- United States

- /

- Food and Staples Retail

- /

- NYSE:TGT

Is Target’s Drop After Supply Chain News a Chance for Investors in 2025?

Reviewed by Bailey Pemberton

- Wondering if Target is finally trading at a price worth a closer look? Let’s dig into what the numbers and recent market moves are really telling us about its value.

- Despite some optimism, Target’s shares are down nearly 37% year-to-date and over 30% from this time last year, with only a modest gain of 0.6% in the past week after a rough 11.4% drop over the last month.

- The recent price swings follow headlines about shifting consumer shopping habits and evolving competition in the retail sector. News about supply chain pressures and growing market share for big-box rivals has been fueling investor debate over Target’s longer-term prospects.

- If you care about value, here’s a key fact: Target currently scores a 5 out of 6 on our valuation checks. We will walk through what this means using the most common valuation approaches, but stick around, because there is an even better way to gauge if Target’s price is truly right.

Find out why Target's -30.5% return over the last year is lagging behind its peers.

Approach 1: Target Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and then discounting them back to today’s dollars. This method is a favorite among analysts because it focuses directly on the money a business is expected to generate, adjusted for the time value of money.

Target’s most recent Free Cash Flow stands at approximately $2.9 Billion. Analyst estimates suggest that annual free cash flow could fluctuate over the next several years, ending up around $2.8 Billion by 2030. For years beyond what analysts forecast, projections are extrapolated to reflect a reasonable growth pattern based on historical data and sector outlook.

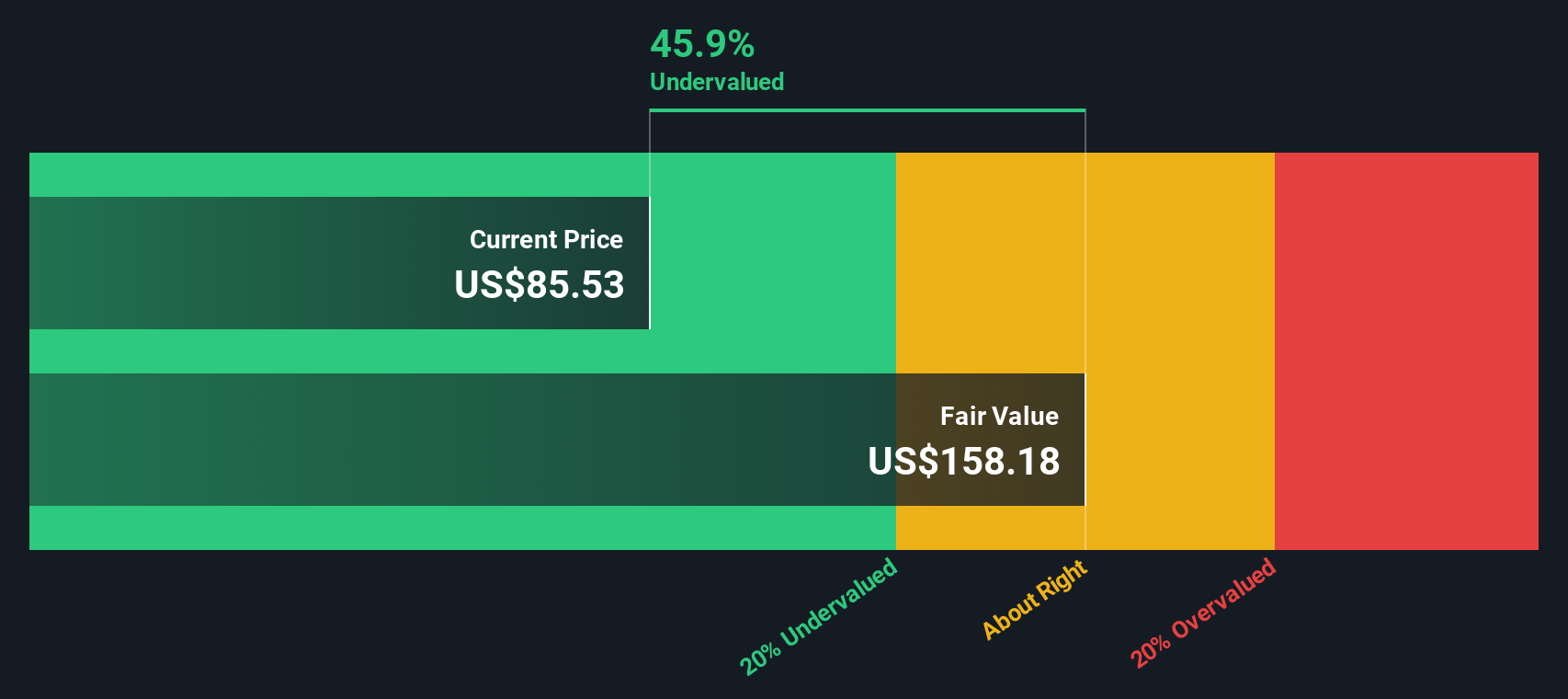

By taking all these projected cash flows through 2035 and discounting them to the present, the model arrives at an intrinsic share value of $131.05. This intrinsic value is about 33.9% higher than where Target’s shares are currently trading, which indicates a significant discount in the market price compared to the underlying cash flow potential.

In simple terms, the DCF suggests that Target stock is considerably undervalued at today’s prices, which may signal an opportunity for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Target is undervalued by 33.9%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

Approach 2: Target Price vs Earnings (PE Ratio)

For profitable companies like Target, the Price-to-Earnings (PE) ratio is a time-tested way of assessing value. The PE ratio tells us how much investors are willing to pay today for a dollar of current earnings, making it a direct and popular measure for established businesses generating steady profits.

The “right” PE ratio for any company depends on a few key factors. Higher growth expectations usually justify a higher PE, since investors are paying up for future earnings potential. In contrast, greater risks or slower expected growth tend to push a fair PE ratio lower. The stability of the company’s industry and its own profitability also play an important role.

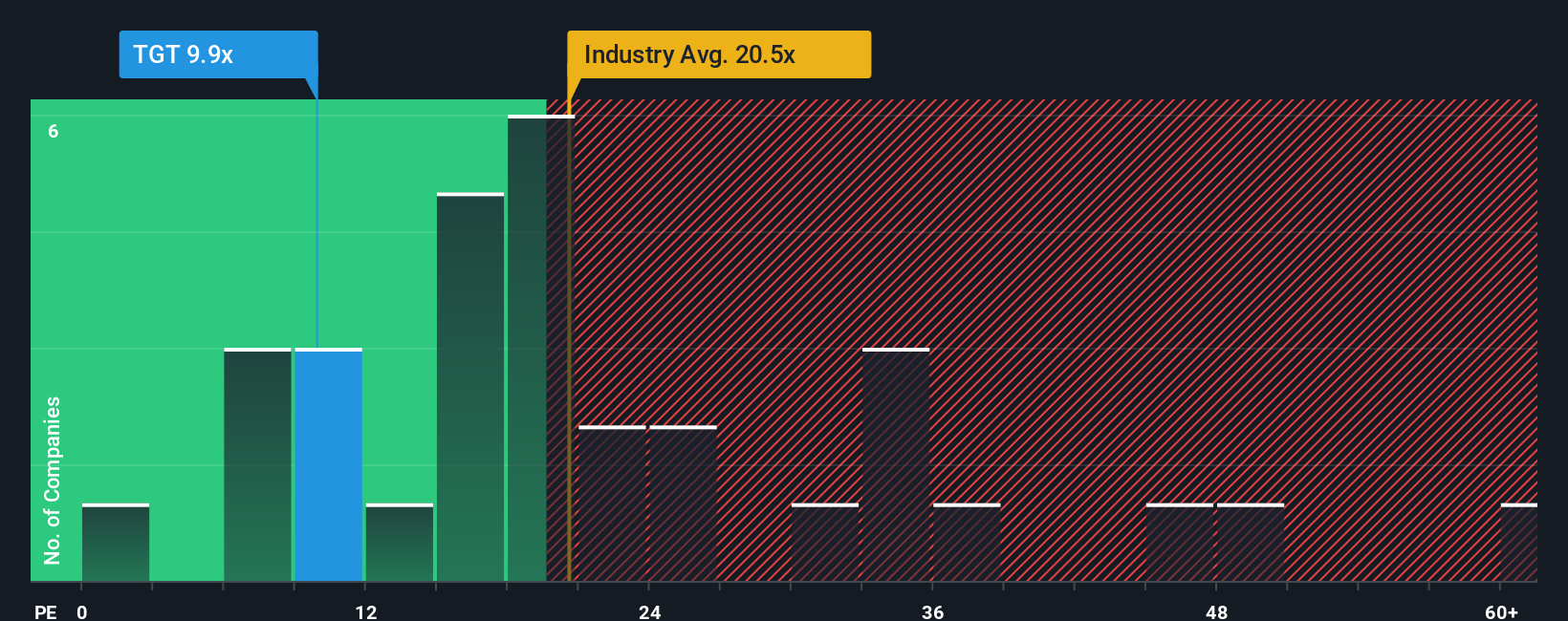

Currently, Target trades at just 10.4x earnings, a large discount to the Consumer Retailing industry average of 20.0x and its closest peers at around 27.0x. This alone might suggest Target is undervalued, but absolute comparisons can be misleading without including unique company traits.

This is where Simply Wall St’s “Fair Ratio” comes in. Their Fair Ratio for Target is 18.8x. Unlike industry or peer averages, the Fair Ratio considers Target’s own earnings growth, profit margins, risk profile, industry, and size, offering a tailored and more meaningful benchmark.

With Target’s current PE sitting well below its Fair Ratio, the stock appears undervalued under this approach too.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Target Narrative

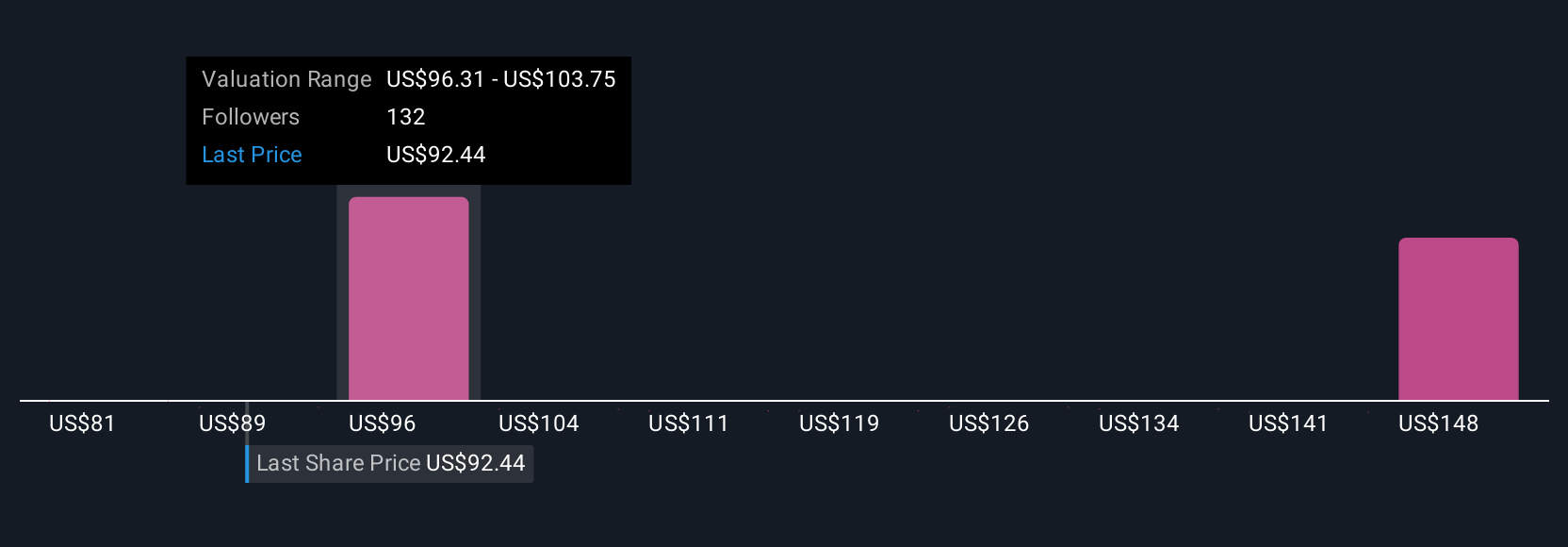

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective about a company, where you bring together your own assumptions about future revenue, earnings, and margins to estimate a fair value and see if you think the stock is a good buy or sell. This puts your reasoning right next to the numbers.

Narratives link the story you believe about a business directly to a financial forecast and a fair value, making it much easier to understand not just what a company is worth, but why. On Simply Wall St’s Community page, millions of investors use Narratives to capture, update, and share their viewpoints, making it accessible to everyone, not just financial professionals.

By comparing each Narrative’s Fair Value to the current share price, you can instantly spot if your view sees an opportunity to buy, hold, or sell a stock. Narratives also update dynamically when new information like news, earnings, or company updates comes in, so your investment thesis can keep pace with the real world.

For example, on Target, some investors believe leadership changes and investment in digital growth will drive higher margins and assign fair values as high as $135, while others see more risks and headwinds, resulting in much lower fair value estimates as low as $82.

Do you think there's more to the story for Target? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Target might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TGT

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success