- United States

- /

- Food and Staples Retail

- /

- NYSE:BJ

The Bull Case For BJ’s Wholesale Club (BJ) Could Change Following Store Expansion and Earnings Update

Reviewed by Sasha Jovanovic

- In November 2025, BJ's Wholesale Club Holdings announced the opening of new locations in Mesquite, Texas, and Foley, Alabama, in addition to the relocation of its Rotterdam, New York club, updated its earnings guidance, released third quarter financial results, and disclosed completion of a significant share buyback tranche.

- These actions highlight BJ's ongoing commitment to market expansion, operational performance, and active capital management amid changing retail conditions.

- We'll explore how the company's latest club openings and updated earnings outlook reshape its investment narrative for long-term growth.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

BJ's Wholesale Club Holdings Investment Narrative Recap

To be a shareholder in BJ's Wholesale Club Holdings, you would typically believe in the resilience of the warehouse club model, the importance of recurring membership revenue, and the company's ability to expand into new markets even during economic fluctuations. The recent news, featuring new club openings, updated earnings guidance, and completed share buybacks, does not materially shift the primary short-term catalyst of physical footprint expansion, nor does it significantly alter the key risk of margin pressures from rising costs or price competition.

Of the recent announcements, the company's plan to open 25-30 new clubs over the next two years stands out as the most relevant, since physical expansion is closely tied to top-line growth and scale-driven margin benefits. These moves are expected to support recurring revenues and could help offset the challenges posed by any pressure on discretionary spending among shoppers, underscoring why store growth remains closely watched by market participants as the most immediate performance driver.

However, investors will also want to weigh the risk that, despite club growth, underperformance in general merchandise and margin pressures from competition could still impact long-term returns if...

Read the full narrative on BJ's Wholesale Club Holdings (it's free!)

BJ's Wholesale Club Holdings' narrative projects $25.2 billion in revenue and $683.1 million in earnings by 2028. This requires 6.5% yearly revenue growth and a $104.2 million earnings increase from $578.9 million currently.

Uncover how BJ's Wholesale Club Holdings' forecasts yield a $109.16 fair value, a 23% upside to its current price.

Exploring Other Perspectives

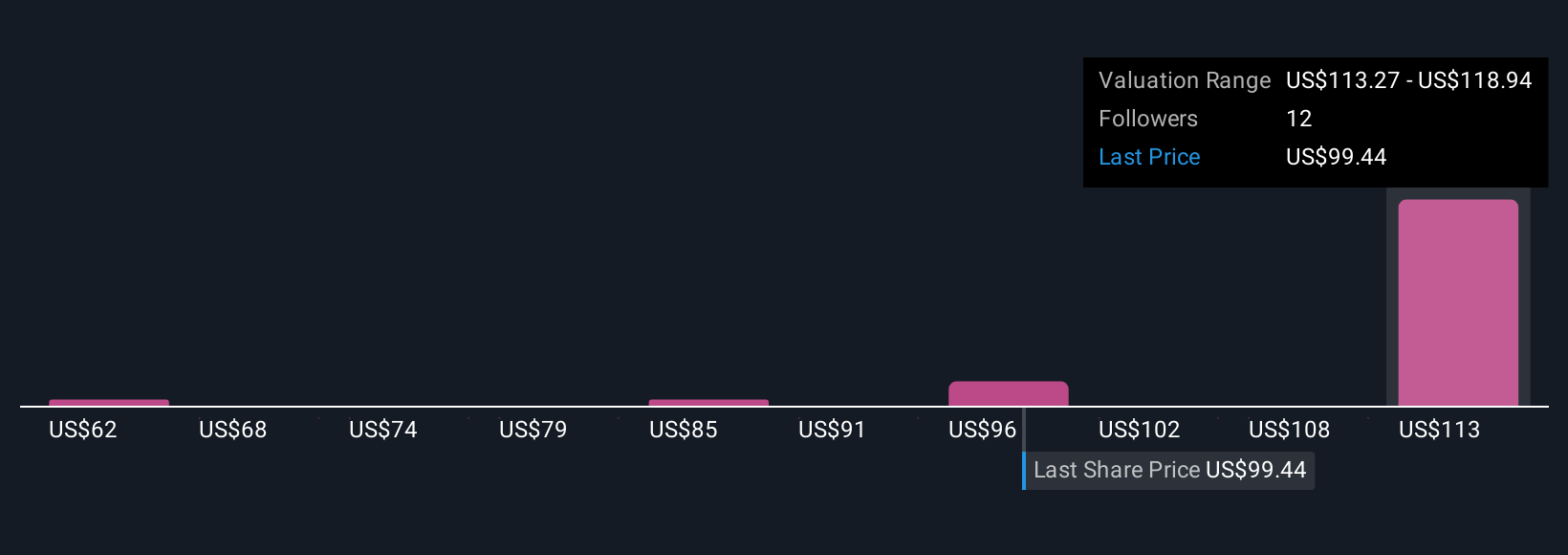

Seven members of the Simply Wall St Community estimated BJ's fair value across a wide band from US$45.36 to US$144.70 per share. While some forecast much lower or higher values, the main debate centers on whether BJ's ongoing new club expansion will lead to sustained revenue gains amid looming margin risks; you can review individual viewpoints to see how expectations vary.

Explore 7 other fair value estimates on BJ's Wholesale Club Holdings - why the stock might be worth as much as 63% more than the current price!

Build Your Own BJ's Wholesale Club Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BJ's Wholesale Club Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BJ's Wholesale Club Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BJ's Wholesale Club Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BJ

BJ's Wholesale Club Holdings

Operates membership warehouse clubs on the eastern half of the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026