- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CHEF

Chefs' Warehouse (CHEF): Assessing Valuation After Strong Q3 Results and Upgraded Earnings Guidance

Reviewed by Simply Wall St

Chefs' Warehouse (CHEF) delivered strong third-quarter results, outpacing expectations with notable sales and income growth. The company also raised its full-year guidance, attracting attention from investors and industry watchers alike.

See our latest analysis for Chefs' Warehouse.

Chefs' Warehouse’s upbeat Q3 results and raised guidance have given the stock fresh momentum. The company has delivered a 14% share price return over the past month and a robust 48% total return for shareholders in the past year. Short-term gains are picking up, building on an impressive multiyear growth story that continues to attract attention.

If you're curious about what other rapidly growing companies with strong insider involvement are making moves right now, it’s worth exploring fast growing stocks with high insider ownership

The question now facing investors is whether Chefs' Warehouse’s strong results and guidance mean the stock still offers value, or if the impressive run has already baked in the company’s growth. Could there still be a buying opportunity here?

Most Popular Narrative: 16.9% Undervalued

Chefs' Warehouse's fair value, according to the most popular narrative, stands notably higher than the current share price. This hints at meaningful upside for investors if the underlying assumptions prove accurate.

Focused portfolio management and disciplined M&A support expansion, improved profitability, and sustained growth by prioritizing high-value customers and specialty products. Margin pressure persists from rising labor costs, integration challenges, supply chain volatility, geographic concentration, and exposure to secular change in the premium foodservice industry.

Want a glimpse into the financial logic driving this premium valuation? This narrative leans on a formula of robust topline growth, expanding margins, and an earnings trajectory more ambitious than the typical industry playbook. The specifics behind these projections will surprise you. Dive in to discover what numbers power this bullish call on Chefs' Warehouse.

Result: Fair Value of $76.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost inflation and the challenges of integrating new acquisitions could threaten Chefs' Warehouse's growth trajectory if these issues are not carefully managed.

Find out about the key risks to this Chefs' Warehouse narrative.

Another View: A Multiples-Based Reality Check

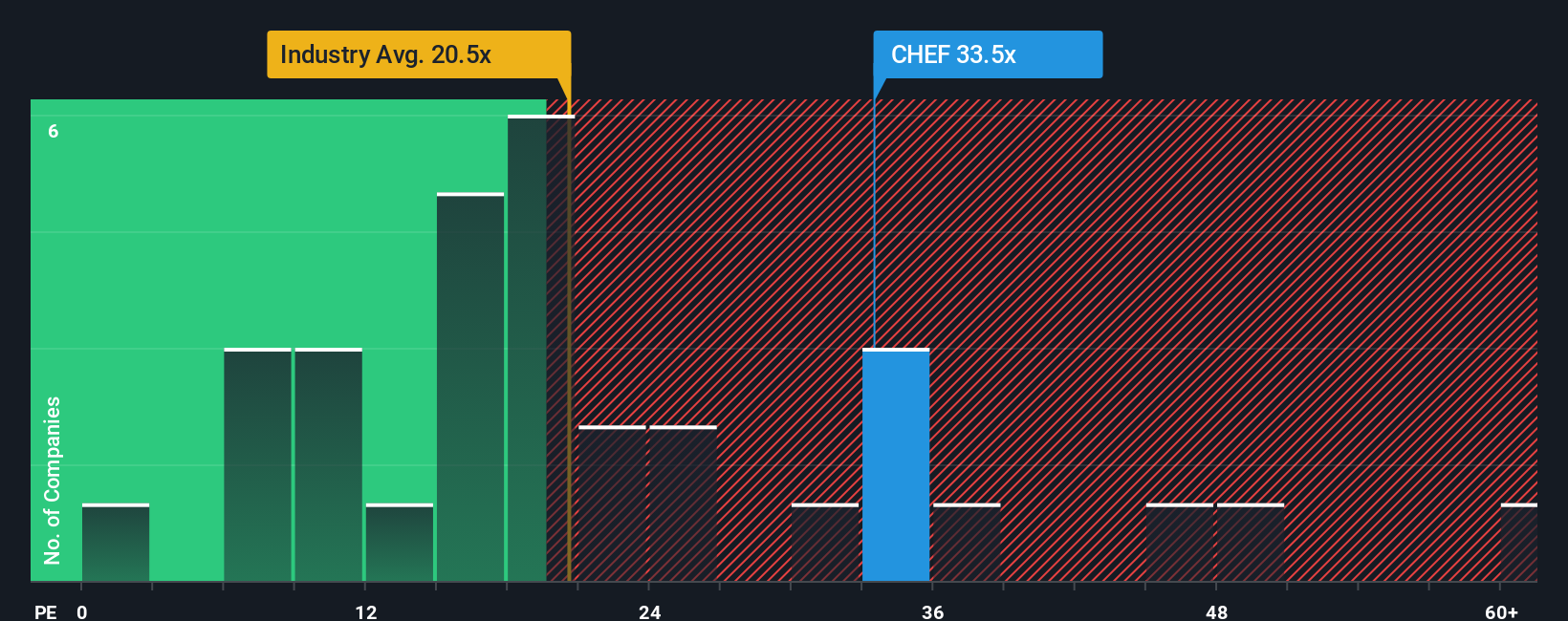

Looking beyond narrative-driven forecasts, the current price tag puts Chefs' Warehouse at a price-to-earnings ratio of 34.7x. This stands considerably above the peer average of 26.8x, the industry’s 19.7x, and even its fair ratio of 16.8x. Such a premium suggests investors are paying up for its growth, raising questions about how much future good news is already reflected in the stock price. Is this optimism justified, or could reality fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chefs' Warehouse Narrative

Curious to test your own theories or want a fresh angle on the numbers? Craft your perspective on Chefs' Warehouse and uncover unique insights in just minutes. Do it your way

A great starting point for your Chefs' Warehouse research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t sit on the sidelines while others seize new opportunities. Expand your horizons and strengthen your portfolio using these powerful tools from Simply Wall Street:

- Unlock steady returns by checking out these 17 dividend stocks with yields > 3% with yields above 3%. Secure reliable income streams for your long-term goals.

- Spot the innovators pushing boundaries by starting with these 24 AI penny stocks, where artificial intelligence meets real market momentum.

- Stay ahead of the pack and catch hidden gems by tracking these 860 undervalued stocks based on cash flows before the rest of the market takes notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHEF

Chefs' Warehouse

Distributes specialty food and center-of-the-plate products in the United States, the Middle East, and Canada.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives