- United States

- /

- Food and Staples Retail

- /

- NYSE:DDL

Further Upside For Dingdong (Cayman) Limited (NYSE:DDL) Shares Could Introduce Price Risks After 27% Bounce

Despite an already strong run, Dingdong (Cayman) Limited (NYSE:DDL) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 98% in the last year.

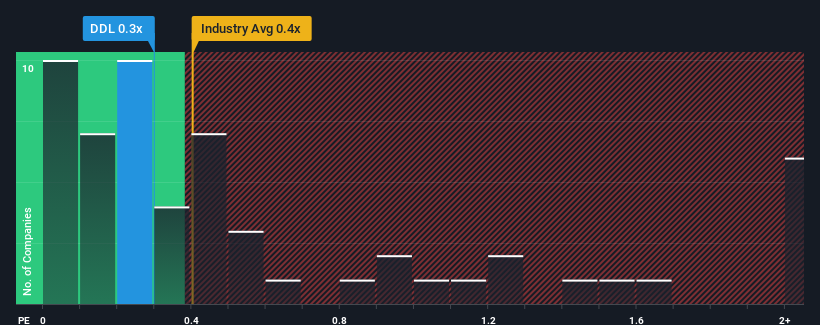

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Dingdong (Cayman)'s P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Consumer Retailing industry in the United States is also close to 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Dingdong (Cayman)

What Does Dingdong (Cayman)'s P/S Mean For Shareholders?

Dingdong (Cayman) could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Dingdong (Cayman) will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Dingdong (Cayman)?

In order to justify its P/S ratio, Dingdong (Cayman) would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 5.6% decrease to the company's top line. Even so, admirably revenue has lifted 42% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 10% during the coming year according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 4.8%, which is noticeably less attractive.

In light of this, it's curious that Dingdong (Cayman)'s P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Dingdong (Cayman) appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Dingdong (Cayman)'s P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Dingdong (Cayman), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DDL

Flawless balance sheet and undervalued.

Market Insights

Community Narratives