- United States

- /

- Food and Staples Retail

- /

- NYSE:TGT

Is Target a Bargain After 33% Stock Drop and Supply Chain Shakeup?

Reviewed by Bailey Pemberton

- Wondering if Target is a bargain right now or simply caught in the headlines? You are not alone, and we are about to break down what really matters when looking for value.

- Target's share price has taken a hit lately, dropping 6.5% in the last week and is now down 33.3% year-to-date, raising a lot of eyebrows about its current risk and growth profile.

- Recent moves in Target’s stock have come as the retail giant has faced shifting consumer demand and ongoing industry competition. Ongoing debates around discounting strategies and fresh news regarding supply chain adjustments have added fuel to market speculation.

- On our valuation checks, Target scores a 5 out of 6, suggesting there may still be value to uncover. Let’s dig into how the numbers stack up across various valuation methods and stick around for a new angle on valuation that could change how you look at the stock altogether.

Find out why Target's -36.7% return over the last year is lagging behind its peers.

Approach 1: Target Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This method provides insight into what a business is fundamentally worth, rather than just what the market is willing to pay.

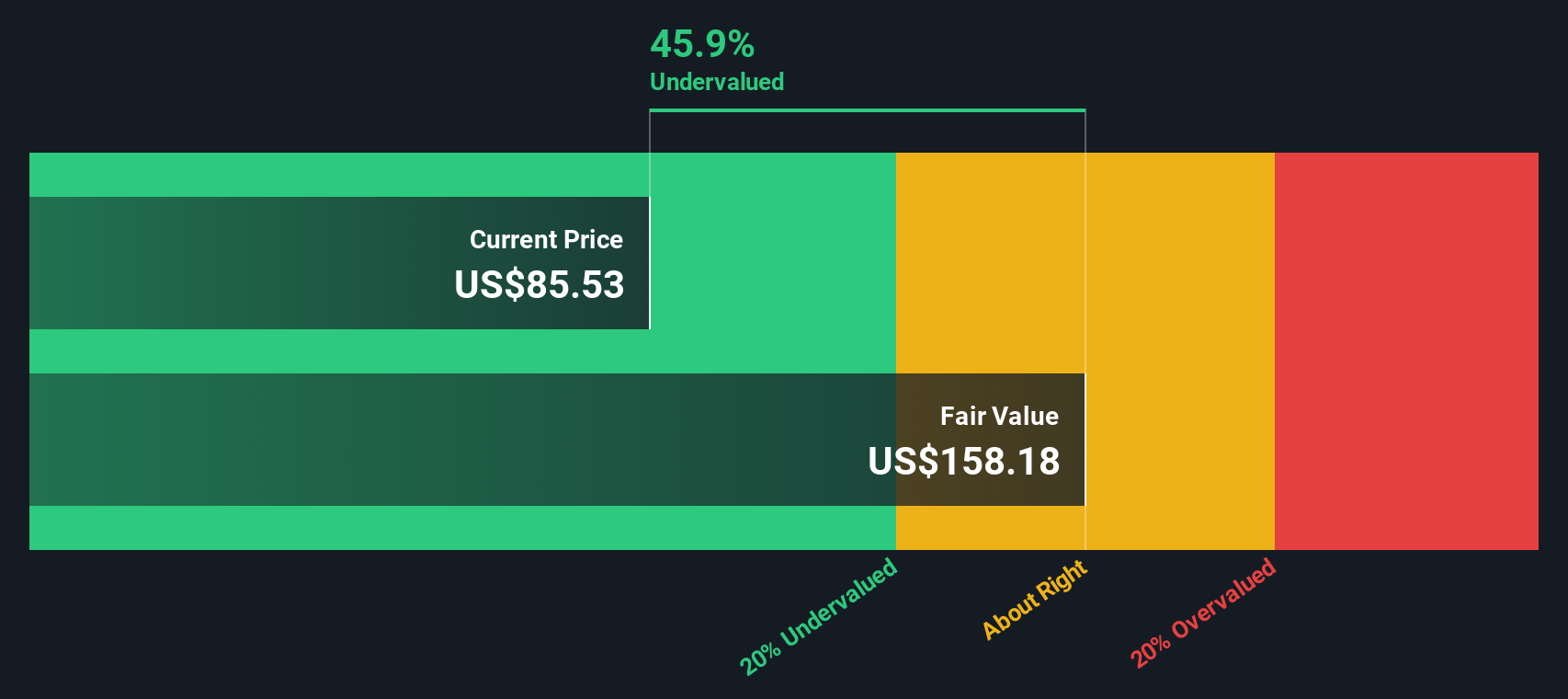

Target currently generates free cash flow (FCF) of approximately $2.26 Billion, and analysts expect this to grow steadily over time. In fact, Target’s projected FCF for 2030 is about $3.49 Billion according to available data. While analyst estimates go out five years, further FCF growth is forecasted by Simply Wall St by extrapolating trends. These continual increases reflect both expected retail growth and management’s ongoing efforts to improve operational efficiency.

Based on these projections, the DCF analysis estimates Target’s fair value at $160.75 per share. With the stock currently trading at a 43.1% discount to this intrinsic value, the model suggests Target is significantly undervalued compared to the cash it is likely to generate in the coming years.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Target is undervalued by 43.1%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Target Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is a widely used valuation metric for companies with stable profits like Target, as it directly connects the market price of a stock to its underlying earnings. For profitable businesses, the P/E ratio acts as a quick reference for whether shares appear cheap or expensive relative to their recent profitability.

Interpreting what a “normal” or “fair” P/E ratio should be, however, depends on expectations for earnings growth, perceived business risks, and how the company compares to peers. Generally, higher expected growth and lower risk can justify higher multiples. Lower growth or more risk tends to bring them down.

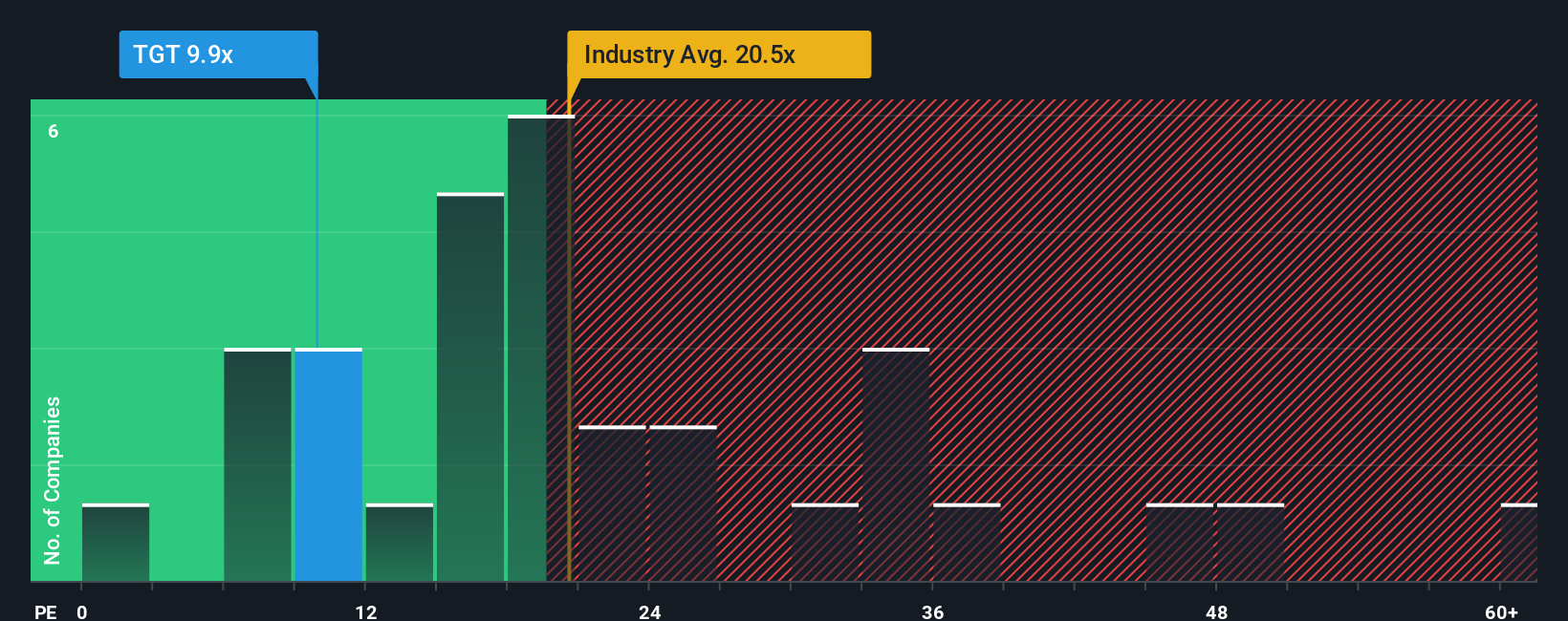

Target currently trades at a P/E ratio of 10.6x. This is not only well below the Consumer Retailing industry average of 19.5x, but also substantially lower than the peer group average of 27.1x. On the surface, this might signal an attractive bargain, but a closer look is needed.

Simply Wall St's proprietary “Fair Ratio” determines an appropriate P/E multiple for Target by factoring in its earnings growth, profit margin, market cap, risks, and industry profile. Unlike a raw comparison with peers or industry averages, the Fair Ratio of 17.9x is specifically tailored to Target's circumstances and offers a more objective assessment of fair value.

Given that Target’s actual P/E (10.6x) is notably below its Fair Ratio (17.9x), the evidence strongly suggests the stock is undervalued based on its current earnings and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Target Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, an innovative tool that allows you to connect Target’s story to its numbers for smarter investing.

A Narrative is your own financial story about Target. You choose what you believe will happen to its revenue, margins, and earnings, and pair these expectations with your reasons, whether it is about digital expansion, shifting shopper trends, or operational pressures.

On Simply Wall St’s platform, Narratives make it easy for anyone (whether you are a seasoned investor or just starting out) to turn those stories into live financial forecasts, helping you calculate a Fair Value in minutes without spreadsheets or jargon.

By comparing your Narrative’s Fair Value to the current Price, you can see right away whether Target looks like a buy or a sell based on your view. Since Narratives update automatically with every new result or headline, your analysis stays relevant as the real world changes.

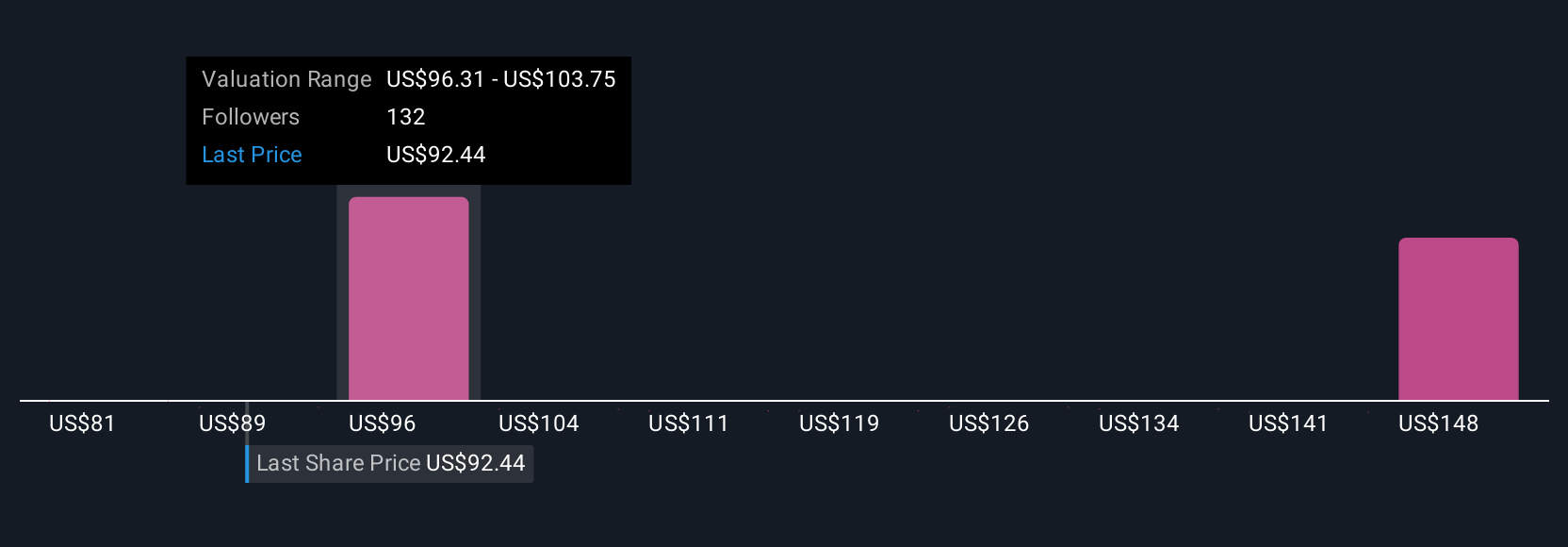

For example, some investors expect weak discretionary spending to shrink margins and set Target’s fair value around $82, while others are optimistic that digital investments drive recovery, supporting a fair value as high as $135. Each Narrative reflects a unique outlook informed by personal research and market updates.

Do you think there's more to the story for Target? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Target might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TGT

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives