- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (WMT): Exploring Valuation as Shares Pull Back 6% from Recent Highs

Reviewed by Simply Wall St

See our latest analysis for Walmart.

Walmart’s share price has pulled back nearly 6% over the past month after a strong run earlier this year. Recent moves reflect investors’ shifting optimism and caution amid changing retail trends. That said, its 1-year total shareholder return of 18.2% and a remarkable 108% over three years show plenty of long-term momentum behind the stock.

If you’re watching how consumer leaders are trading, now’s the perfect time to expand your search and discover fast growing stocks with high insider ownership

With shares easing back from their highs and still trading below most analyst price targets, investors are considering whether Walmart is currently undervalued or if the market is already pricing in all of the retail giant’s future growth.

Most Popular Narrative: 10.9% Undervalued

Walmart’s latest fair value estimate stands at $113.78 per share, roughly 11% higher than its recent close. This gap has investors questioning what’s fueling such confidence in future upside.

Expansion of high-margin business streams such as Walmart Connect (advertising, up 31-46% globally), marketplace, and Walmart+ memberships (global advertising up 46%, membership income up 15%) is diversifying Walmart's income base beyond retail. This is gradually transforming the company's profit mix and resulting in structurally higher net margins and earnings over time.

Want to know what’s powering Walmart’s recent valuation boost? The most followed perspective backs up this price with bold growth assumptions, shifting profit streams, and margin ambitions. Which surprising forecasts unlock this potential? Dive in and see how this narrative assembles its high-conviction price target.

Result: Fair Value of $113.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures or setbacks in international expansion could threaten Walmart’s ability to deliver the margin gains and growth that analysts are counting on.

Find out about the key risks to this Walmart narrative.

Another View: Is the Market Overpaying?

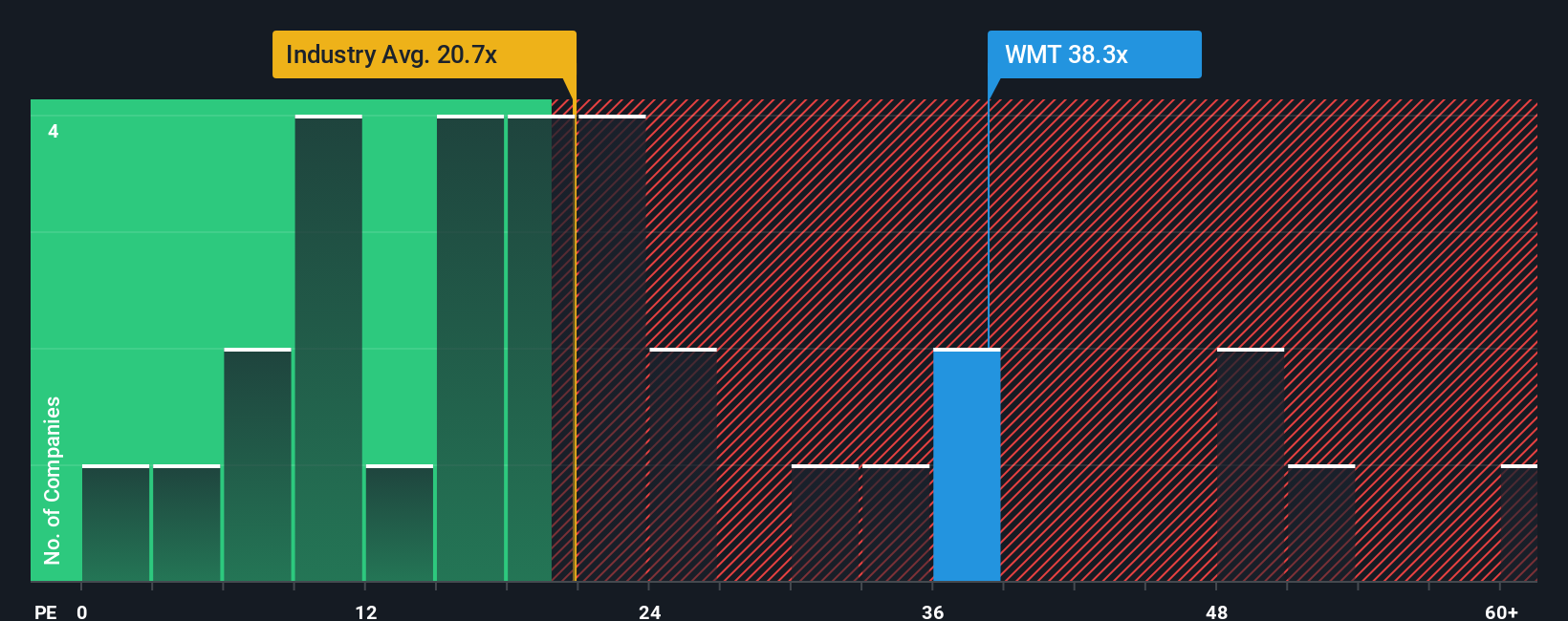

While our previous analysis suggests Walmart is undervalued, looking through the lens of its price-to-earnings ratio paints a different picture. Walmart trades at 37.9x earnings, a notable premium over both its peers (24.8x) and the industry average (21.1x). Even compared to its fair ratio of 35.1x, the shares appear expensive, raising questions about valuation risk if market sentiment shifts. Is this premium a sign of untapped growth or growing complacency among investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walmart Narrative

If the mainstream outlook does not match your view, or you would rather rely on your own research, it only takes a few minutes to chart your own course and Do it your way.

A great starting point for your Walmart research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio with promising stocks beyond the retail sector. With the right tools, you can spot unique trends and make confident investment decisions before the crowd does.

- Tap into the future of medicine by checking out these 31 healthcare AI stocks, which offers innovation in artificial intelligence for healthcare breakthroughs.

- Boost your returns with steady income by exploring these 18 dividend stocks with yields > 3%, which delivers consistent yields greater than 3%.

- Unlock high growth potential by scanning these 3587 penny stocks with strong financials, featuring financially solid up-and-comers poised for outsized performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives