- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:PSMT

Mixed Q4 Results and Insider Sale Might Change the Case for Investing in PriceSmart (PSMT)

Reviewed by Sasha Jovanovic

- PriceSmart recently reported its fourth-quarter 2025 earnings, with earnings per share falling short of expectations but revenue exceeding forecasts, and a director sold 851 shares valued at US$99,941.

- This combination of earnings results and insider activity draws attention to operational trends amid ongoing expansion in key Latin American markets.

- To explore the implications of these mixed results, we will assess how the EPS miss adds complexity to PriceSmart's growth narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

PriceSmart Investment Narrative Recap

To be a PriceSmart shareholder, you need to believe in the company’s ability to capitalize on recurring club membership revenues and expand throughout Latin America without succumbing to margin pressures or market saturation. The recent fourth-quarter earnings miss may dampen some optimism around near-term profit growth, but the top-line beat suggests expansion remains intact; these outcomes do not significantly alter the primary short-term catalyst, continued club openings, or the biggest risk, which remains persistent foreign currency headwinds in core markets.

Among recent announcements, the planned CEO transition to David Price in September stands out, as stable and long-tenured leadership will be essential for managing growth and maintaining consistent execution during ongoing regional expansion, especially as the company navigates differing economic and competitive conditions across markets.

In contrast, there’s a risk investors should be aware of: persistent FX headwinds in places like Trinidad could create...

Read the full narrative on PriceSmart (it's free!)

PriceSmart's narrative projects $6.9 billion revenue and $209.1 million earnings by 2028. This requires 10.1% yearly revenue growth and a $66.5 million earnings increase from the current $142.6 million.

Uncover how PriceSmart's forecasts yield a $120.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

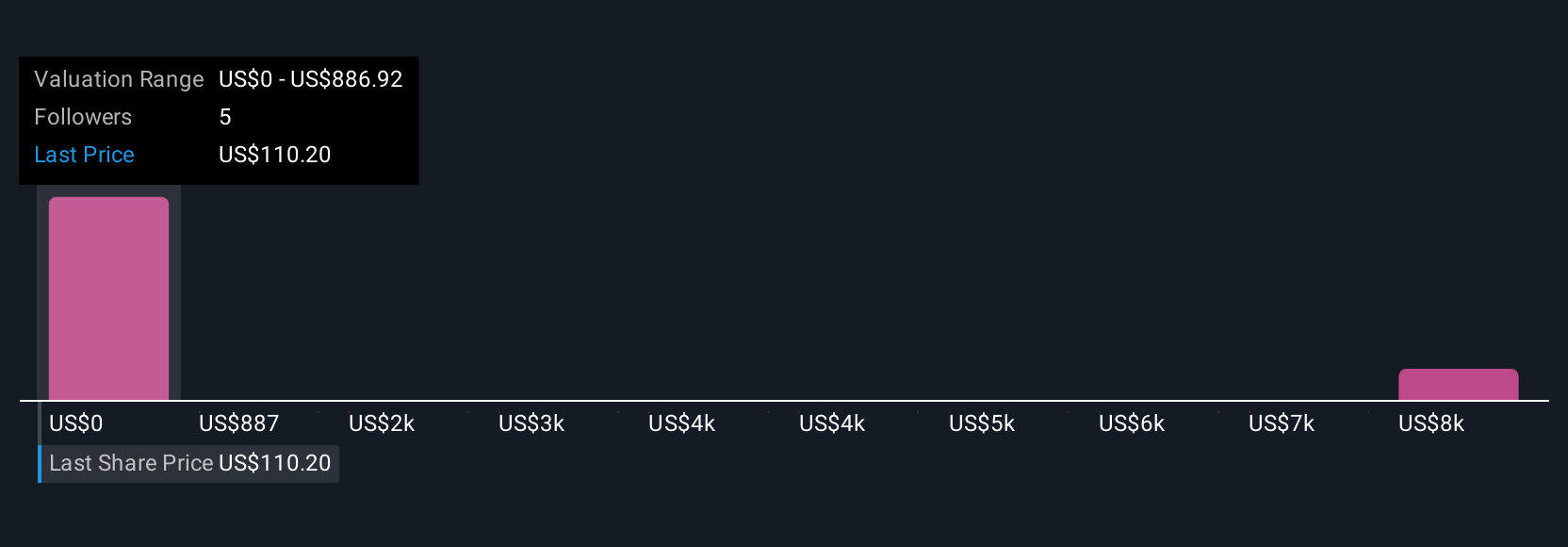

Five community-driven fair value estimates for PriceSmart from the Simply Wall St Community range widely from US$886,922 to US$8,869,220. With this diversity of opinions, and the company’s ongoing exposure to FX risk in key markets, you can explore how market participants view both challenges and opportunities facing PriceSmart.

Explore 5 other fair value estimates on PriceSmart - why the stock might be a potential multi-bagger!

Build Your Own PriceSmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PriceSmart research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PriceSmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PriceSmart's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PSMT

PriceSmart

Owns and operates U.S.-style membership shopping warehouse clubs in the United States, Central America, the Caribbean, and Colombia.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives