- United States

- /

- Food and Staples Retail

- /

- NYSE:SYY

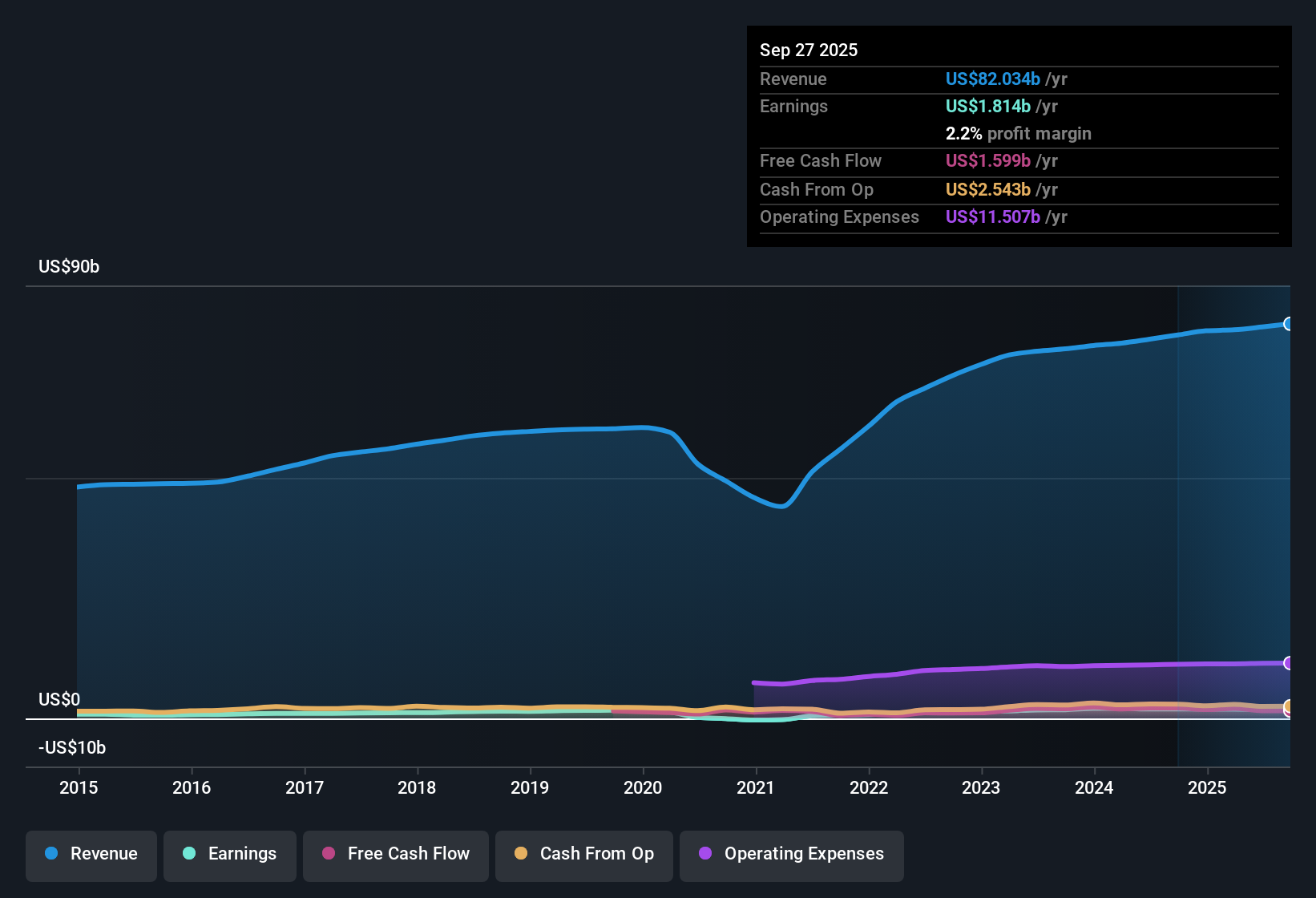

Sysco (SYY): 5-Year Earnings Growth Undercut by Margin Decline, Challenging Profitability Story

Reviewed by Simply Wall St

Sysco (SYY) delivered striking results with earnings climbing at a 33% annual rate over the past five years, marking a transition to sustained profitability. Current net profit margins, however, have slipped to 2.2% from last year’s 2.4%. Future revenue is projected to grow at 4.1% per year, trailing the broader US market’s 10.3% pace. Despite the softer growth expectations, the company’s price-to-earnings ratio remains favorable compared to its industry and peer group. The attractive dividend continues to catch investors’ eyes, even as margin pressures weigh on sentiment.

See our full analysis for Sysco.Next, we'll put these headline numbers alongside the prevailing narratives from the Simply Wall St community to see which themes get confirmed and which might need a rethink.

See what the community is saying about Sysco

Margin Expansion in Sight as Profitability Nudges Upward

- Analysts project Sysco's profit margin will rise from 2.2% today to 2.8% within three years, which would mark a significant improvement in underlying profitability if realized.

- According to the analysts' consensus view, the company’s planned pricing agility tools and strategic compensation changes for its sales consultants support expectations of better margins and higher earnings by fiscal 2026.

- The margin forecast aligns with consensus claims that cost management will drive profit improvements, potentially counteracting recent margin compression.

- Still, consensus notes ongoing headwinds such as adverse weather and low consumer confidence put pressure on near-term profitability. This suggests the margin rebound will not be linear.

Curious if Sysco can deliver the margin turnaround that analysts expect? Dive into the full consensus view for insight into the catalysts and risks powering the story. 📊 Read the full Sysco Consensus Narrative.

Dividend Stands Out, Even as Growth Slows

- Sysco’s dividend is widely regarded as attractive, with both yield and durability standing out in a period where projected earnings growth (10% per year) trails the US market average (15.7% per year).

- Analysts' consensus view points to the dividend’s appeal being firmly based on the company’s ongoing ability to generate high quality earnings, despite macroeconomic challenges and slower revenue expansion.

- Consensus sees disciplined capital allocation and cost-saving efforts as central to supporting the dividend, even as industry growth lags and near-term headwinds persist.

- There is a subtle debate in the consensus about whether rising competition or economic disruptions could eventually squeeze the company’s dividend capacity, though most still see payout durability holding up.

Valuation Discount Remains Despite $74.70 Share Price

- Sysco trades at a 19.7x price-to-earnings ratio, which is below its direct peer group (31.8x) and slightly under the Consumer Retailing industry (over 20x). This makes the current $74.70 share price appear reasonable relative to forecasted growth and market multiples.

- Consensus narrative highlights that with analysts’ average price target at 87.19, only a 17% upside is seen from recent prices. Consensus suggests this “fairly priced” view is tied to assumptions that margins and earnings will improve, but future upside is tempered by moderate topline and profit growth compared to sector peers.

- The tension lies in analysts requiring belief in a $2.6 billion earnings target and a lower future PE to justify target price gains. This anchors valuation hopes on operational execution rather than market momentum.

- Consensus also points out that given the only modest gap between market price and analyst target, short-term valuation swings will likely hinge on clear demonstration of those margin and earnings improvements.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sysco on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another angle on the numbers? Add your perspective and assemble your own narrative in just a few minutes. Do it your way.

A great starting point for your Sysco research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Sysco’s mixed performance features slower revenue growth and only modest upside compared to peers, despite hopes for margin rebound and proven dividend strength.

If you want more reliable expansion and steady market-beating results, check out stable growth stocks screener (2108 results) for companies that consistently deliver growth across various conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYY

Sysco

Through its subsidiaries, engages in the marketing and distribution of various food and related products to the foodservice or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives