- United States

- /

- Food and Staples Retail

- /

- NYSE:BJ

BJ's Wholesale Club (BJ): Assessing Valuation After Digital Sales Surge and Record Member Growth

Reviewed by Kshitija Bhandaru

BJ’s Wholesale Club Holdings (BJ) is in the spotlight this week with a 34% increase in digitally enabled comparable sales. Record membership income and user engagement suggest momentum, as the company focuses on its digital transformation and expansion plans.

See our latest analysis for BJ's Wholesale Club Holdings.

Momentum is picking up for BJ’s, as its digital initiatives and expanding club network have fueled operational growth and strong engagement. The company’s 1-year total shareholder return stands at 7.2%, and with five-year total shareholder return topping 127%, BJ’s has rewarded long-term investors while also raising growth expectations with its latest results.

If BJ’s digital evolution has you interested in what else is possible, now is a great chance to discover fast growing stocks with high insider ownership

After impressive digital gains and robust membership growth, the key question now is whether BJ’s stock still offers value to investors, or if the recent performance already reflects future growth prospects in the current price.

Most Popular Narrative: 19.8% Undervalued

The current fair value calculation in the most widely followed narrative puts BJ’s Wholesale Club Holdings’ shares nearly 20% below today’s price. This sets up a strong case for upside if these underlying growth assumptions prove accurate.

Accelerating membership growth, particularly in higher-tier memberships and underpenetrated secondary markets, is likely to boost recurring revenues and expand BJ's addressable market. This provides a strong base for future earnings growth. Expansion of BJ's physical footprint, with 25 to 30 new clubs planned over two years, especially in high-growth suburban and Sunbelt markets, supports sustained topline revenue growth and fixed cost leverage. This helps drive margin expansion.

Want to learn what’s powering this optimistic valuation? The narrative’s bold assumptions around recurring income and store expansion could surprise you. Which key moves might take BJ’s into a different growth league? Dive into the full story and see if the foundation justifies the price target.

Result: Fair Value of $115.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential headwinds such as ongoing macro uncertainty and softer growth in discretionary categories could challenge the bullish outlook going forward.

Find out about the key risks to this BJ's Wholesale Club Holdings narrative.

Another View: Valuation by Market Comparisons

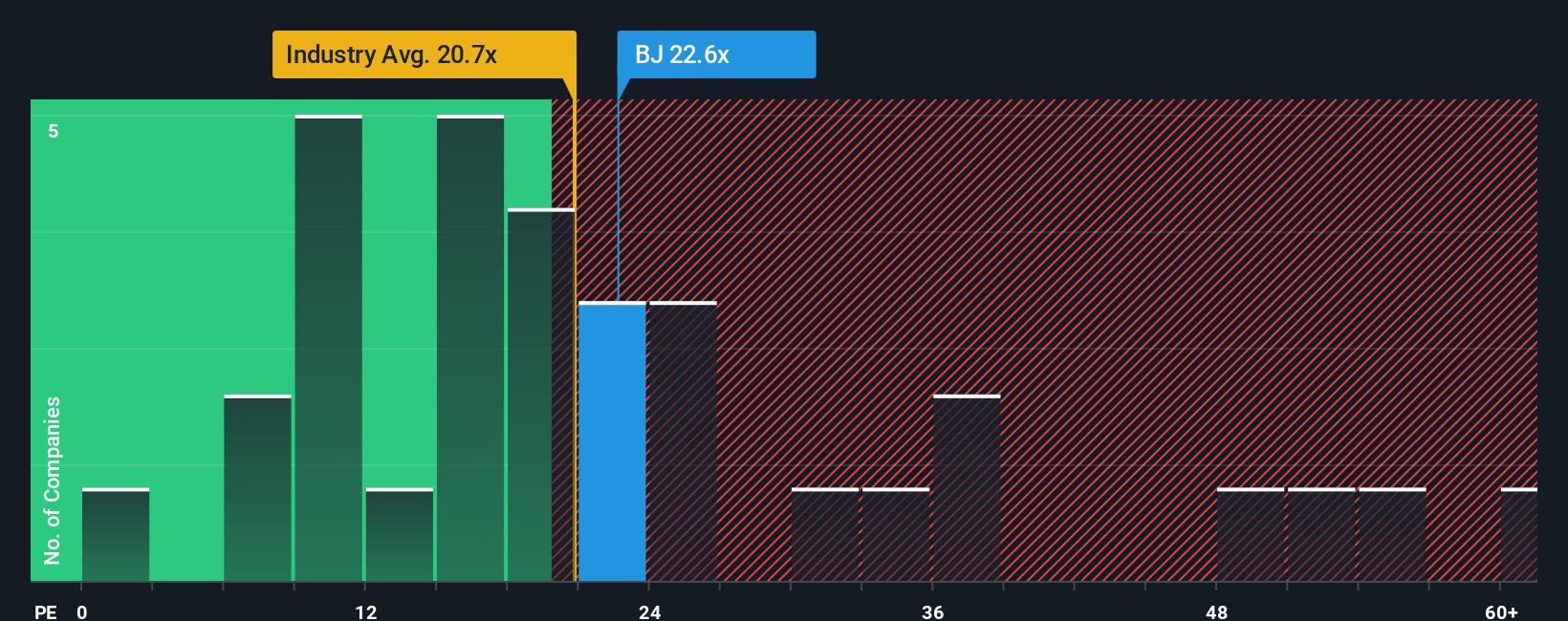

While analyst consensus sees room for upside, our market-based view tells a different story. BJ's current price-to-earnings ratio is 21.1x, noticeably higher than the average for peers at 17.8x, the U.S. Consumer Retailing industry at 21x, and the fair ratio of 19.1x. This signals that the shares may be pricey compared to where the market could eventually normalize. The current premium could signal investor confidence, or it could be a warning sign of limited value ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BJ's Wholesale Club Holdings Narrative

If you think a different set of numbers or insights leads to a new story for BJ’s, you can easily bring your own perspective to life in just minutes. Do it your way

A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take your investing to the next level with tailored stock ideas just one click away. Broaden your portfolio and don’t risk missing tomorrow’s big opportunity.

- Uncover growth potential by checking out these 24 AI penny stocks, which are transforming tomorrow’s industries through surprising innovation and bold adoption of artificial intelligence.

- Supercharge your returns by reviewing these 19 dividend stocks with yields > 3%, which consistently reward shareholders with robust payouts above market averages.

- Capitalize on value by spotting these 78 cryptocurrency and blockchain stocks, which are at the forefront of finance and blockchain-driven breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BJ's Wholesale Club Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BJ

BJ's Wholesale Club Holdings

Operates membership warehouse clubs on the eastern half of the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives