- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

How Walmart's Tech Upgrades and Big Stock Gains Are Shaping Its 2025 Valuation

Reviewed by Bailey Pemberton

If you’re trying to decide whether to add, hold, or even trim Walmart from your portfolio right now, you’re not alone. The most notable thing about this stock is the gap between its reputation as a retail giant and the reality of its current price action. Just this past week, Walmart’s shares popped nearly 6%, which is not too shabby for a company that’s been around longer than most of us have been investing. Over the past year, the gains have continued, with share price growth of almost 34%, and strong numbers stretching back three and five years.

What’s fueling all this upward momentum? For starters, Walmart continues its push to modernize by leaning into technology such as sensors to track grocery pallets across the U.S. This is not just high-tech window dressing; it is a real operational efficiency strategy that is intended to boost sales and margins, and investors have noticed. There is also a long-term story at play, from labor strategy changes that influenced the hourly wage market to a willingness to tackle workforce transformation as AI reshapes how jobs get done.

Here is where things get especially interesting for value-minded investors: despite these headlines and substantial returns, Walmart’s current valuation score is zero out of six. If you sum up all the usual valuation checks, including price-to-earnings, price-to-book, and others, the company is not considered undervalued by any traditional metric.

In the next section, we will explain exactly how that score was calculated, look at the specific valuation approaches, and, since there is always more than one way to judge a stock’s worth, point you toward what might be an even smarter way to think about value when it comes to a powerhouse like Walmart.

Walmart scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Walmart Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model seeks to estimate the value of a business by forecasting its future cash flows and then discounting those amounts back to today’s dollars. This approach is widely regarded as one of the best ways to measure a company's true worth because it focuses on the cash a business actually generates.

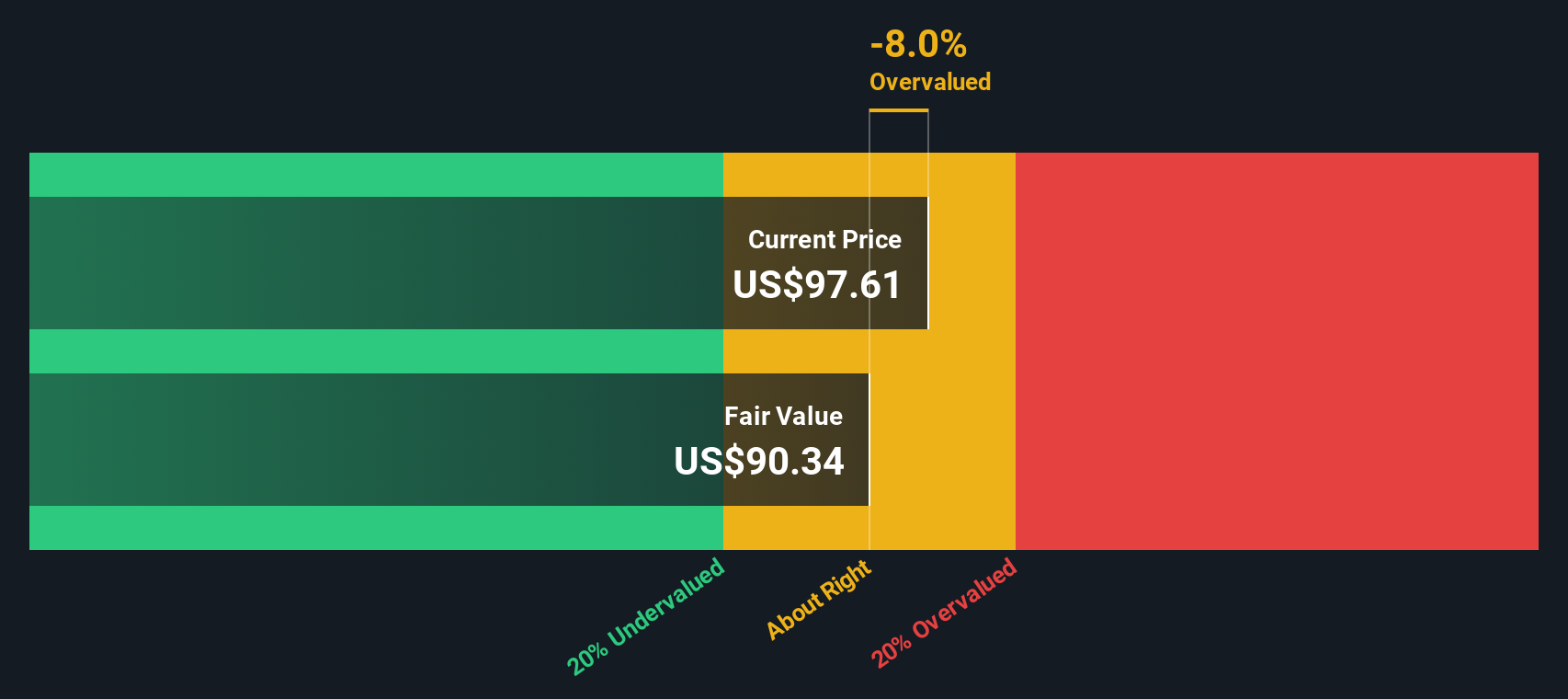

For Walmart, the DCF uses recent Free Cash Flow (FCF) data of $15.7 Billion, reflecting solid operational performance. Analysts forecast that by 2030, Walmart's FCF could rise to $30.9 Billion, with notable growth in the earlier years and slowing increases further out. It is important to note that forecasts are based on analyst estimates for the next five years. After that period, Simply Wall St extrapolates future growth rather than relying on external analyst numbers.

According to this model, Walmart’s intrinsic value lands at $107.02 per share. With the current share price slightly higher, the stock is considered about 0.7% overvalued. In essence, the market price is closely aligned with the company’s underlying cash flow potential based on current projections.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Walmart's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Walmart Price vs Earnings

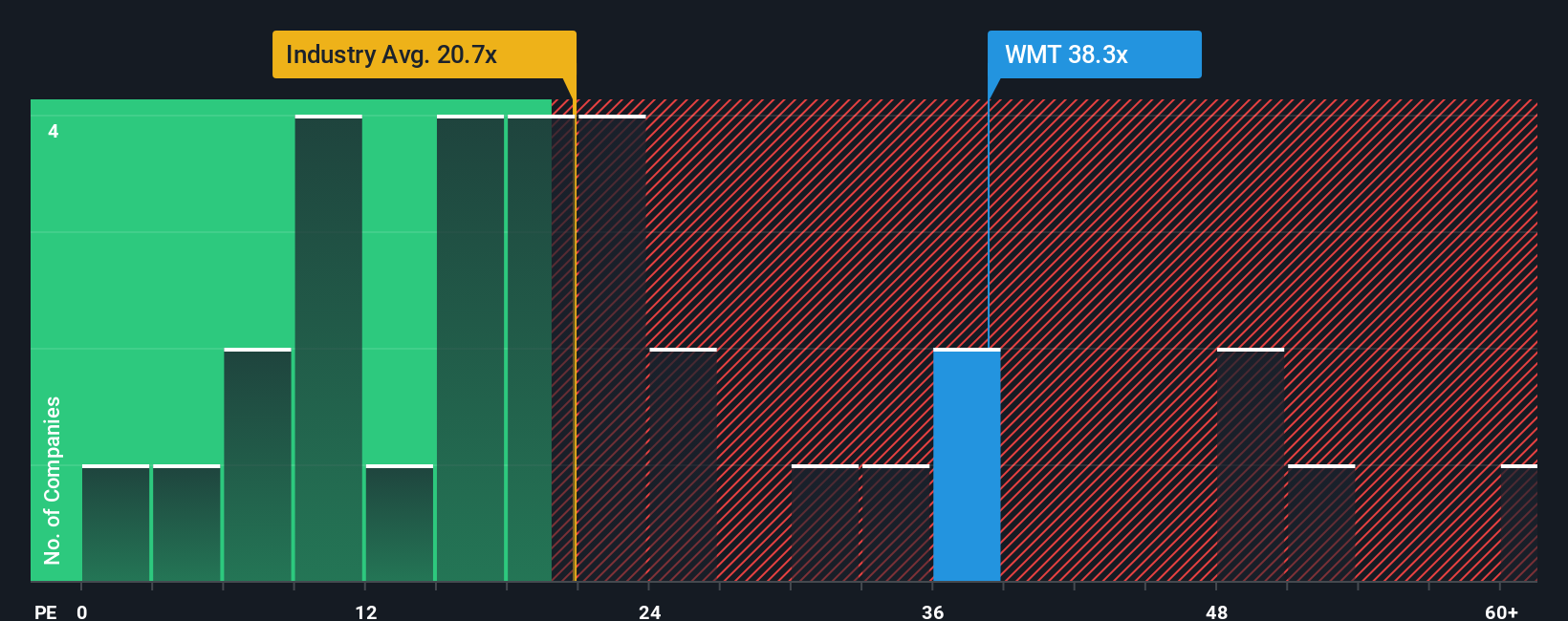

For established, profitable companies like Walmart, the Price-to-Earnings (PE) ratio is a popular tool for assessing valuation. The PE ratio can be a quick way to see how much investors are willing to pay today for a dollar of earnings. Naturally, higher growth expectations or lower risk can justify higher PE multiples, while slower growth or greater uncertainties might warrant a lower PE.

At the moment, Walmart trades at a PE of 40x, which is noticeably above both the average for its Consumer Retailing industry at 21x and the average of its peers at 26x. This gap signals that the market is either betting on substantial growth or placing a premium on Walmart's stability and scale.

To get a more tailored benchmark, Simply Wall St calculates a "Fair Ratio" in this case 32x which considers not only the company’s growth prospects and profit margins but also its industry, scale, and unique risk factors. This Fair Ratio is designed to be more meaningful than a generic industry or peer comparison, since it incorporates all the factors that actually matter to Walmart's performance and outlook.

When comparing the Fair Ratio of 32x to Walmart’s current PE of 40x, the share price looks somewhat stretched, though not dramatically so. The difference suggests Walmart is trading above what would be justified by its fundamentals, after factoring in growth and market context.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Walmart Narrative

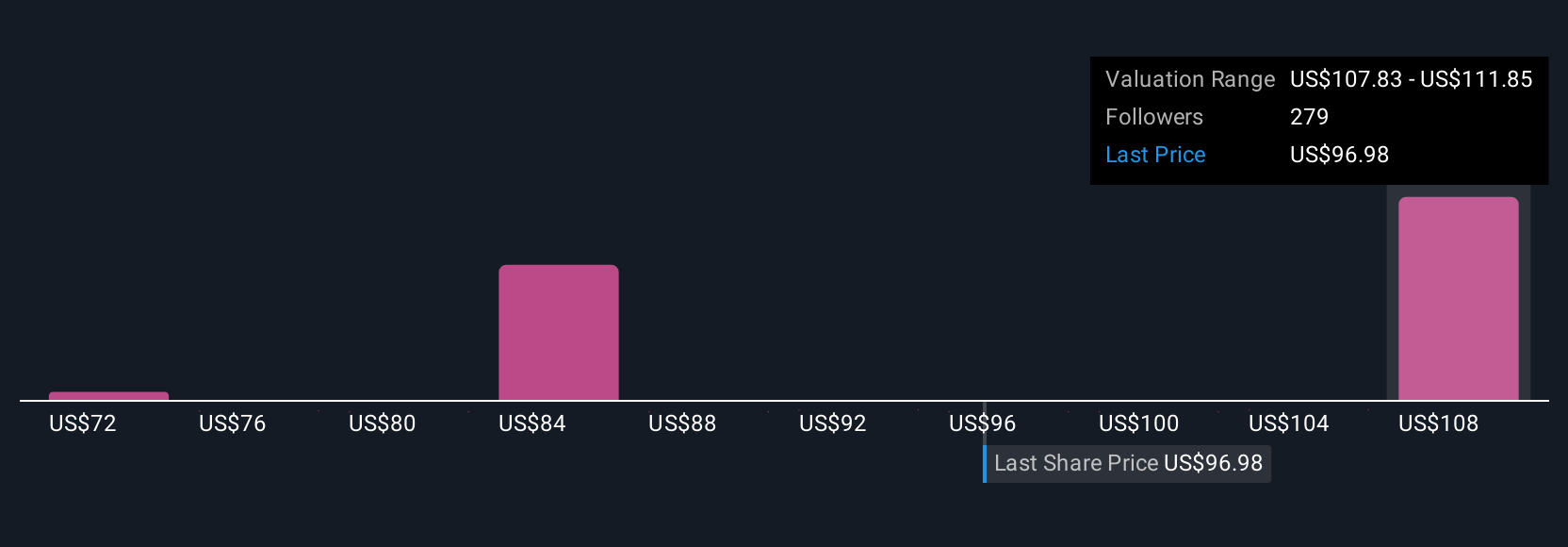

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is more than just a number; it is a story that puts your big-picture view of a company front and center, backed by your own assumptions on future revenue, earnings, and profit margins. Narratives bridge the gap between a company’s business story and the numbers by connecting your outlook, a tailored financial forecast, and a resulting fair value. This approach provides complete transparency about the reasoning behind each assumption.

On Simply Wall St’s Community page, millions of investors are already using Narratives as an easy and accessible tool to express and test their own perspectives. Comparing Narrative-driven fair value and the current share price can help you confidently decide whether a stock looks attractive or expensive. There is no need to rely solely on static analyst estimates or backward-looking ratios. As company news or earnings updates arrive, Narratives update automatically so your view stays relevant and responsive.

For example, some investors see Walmart’s global technology adoption and omni-channel strategy driving fair values as high as $127, while others remain cautious about competitive risks and set targets as low as $64. The Narrative tool helps you understand and track both, so you can invest with conviction in your own story.

Do you think there's more to the story for Walmart? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives