- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

A Fresh Look at DoorDash (DASH) Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

DoorDash (DASH) shares have slipped in the past month, catching the eye of investors evaluating the company’s next moves. Despite recent volatility, many are watching closely to see how DoorDash adapts in the dynamic delivery market.

See our latest analysis for DoorDash.

DoorDash’s 30-day share price return of -24.6% underscores some fading momentum, even as earlier gains kept its year-to-date return in the green at 17.6%. Looking farther ahead, its three-year total shareholder return of 217% highlights significant growth for those who stayed the course.

If DoorDash’s recent moves have you reconsidering your portfolio strategy, this could be a perfect moment to discover fast growing stocks with high insider ownership

With shares well below recent analyst price targets and healthy revenue growth, investors are left to ponder whether recent declines reflect an opportunity or if DoorDash’s long-term growth has already been fully accounted for by the market.

Most Popular Narrative: 33.7% Undervalued

With DoorDash closing at $200.63 and the most widely followed fair value estimate reaching $302.53, sentiment suggests significant upside if the narrative assumptions are met. This sets up a compelling valuation story, hinging on the company's ability to deliver on ambitious growth and profit goals outlined below.

Rapid expansion into new verticals (grocery, retail, convenience, pharmacy) and international markets is yielding faster growth rates and improving unit economics. This should diversify and accelerate topline revenue while supporting net margin expansion.

Curious about the financial engine behind that bold price target? The forecast relies on a future profit surge and margin leap usually seen in high-growth disruptors. If you want to know which growth levers DoorDash has to pull, you’ll find the key quantitative assumptions and logic driving this valuation in the full narrative.

Result: Fair Value of $302.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory pressure and intensifying competition from both peers and new entrants could quickly challenge DoorDash’s growth and margin assumptions.

Find out about the key risks to this DoorDash narrative.

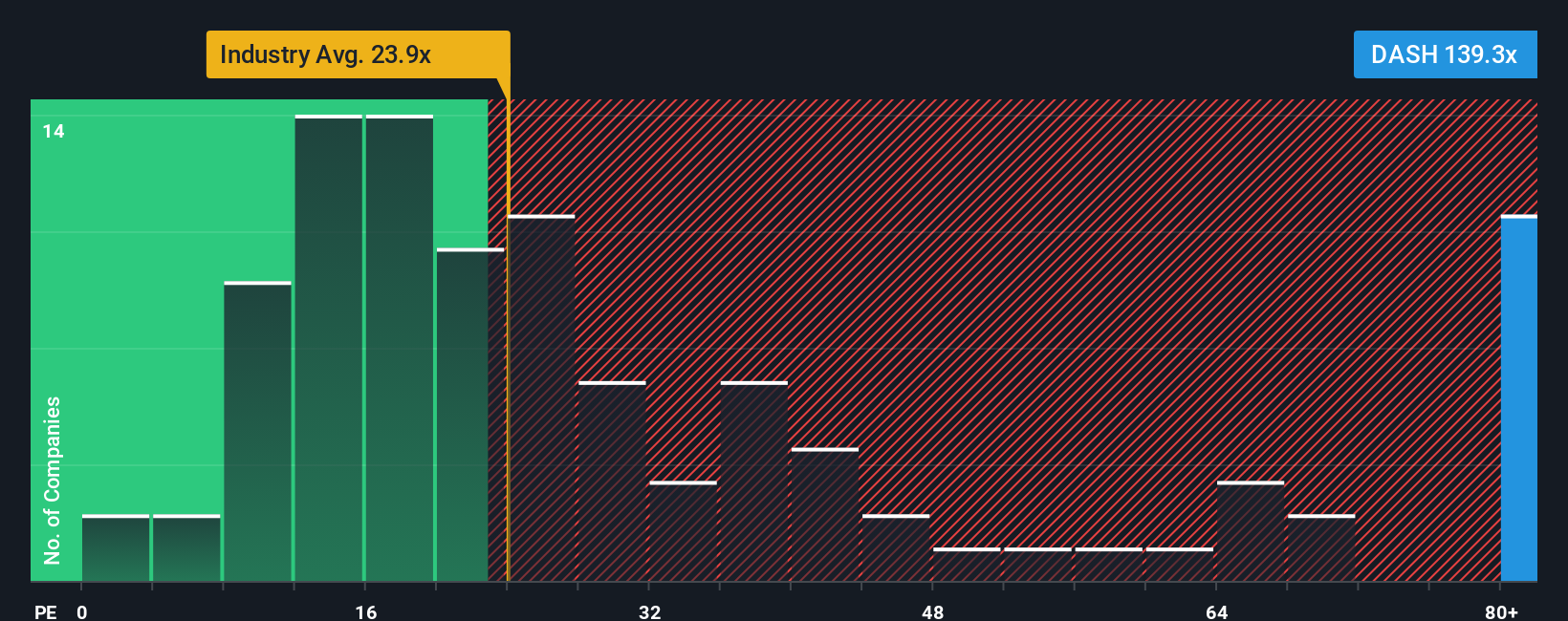

Another View: Multiples Signal Overvaluation

While the fair value story looks compelling, DoorDash's price-to-earnings ratio stands at 100.2x, which is more than three times the US Hospitality industry average of 29.1x and well above its fair ratio of 47.1x. Such a gap highlights considerable valuation risk if growth expectations soften or conditions change. Will the market keep rewarding this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoorDash Narrative

If you see the story unfolding differently or want to run your own numbers, you can build a fresh narrative of your own in just a few minutes with Do it your way.

A great starting point for your DoorDash research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you want to stay a step ahead, power up your watchlist by scouting among the smartest opportunities Simply Wall Street has to offer. Don’t let the next breakout pass you by.

- Capture the future of artificial intelligence by searching for market leaders among these 26 AI penny stocks as they reshape entire industries with smart automation and analytics.

- Boost your income stream by finding reliable companies through these 15 dividend stocks with yields > 3% that deliver consistent yields above 3%, which may be suitable for steady, long-term growth.

- Get ahead of the curve and spot undervalued prospects using these 872 undervalued stocks based on cash flows that might be overlooked but have the fundamentals for a strong comeback.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives