- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Can Duolingo's (DUOL) Strategic Shift Balance User Growth With Sustainable Profitability?

Reviewed by Sasha Jovanovic

- Duolingo recently presented at VantaCon in San Francisco, where security risk management was a key focus, and reported quarterly results showing strong revenue and user growth but missed near-term profitability estimates.

- Skepticism has emerged regarding the company's ability to sustain its high valuation, partly due to co-founder stock sales, increased marketing costs, and concerns over the future effectiveness of its strategic shift toward user growth over monetization.

- We’ll explore how missed EBITDA guidance and changing growth priorities may influence Duolingo’s long-term investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Duolingo Investment Narrative Recap

To own shares in Duolingo today, investors need to believe that its rapid user expansion and sustained leadership in digital learning will ultimately translate into higher long-term earnings, justifying its premium valuation. The recent earnings miss on EBITDA guidance, combined with sharper scrutiny on monetization and insider stock sales, may pressure short-term sentiment, but the most important near-term catalyst remains continued user growth, while the biggest risk centers on investor faith in Duolingo's ability to convert those users into profits; neither factor appears conclusively derailed by the latest updates.

Among recent announcements, the launch of 148 new language courses using generative AI stands out, reinforcing confidence in Duolingo's ongoing commitment to product and market expansion. This supports one of the key growth catalysts: broadening the platform’s appeal to new audiences and enhancing engagement, which is vital given that near-term profitability has taken a back seat to growth ambitions.

However, investors should pay attention to the contrasting signs around co-founder stock sales and lingering questions about...

Read the full narrative on Duolingo (it's free!)

Duolingo's narrative projects $1.7 billion revenue and $368.7 million earnings by 2028. This requires 23.7% yearly revenue growth and a $251.5 million earnings increase from $117.2 million currently.

Uncover how Duolingo's forecasts yield a $289.81 fair value, a 68% upside to its current price.

Exploring Other Perspectives

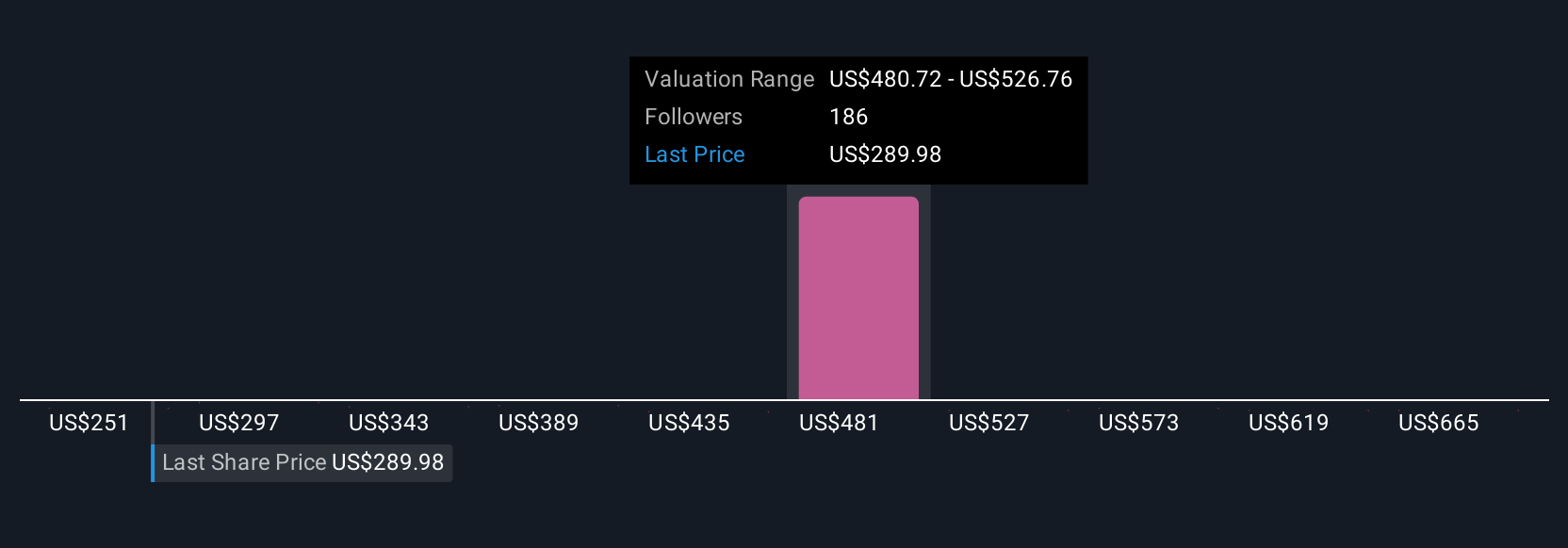

Fair value estimates from 24 Simply Wall St Community members range widely from US$238.77 to US$680.60 per share. These varying opinions highlight the uncertainty around Duolingo’s ability to sustain its high user growth while managing margin pressures, inviting readers to review multiple perspectives on future performance.

Explore 24 other fair value estimates on Duolingo - why the stock might be worth over 3x more than the current price!

Build Your Own Duolingo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Duolingo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Duolingo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Duolingo's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives