- United States

- /

- Food and Staples Retail

- /

- NYSE:BJ

Is BJ’s Wholesale Club Still a Bargain After Its New Delivery Partnership in 2025?

Reviewed by Bailey Pemberton

- Curious if BJ's Wholesale Club Holdings stock could be a hidden bargain or just along for the ride? Let’s unpack what the numbers and the news are really saying about its value.

- While shares are up an impressive 141% over five years, recent momentum has slowed with a 3.0% dip this past week and a 2.0% slide over the last month. The stock is still holding a 4.7% gain for the year.

- Investors have taken notice of BJ’s recent partnership expansion with a major delivery service, signaling focus on convenience and member growth. These headlines brought buzz, but questions about long-term margins and competition have kept price moves in check lately.

- On our six-point valuation check, BJ’s comes in at just 1 out of 6. It is not setting off undervaluation alarms yet, but stay tuned as we dig deeper into classic valuation approaches and an even smarter way to weigh fair value at the end of the article.

BJ's Wholesale Club Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BJ's Wholesale Club Holdings Discounted Cash Flow (DCF) Analysis

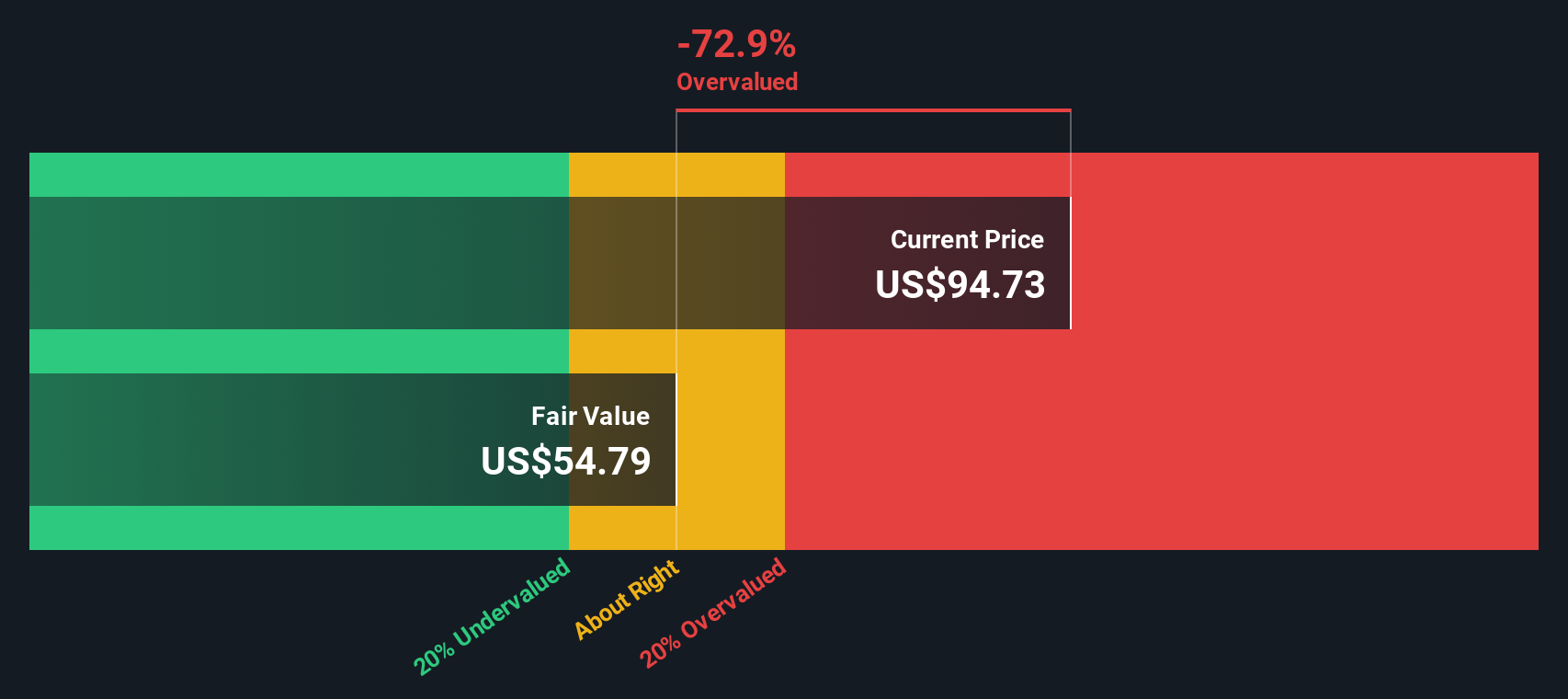

The Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting its future cash flows and discounting them back to today’s dollars. This helps investors understand what the business might be worth if it continues to generate profits at the forecasted pace.

For BJ's Wholesale Club Holdings, the latest twelve months’ Free Cash Flow is $396.4 million. Analyst projections show annual Free Cash Flows moving from $278 million in 2026 up to $381.4 million by 2035, with modest growth along the way. For the years beyond those covered by analyst estimates, Simply Wall St extrapolates the cash flow trend to fill out the next decade.

Using these forecasts, the DCF model puts BJ's current intrinsic value at $54.54 per share. Compared to the current share price, this suggests the stock is trading about 66.5% above its estimated fair value. This indicates it looks significantly overvalued right now according to this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BJ's Wholesale Club Holdings may be overvalued by 66.5%. Discover 842 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: BJ's Wholesale Club Holdings Price vs Earnings

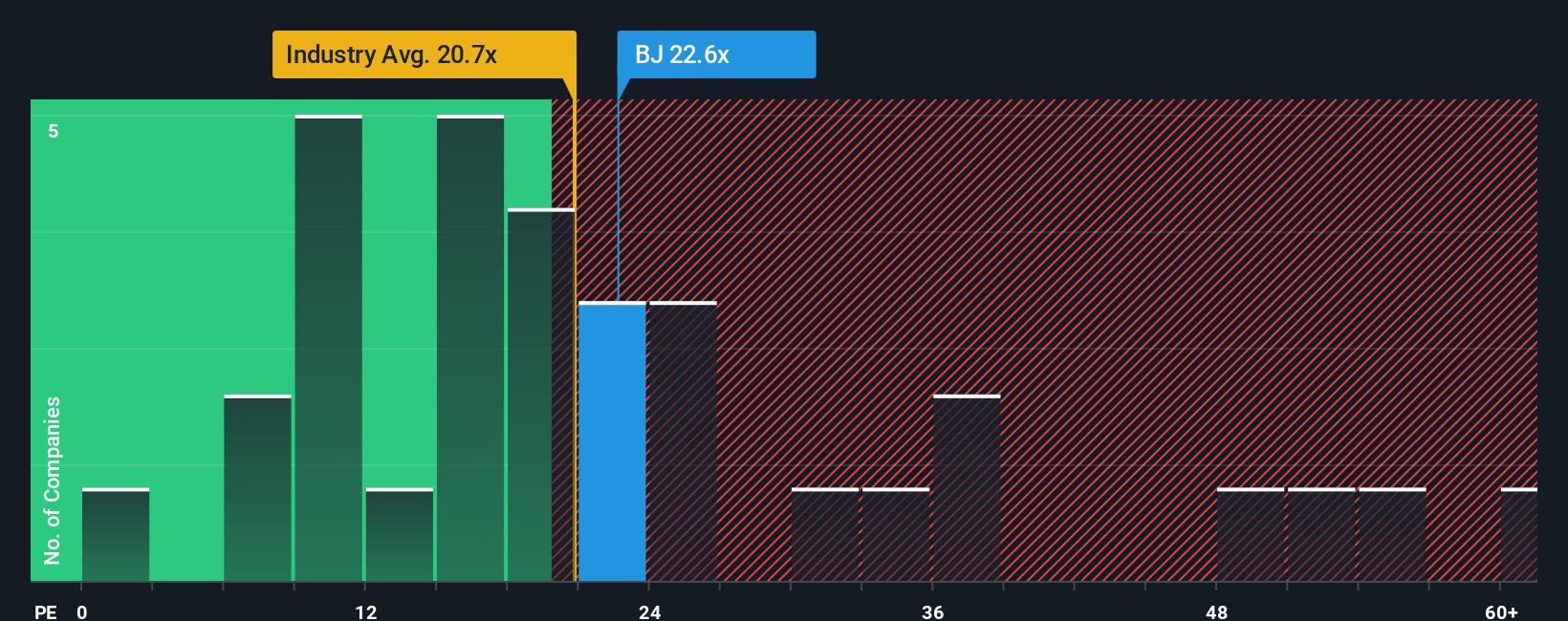

The Price-to-Earnings (PE) ratio is a widely used yardstick for valuing profitable companies. It highlights how much investors are willing to pay for each dollar of earnings. This measure is especially relevant for businesses with steady profits, like BJ’s, because it connects the company's share price directly to its underlying performance.

Growth expectations and perceived risk play a major role in what is considered a “normal” PE ratio. Higher growth potential or lower risk usually justifies a higher PE, while slower growth or more uncertainty tends to lower valuation multiples. For this reason, it is important to compare a company’s PE not only with peers but also with the broader industry and investors' outlook for the business.

BJ's Wholesale Club Holdings currently trades at a PE ratio of 20.7x. This is somewhat higher than both the Consumer Retailing industry average of 19.5x and the average of its closest peers at 17.8x. Simply Wall St’s proprietary “Fair Ratio” model, which factors in company-specific traits such as earnings growth potential, profit margins, industry trends, and market cap, sets a fair PE at around 17.9x for BJ's at this time. This tailored approach provides a more comprehensive comparison by weighing all the unique factors that influence value for companies like BJ’s.

With BJ’s actual PE sitting noticeably above this fair benchmark, the stock appears overvalued based on current fundamentals and risk-adjusted outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BJ's Wholesale Club Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story or perspective about a company, combining what you expect for its future revenue, earnings, and margins with the reasoning behind those estimates. Narratives connect the story you see unfolding, such as new store openings, membership growth, or digital advances, to a financial forecast, and from there to an estimated fair value. On Simply Wall St’s Community page, millions of investors use Narratives to make smarter, more personal investment decisions by comparing their fair value estimate to the current market price to decide when to buy or sell.

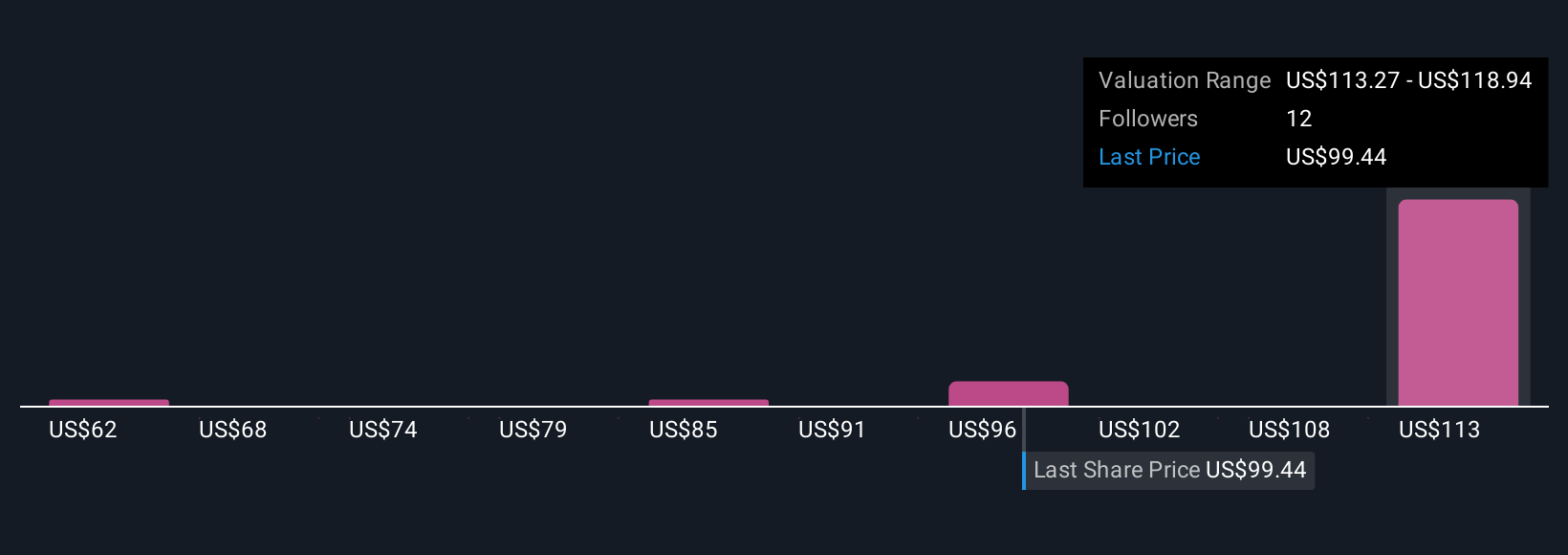

The beauty of Narratives is that they are easy to create, adapt, and update. When BJ’s announces a new club or faces fresh economic headwinds, your Narrative can immediately reflect it. Different investors will naturally have different Narratives. At one end, an optimistic view sees BJ’s rapidly growing memberships and expanding locations driving a fair value as high as $130 per share. A more cautious Narrative, concerned about shrinking margins and changing demographics, might put fair value closer to $70. Narratives let you anchor your investment decisions to your own outlook, always informed by the most relevant data and news.

Do you think there's more to the story for BJ's Wholesale Club Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BJ's Wholesale Club Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BJ

BJ's Wholesale Club Holdings

Operates membership warehouse clubs on the eastern half of the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives