- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Does Duolingo’s 44% Share Price Drop Signal a Better Opportunity in 2025?

Reviewed by Bailey Pemberton

- Wondering whether Duolingo is a bargain after its rollercoaster ride? Let’s dig into what the numbers and the story really say about its value today.

- In the past month, Duolingo shares have dropped 44.2%, taking their year-to-date return to -46.5%. The three-year return is still an impressive 154.4%.

- Investors have been rethinking the stock after competitive pressures in the edtech sector made headlines as major new players enter the language learning market and existing rivals ramp up their offerings. These shifts have put the spotlight on Duolingo's ability to retain users and grow internationally.

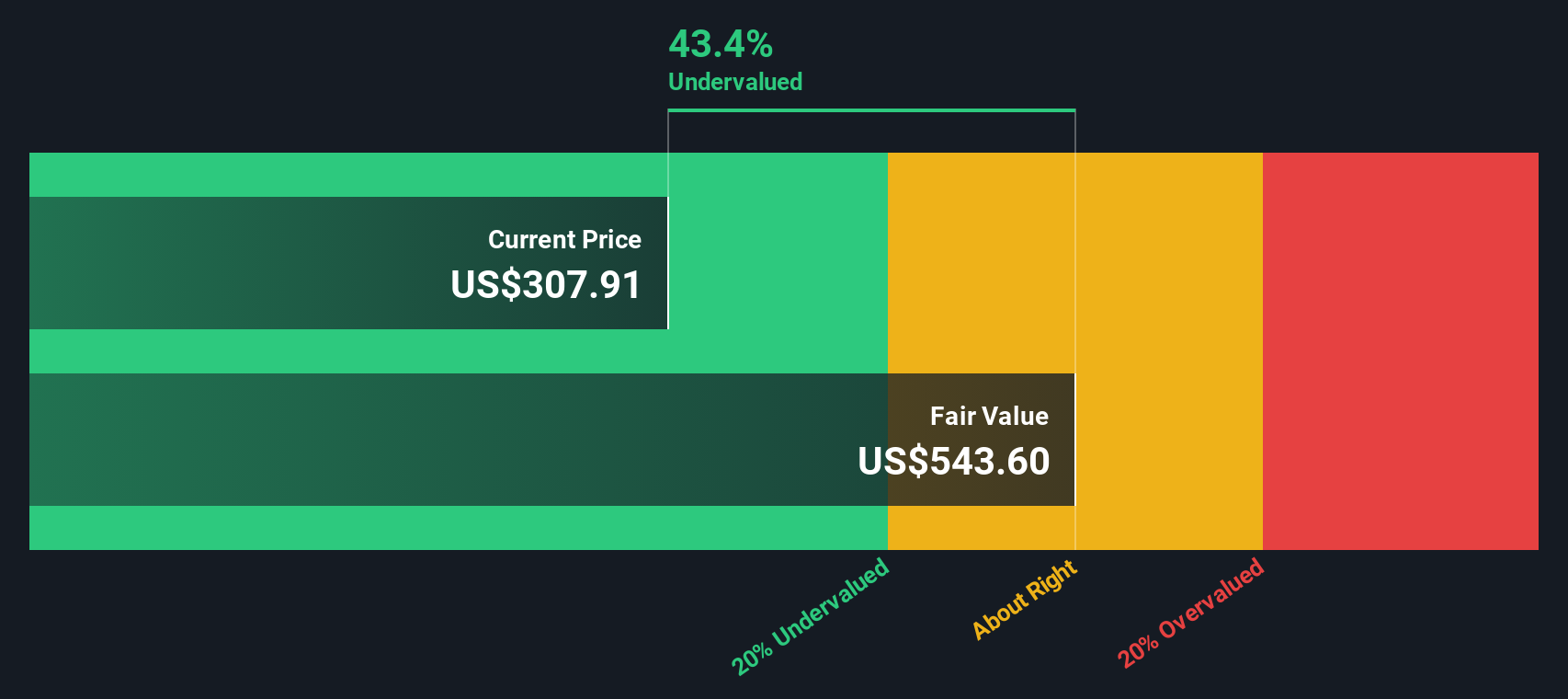

- According to our valuation checks, Duolingo scores a 3 out of 6 for being undervalued. This puts us right at a crossroads; it is worth seeing how different valuation methods stack up, but stick around to the end for an even more insightful way to gauge Duolingo’s true worth.

Find out why Duolingo's -47.3% return over the last year is lagging behind its peers.

Approach 1: Duolingo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s value. This helps investors understand what the business is truly worth if future growth matches expectations.

For Duolingo, current Free Cash Flow stands at $341.6 Million. Analyst estimates go out about five years, after which further growth is projected by Simply Wall St, expecting Free Cash Flow to reach roughly $1.2 Billion by 2035. These projections assume Duolingo continues to expand and maintain profitability over the coming decade, with increasing user engagement and revenue streams.

After discounting these expected cash flows, the DCF approach calculates an intrinsic fair value of $482.45 per share for Duolingo. This value suggests the stock is trading at a steep 63.8% discount and appears significantly undervalued compared to its current market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Duolingo is undervalued by 63.8%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

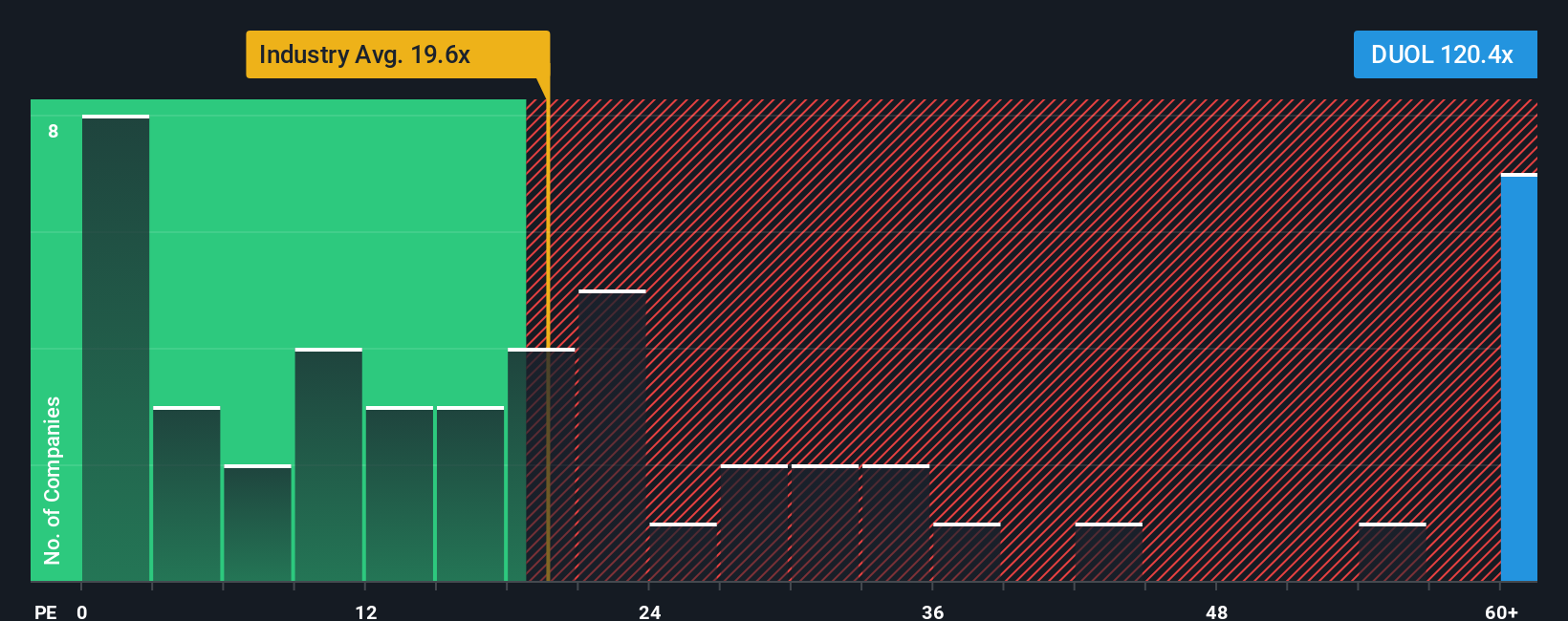

Approach 2: Duolingo Price vs Earnings

When it comes to valuing profitable companies like Duolingo, the Price-to-Earnings (PE) ratio stands out as one of the most widely used metrics. It helps investors gauge how much the market is willing to pay today for each dollar of current earnings, making it especially relevant for assessing companies generating positive profits.

The "right" PE ratio for a company depends on growth expectations and risk. Fast-growing or less risky companies typically command higher PE multiples, since investors are willing to pay more for future earnings. Conversely, mature or riskier companies usually trade at lower PEs.

Duolingo currently trades at a PE ratio of 20.9x. For context, this stands above the Consumer Services industry average of 15.8x, but just below its peer group average of 24.2x. While comparing to industry averages and peers can provide a quick reality check, these methods can overlook individual company differences.

This is where the Simply Wall St “Fair Ratio” offers more depth. It is a custom benchmark that adjusts for Duolingo’s growth outlook, profit margins, market cap, and specific risks, aiming to represent the most reasonable PE multiple for the business today. For Duolingo, the Fair Ratio is calculated at 12.4x, which is noticeably below both its current PE and peer averages. This signals the market may be overvaluing the company relative to what its fundamentals justify.

Because Duolingo’s PE of 20.9x is substantially higher than its Fair Ratio, the stock looks overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

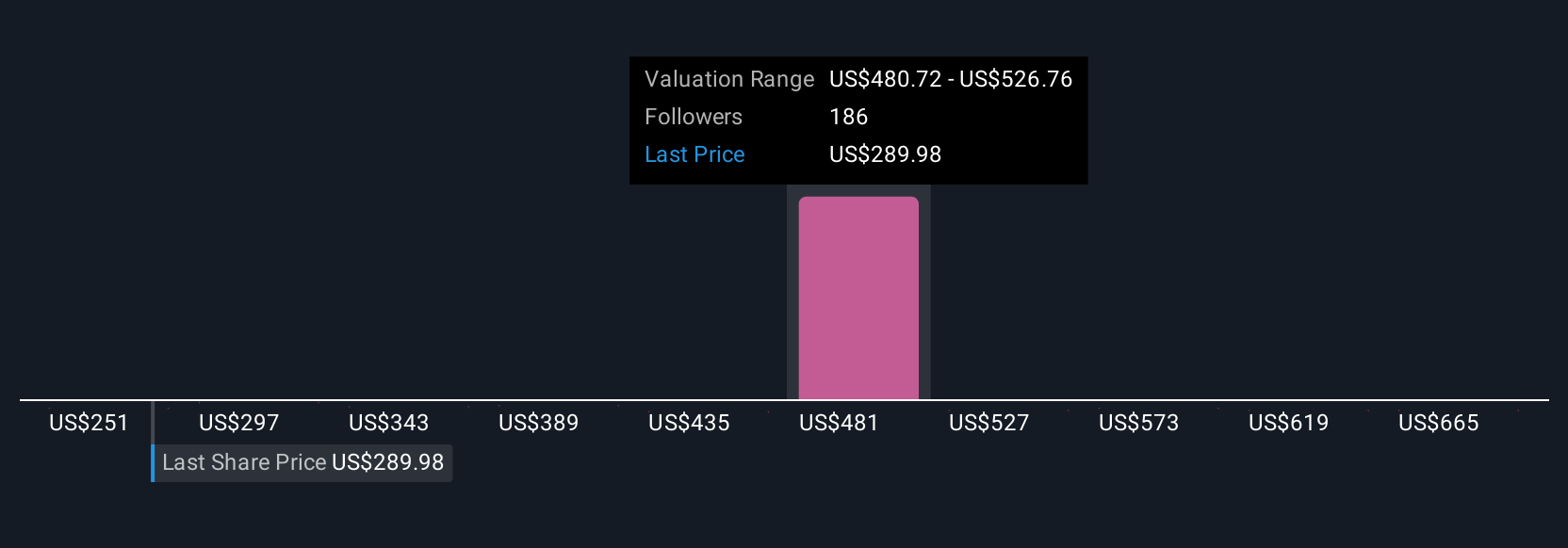

Upgrade Your Decision Making: Choose your Duolingo Narrative

Earlier, we mentioned there is an even better way to understand value, so let us introduce Narratives, a powerful and accessible approach used by millions of investors on Simply Wall St’s Community page. In simple terms, a Narrative captures your story or perspective behind the numbers by combining your assumptions on Duolingo’s future outcomes, such as revenue, margins, and fair value, into a personalized financial forecast.

A Narrative links what you believe about the company’s future to an estimated fair value, then shows how that stacks up against the current market price to help inform your decision to buy, hold, or sell. Narratives are dynamic and automatically update as new events (like news, product launches, or earnings) change the underlying data.

For example, investors currently range from confidently bullish, seeing Duolingo reaching a fair value up at $600 per share if global expansion, new product monetization, and engagement growth stay strong, to notably cautious, expecting a fair value near $239 if competition, slowing user growth, or regulatory risks weigh more heavily. Narratives invite you to build your own, track others’ perspectives, and react swiftly as the story evolves.

Do you think there's more to the story for Duolingo? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives