- United States

- /

- Food and Staples Retail

- /

- NYSE:PFGC

Does Performance Food Group’s Recent Acquisition Activity Signal More Value After a 21% Share Climb?

Reviewed by Bailey Pemberton

- Ever wondered if Performance Food Group is truly living up to the buzz, or if the stock is quietly offering great value to those who look a little deeper?

- Shares have climbed 21.1% over the past year and racked up an impressive 111.1% gain in five years, but have edged down slightly by 4.5% over the last month. This shows both momentum and recent volatility.

- Recent acquisitions in the distribution sector and strategic partnerships have been making headlines, attracting attention from both investors and competitors. These moves are shifting expectations for future growth and could be a big reason behind the stock's recent performance swings.

- On our six-point valuation check, Performance Food Group sits right in the middle with a score of 3 out of 6, hinting at a story that is more nuanced than just riding the market’s ups and downs. We will dig into a range of valuation approaches, and before we are done, introduce an even better way to really understand what this valuation means for investors.

Approach 1: Performance Food Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by forecasting a company’s expected future cash flows and discounting them back to their value today. This approach helps investors estimate what a business might truly be worth. The process focuses on free cash flow, an important measure of the cash a business generates after accounting for necessary capital spending.

For Performance Food Group, the most recent reported free cash flow stands at $792.95 million. Analysts anticipate continued growth, projecting free cash flow to reach approximately $1.17 billion by 2028. While analysts typically offer estimates up to five years out, projections beyond this window—including predictions through 2035—are modelled by Simply Wall St and suggest steady cash flow growth over the coming decade.

Using this two-stage free cash flow to equity model, the estimated intrinsic value of Performance Food Group shares is $169.72. This valuation implies the stock is currently trading at about a 42.3% discount to its intrinsic value. Based on cash flow forecasts, this suggests the stock may be significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Performance Food Group is undervalued by 42.3%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Performance Food Group Price vs Earnings

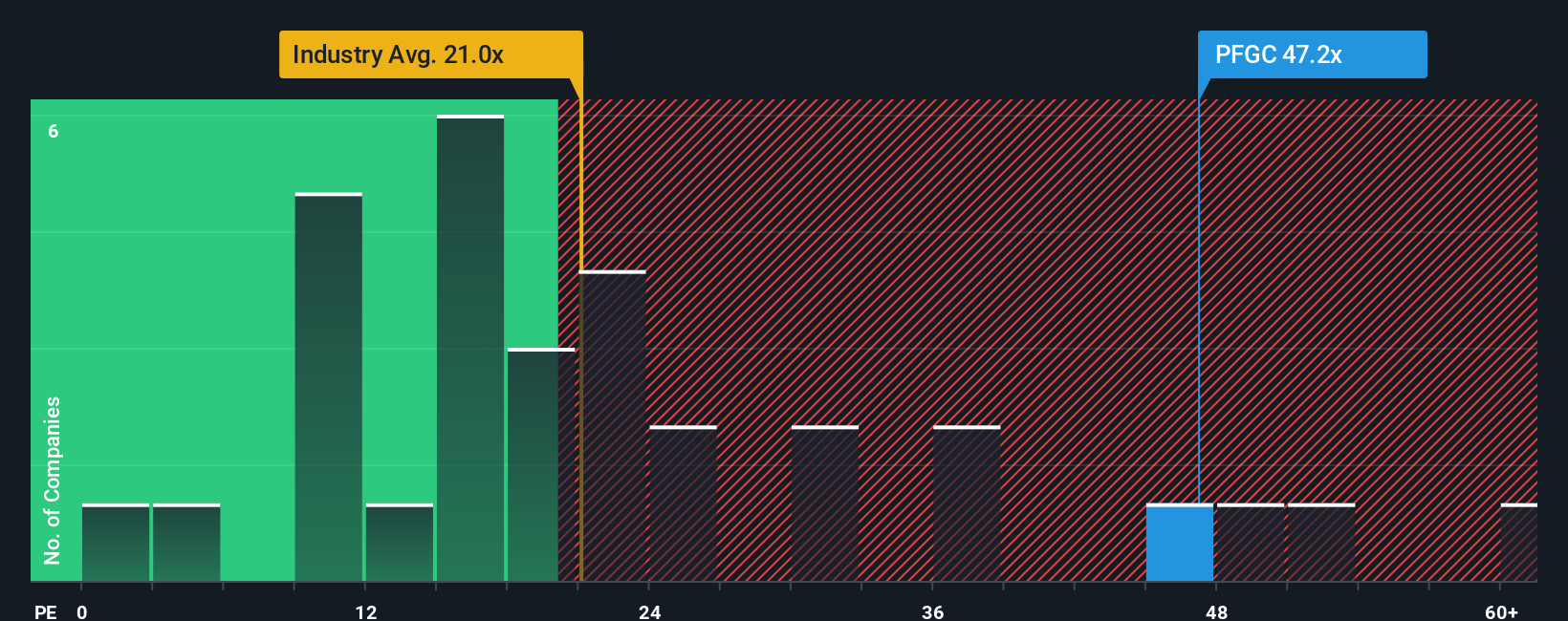

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for profitable companies like Performance Food Group. This metric tells investors how much they are paying for each dollar of a business’s earnings, and it is particularly useful for comparing companies that have strong bottom-line profits.

It is important to understand that what counts as a “normal” PE ratio can shift based on a company’s outlook. Firms with higher expected earnings growth or lower business risks typically command higher PE ratios, while companies in slower-growth or riskier sectors usually trade at lower multiples.

Performance Food Group currently trades at a PE of 45x. That is well above the Consumer Retailing industry average of 19.5x and higher than its peer group’s average of 25.5x. At first glance, this might make shares look expensive. However, simply comparing with broad benchmarks rarely gives the full picture.

This is where Simply Wall St’s proprietary "Fair Ratio" comes in. The Fair Ratio for Performance Food Group is set at 30.4x, calculated using a deeper approach that considers the company’s unique earnings growth, profit margin, market cap, industry environment, and risk factors. Unlike raw peer comparisons or industry averages, the Fair Ratio aims to reflect what multiple is truly justified by the company’s current fundamentals and future potential.

Comparing the company’s actual PE of 45x to its Fair Ratio of 30.4x suggests Performance Food Group’s shares are priced at a premium to what is considered fundamentally fair value.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Performance Food Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are simple, dynamic tools that allow you to apply your own perspective about a company’s future by turning your expectations for growth, margins, and risks into a story that connects directly to financial forecasts and a fair value estimate.

On Simply Wall St’s Community page, millions of investors use Narratives to link business stories with numbers, making it easy to see if a stock is undervalued or overvalued based on your view of its future. Narratives empower you to decide when to buy or sell by comparing your calculated Fair Value to the current share price, and are automatically updated as new news or earnings reports emerge.

For Performance Food Group, for example, one investor’s bullish narrative might see recent acquisitions and strong guidance justifying a higher fair value of $127 per share. In contrast, a more cautious perspective focusing on sector risks and integration challenges could lead to a fair value as low as $102. Narratives make it easy to explore these different viewpoints, tailor forecasts to your beliefs, and update your investing decisions as new developments arise.

Do you think there's more to the story for Performance Food Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFGC

Performance Food Group

Through its subsidiaries, engages in the marketing and distribution of food and food-related products in North America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives