- United States

- /

- Hospitality

- /

- NasdaqGS:DPZ

Domino’s Pizza (DPZ): Assessing Valuation After New Menu Launch and Marketing Push

Reviewed by Simply Wall St

Domino's Pizza (DPZ) just introduced the Spicy Chicken Bacon Ranch Pizza as part of its expanded lineup of Specialty Pizzas. Alongside this, the company is rolling out new TV ads and a limited-time promotion, catching the eye of investors curious about sales momentum.

See our latest analysis for Domino's Pizza.

While Domino's latest specialty pizza has generated some buzz and marketing momentum, the stock hasn’t quite reflected that excitement. Its share price is currently $409.23, with a 1-year total shareholder return of -5.7%. Multi-year returns remain comfortably positive, signaling long-term value despite recent volatility.

If new menu moves spark your curiosity, this could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

But with shares down for the year despite new product launches and upbeat promotions, investors have to wonder if Domino's is undervalued at these levels or if the market is already pricing in all the future growth.

Most Popular Narrative: 17.9% Undervalued

The most widely followed narrative now points to Domino's Pizza trading well below its fair value, with analysts projecting a fair value of $498.26 versus the latest close at $409.23. This outlook creates a sharp contrast between consensus-driven optimism and the market's recent skepticism.

The recent full national rollout on DoorDash, building on last year's Uber Eats integration, is expected to be a multiyear growth driver. This allows Domino's to tap into a broader, digitally native customer base and meet rising consumer preference for at-home dining and off-premise consumption, which is anticipated to drive higher delivery segment revenues and increased market share.

What exactly convinces analysts that Domino's should command such a premium price? There are future revenue leaps, profit margin improvements, and a bold bet on how fast earnings might grow. Want to know which aggressive financial milestones justify this target? You’ll have to read the full narrative to uncover the surprising drivers and the numbers that power the bullish valuation.

Result: Fair Value of $498.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer consumer demand or slower international growth could quickly challenge the bullish case that Domino's remains significantly undervalued at current prices.

Find out about the key risks to this Domino's Pizza narrative.

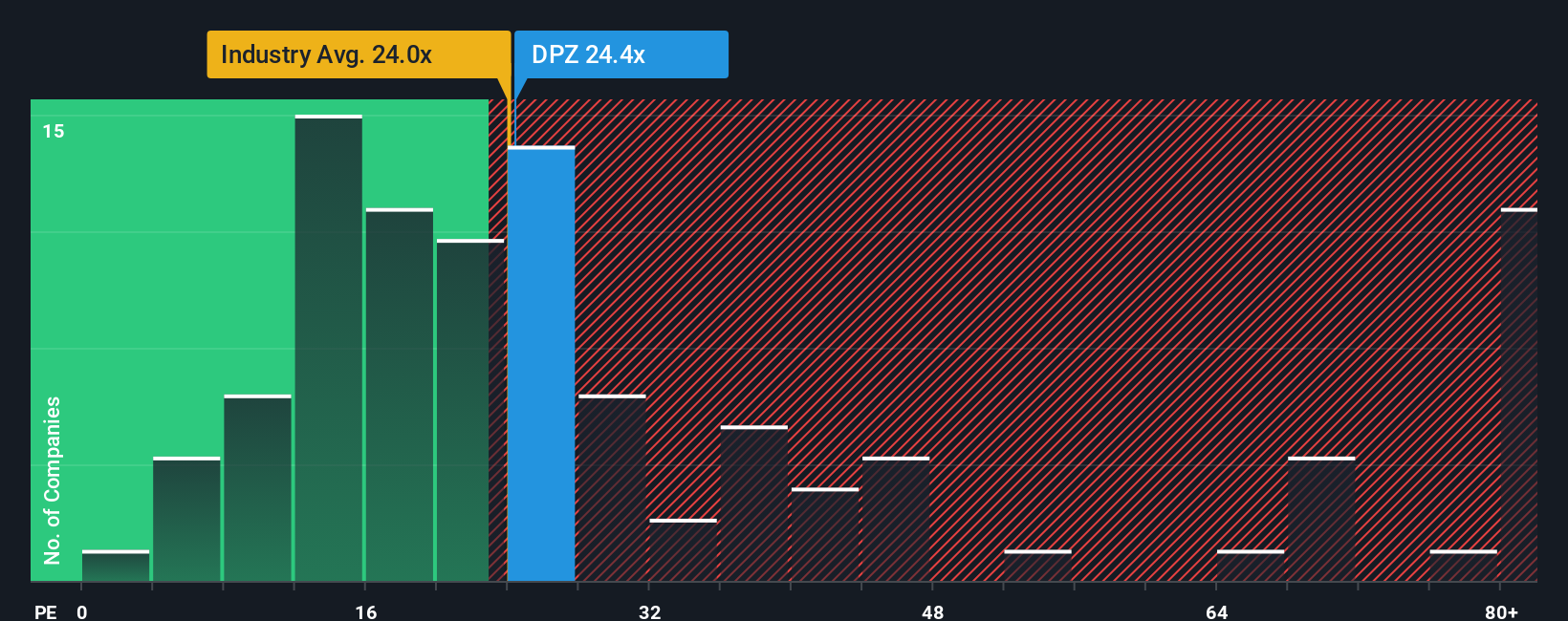

Another View: Multiples Send a Different Signal

Looking from another angle, Domino’s trades at a price-to-earnings ratio of 23.5 times, which is higher than both its industry average of 22.1 times and its peers at 22.2 times. That is also above the fair ratio of 21 times, implying the market is demanding a premium for Domino’s compared to others in its space.

What does that gap mean? It could signal a risk of the share price moving lower to narrow the premium, or it might suggest investors see something special the numbers cannot capture. Will the market prove them right?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Domino's Pizza Narrative

If you’re not convinced by the angles presented, or you trust your own analysis more, why not dig into the data and craft a personal take on Domino’s outlook in just a few minutes with Do it your way

A great starting point for your Domino's Pizza research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop searching for the next standout stock. Open yourself to fresh opportunities and see what else could help you build a winning portfolio.

- Unlock high yields and steady cash flow by checking out these 15 dividend stocks with yields > 3%, which reward shareholders with strong dividend payouts and sustainable growth.

- Capitalize on tomorrow’s tech leaders when you access these 26 AI penny stocks, shaping industries with breakthroughs in artificial intelligence and innovative solutions.

- Stay ahead of the curve by reviewing these 3564 penny stocks with strong financials, offering high potential at low entry prices, ideal for bold investors seeking the next big opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DPZ

Domino's Pizza

Operates as a pizza company in the United States and internationally.

Established dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives