- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

What DraftKings (DKNG)'s Exclusive ESPN Sportsbook Deal Could Mean for Shareholders

Reviewed by Sasha Jovanovic

- Walt Disney Co. recently announced a multi-year partnership naming DraftKings as the exclusive sportsbook and odds provider for ESPN, starting in December 2025, following the early termination of ESPN's previous deal with Penn Entertainment.

- This agreement is expected to give DraftKings significant exposure across ESPN’s digital platforms, potentially bolstering user acquisition and expanding its presence in the fast-evolving online sports betting industry.

- We'll now examine how this new ESPN partnership could influence DraftKings' growth outlook and impact its longer-term investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

DraftKings Investment Narrative Recap

To own DraftKings, shareholders need to believe in the company’s ability to sustain topline growth and drive profitability as legal sports betting expands and customer engagement deepens, especially now, with the ESPN partnership offering potential for increased user acquisition. While the ESPN deal boosts near-term visibility and reach, the primary short-term catalyst remains efficient expansion into new states, but the largest risk continues to be heightened state-level tax pressures; the latest news does not materially lessen this concern.

One announcement with special relevance here is DraftKings’ revised 2025 revenue guidance, now set at US$5.9 billion to US$6.1 billion, implying strong growth but also acknowledging external pressures from things like fluctuating hold rates and regulatory changes, factors at play even as new partnerships drive brand recognition.

By contrast, investors should be aware of the meaningful financial impact that rising state taxes could have on DraftKings’ margins and profitability...

Read the full narrative on DraftKings (it's free!)

DraftKings' outlook calls for $9.5 billion in revenue and $1.3 billion in earnings by 2028. This is based on analysts forecasting 20.5% annual revenue growth and an earnings increase of $1.6 billion from the current loss of $-304.5 million.

Uncover how DraftKings' forecasts yield a $50.74 fair value, a 67% upside to its current price.

Exploring Other Perspectives

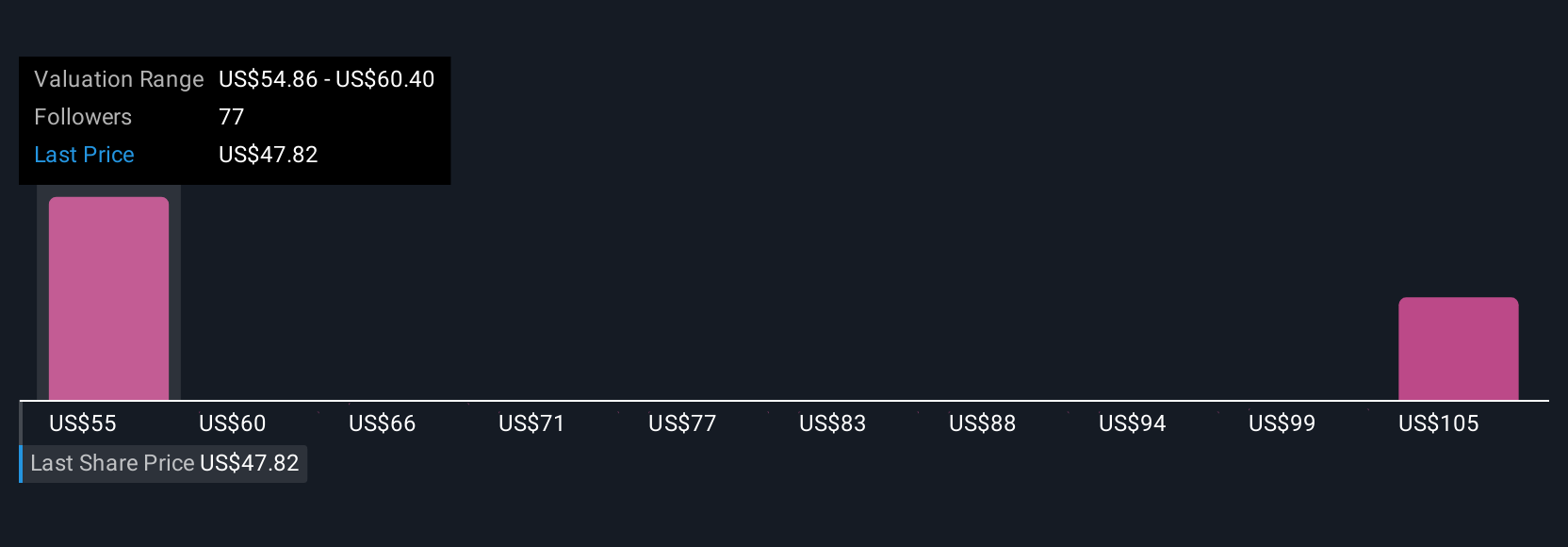

Six fair value estimates from the Simply Wall St Community range from US$48.11 to US$99.47 per share. With market opinions spread across this wide spectrum, the ongoing expansion into new states and partnerships like ESPN may hold increasingly significant implications for DraftKings’ outlook, explore these different views to see what each might mean for your investment thesis.

Explore 6 other fair value estimates on DraftKings - why the stock might be worth over 3x more than the current price!

Build Your Own DraftKings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DraftKings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DraftKings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DraftKings' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives