- United States

- /

- Food and Staples Retail

- /

- NYSE:BJ

BJ's Wholesale Club (BJ): Evaluating Valuation After Recent Share Price Drift

Reviewed by Simply Wall St

BJ's Wholesale Club Holdings (BJ) has recently seen its stock under some pressure over the past month, slipping about 3%. Despite this, the company’s fundamentals and long-term total return remain in focus for investors.

See our latest analysis for BJ's Wholesale Club Holdings.

BJ's Wholesale Club Holdings’ share price has been drifting lower lately, with a 17% slide over the last 90 days. However, a steady yearly total shareholder return of around 2% reflects resilience beneath the headlines. The longer-term picture remains robust, boasting a total return of nearly 129% over five years. This suggests that while recent momentum has faded, long-term holders have been well rewarded.

If the shift in sentiment around BJ’s has you curious about other opportunities, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With BJ’s shares drifting but long-term returns strong, is the recent dip a compelling entry point? Or has the market already baked in all of BJ’s future growth potential?

Most Popular Narrative: 22% Undervalued

According to the most widely followed narrative, BJ's Wholesale Club Holdings could have notable upside, with the fair value estimate set well above the recent closing price of $90.19. This context hints at a compelling growth story shaping expectations behind the stock's current valuation.

Accelerating membership growth, particularly in higher-tier memberships and underpenetrated secondary markets, is likely to boost recurring revenues and expand BJ's addressable market, providing a strong base for future earnings growth. Expansion of BJ's physical footprint, with 25 to 30 new clubs planned over two years, especially in high-growth suburban and Sunbelt markets, supports sustained topline revenue growth and fixed cost leverage, which helps drive margin expansion.

Want to see what’s fueling analyst optimism? The blueprint behind this valuation features bold revenue and profit projections, and a critical future profit multiple. Discover the financial levers that could turn membership growth into market-beating gains. Curiosity piqued? The next step reveals the metrics powering this price target.

Result: Fair Value of $115.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and slower discretionary sales remain concerns. These factors could limit upside if these trends continue in the coming quarters.

Find out about the key risks to this BJ's Wholesale Club Holdings narrative.

Another View: How Do Market Ratios Stack Up?

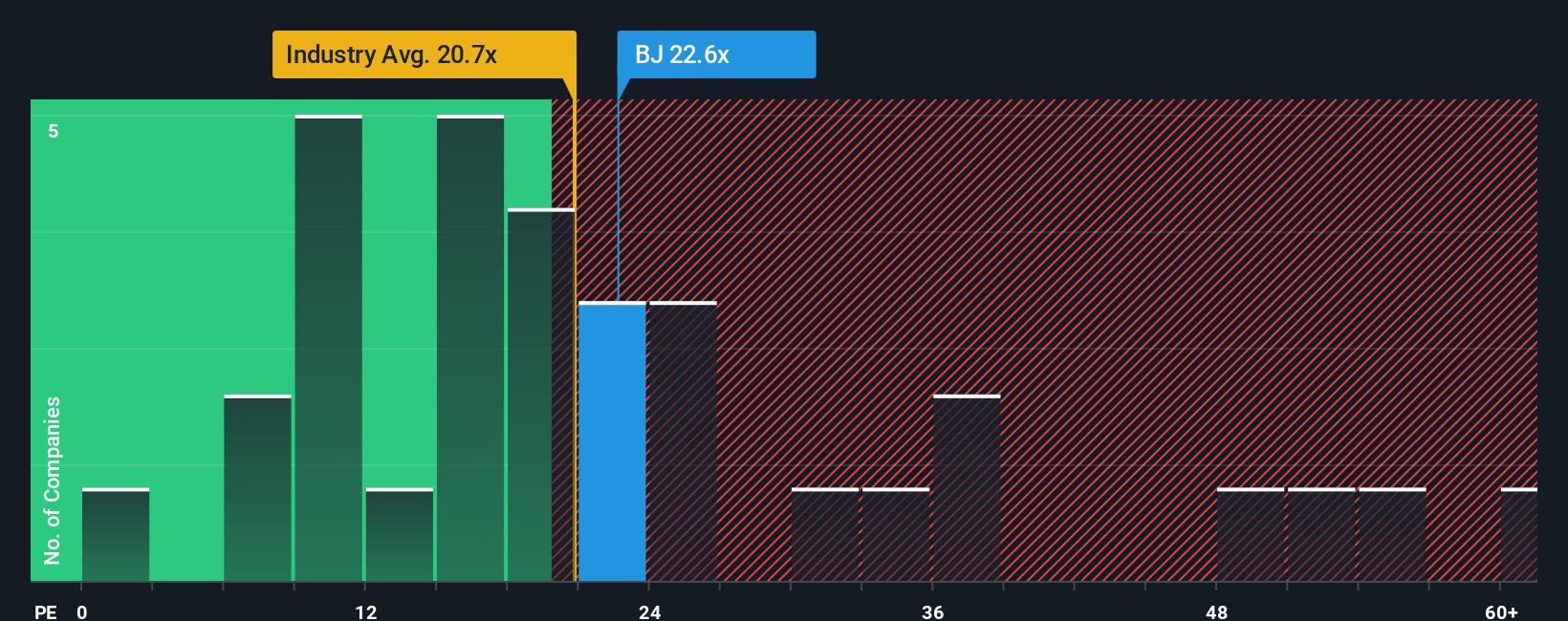

While analysts see upside, BJ's is trading at a price-to-earnings ratio of 20.5 times. This is higher than both the industry average of 19.5 and the peer average of 18. In fact, this is well above its fair ratio of just 17.9. This puts the valuation risk on the high side, which could make the stock vulnerable if expectations soften. Is growth strong enough to justify this premium, or is caution needed from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BJ's Wholesale Club Holdings Narrative

If you want to dig deeper or prefer forming your own outlook, you can analyze the numbers and build your perspective in just a few minutes. Do it your way

A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Great investors keep an eye on big opportunities. Go further with these proven stock screens, each designed to help you target market winners before others spot them.

- Capture high yields for your portfolio by checking out these 20 dividend stocks with yields > 3% to see which companies are returning more cash to shareholders.

- Join the surge in breakthrough tech innovation with these 26 AI penny stocks, which surfaces the pioneers at the forefront of artificial intelligence growth.

- Get ahead of the next wave in digital finance by tracking these 82 cryptocurrency and blockchain stocks, featuring stocks linked to cryptocurrency and blockchain trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BJ's Wholesale Club Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BJ

BJ's Wholesale Club Holdings

Operates membership warehouse clubs on the eastern half of the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives