond formulas and ratios to put your perspective at the center of investment decisions.

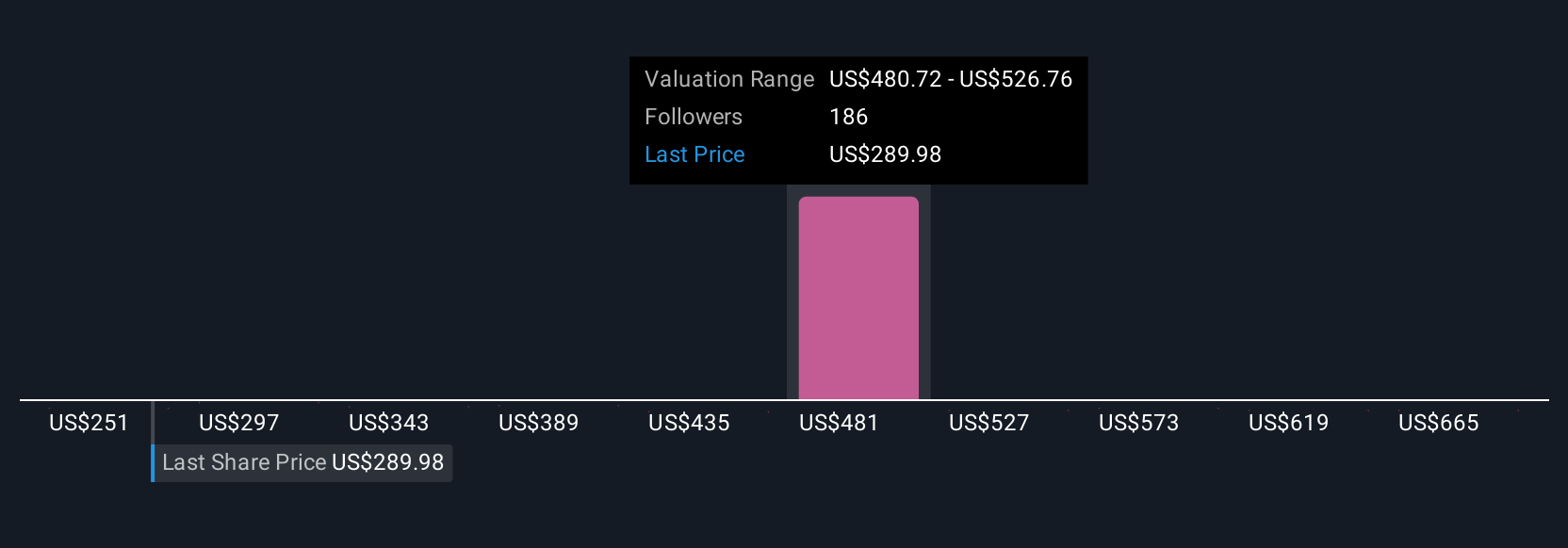

A Narrative is simply your story about a company, connecting your expectations and beliefs about Duolingo’s future to projected financial outcomes like revenue, earnings, and profit margins, and then translating those forecasts into an estimated fair value.

With Narratives, you can quickly see how your unique view or the community’s consensus stacks up, no spreadsheet required. On Simply Wall St’s Community page, used by millions of investors, anyone can build, update, and share their thinking in a way that is transparent and easy to follow.

Narratives allow you to track not just the numbers but also the “why” behind your fair value, updating automatically as new information or events such as news headlines, product launches, or earnings reports emerge. This keeps your investment decisions dynamic and fully informed.

For example, one Duolingo Narrative sees booming international expansion and successful AI-driven monetization driving fair value as high as $600 per share, while another, more cautious perspective focused on slowing core user growth and rising competition puts fair value closer to $239. Narratives help you clearly see which story you believe, and whether the current price justifies a buy, hold, or sell decision.

Do you think there's more to the story for Duolingo? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives