- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Duolingo (DUOL): Exploring Valuation After Recent Share Price Slide and Shifting Investor Sentiment

Reviewed by Simply Wall St

Duolingo (DUOL) shares have been in focus recently, trading around $260. The stock’s movement this month has drawn attention from investors who are weighing the company’s growth trends in light of recent market volatility.

See our latest analysis for Duolingo.

It’s been a rollercoaster year for Duolingo, with momentum fading in recent months as the share price slid 18.8% over the past month and 20.2% year-to-date. While there is still impressive long-term growth, with Duolingo’s three-year total shareholder return well above most peers, recent moves point to shifting sentiment as investors reassess near-term risks and growth potential.

If you’re weighing your next move, this is a perfect time to see what’s trending beyond language learning and discover fast growing stocks with high insider ownership

With Duolingo trading well below analyst targets but still boasting strong growth metrics, investors now face a critical question: does today’s price offer an attractive entry point, or is the future already fully baked in?

Most Popular Narrative: 41.3% Undervalued

With Duolingo closing at $260.02, the most followed narrative estimates fair value at $442.74. This is significantly higher than today's price and hints at a possible buying opportunity if bold growth assumptions play out.

"Continued investment in and expansion of adjacent educational categories such as Math, Music, and Chess leverages Duolingo's gamification infrastructure and strong brand; these new subjects broaden the platform's appeal, attract additional user segments, and are expected to drive higher ARPU and incremental revenue streams over the next several years."

What’s the secret ingredient fueling this high valuation? The fair value is based on an aggressive three-year expansion plan, rising profit margins, and future earnings leaps. Want to see which forecasts send Duolingo’s worth to new heights? Find out what’s driving this narrative's ambitious price target and see the numbers that could rewrite expectations.

Result: Fair Value of $442.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing user growth in core markets and rising competition from major tech players could present challenges to Duolingo’s high growth expectations in the near term.

Find out about the key risks to this Duolingo narrative.

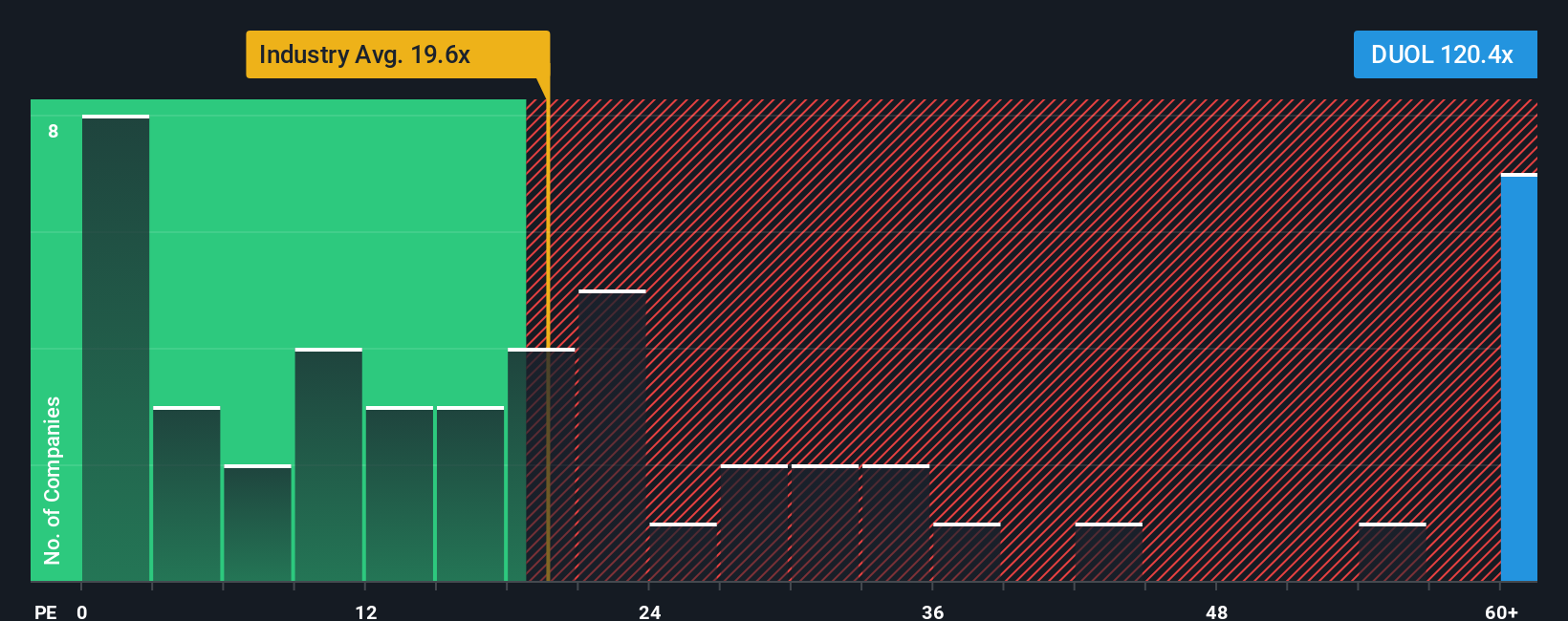

Another View: High Earnings Multiple Poses a Caution

Contrast that optimistic fair value with current earnings multiples. Duolingo trades at a price-to-earnings ratio of 101.7x, far above the US Consumer Services industry average of 15.7x and its peers at 29x. Even compared to the fair ratio of 36.1x, Duolingo looks expensive, which could amplify downside if growth stalls. Is the premium justified, or is this pricing in risk more than reward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Duolingo Narrative

If you’re not convinced by these perspectives or want to dive deeper into Duolingo’s numbers, it only takes a few minutes to develop your own view. Do it your way.

A great starting point for your Duolingo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take charge of your investing strategy today and uncover opportunities you might be missing. These handpicked stock ideas can help you get ahead of the next big move.

- Benefit from fast-growing, forward-looking breakthroughs by exploring these 26 AI penny stocks, which are propelling the future of artificial intelligence in real-world businesses.

- Supercharge your portfolio with reliable income and stability by reviewing these 20 dividend stocks with yields > 3%, offering yields above 3%.

- Unleash your potential to spot major value opportunities by tracking these 849 undervalued stocks based on cash flows, priced well below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives