- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CART

Should Instacart’s (CART) WellTheory Partnership Prompt a Rethink of Its Healthcare Ambitions?

Reviewed by Sasha Jovanovic

- WellTheory recently announced a partnership with Instacart to give roughly 300,000 autoimmune care members access to Instacart Health Fresh Funds, enabling the purchase of clinically recommended groceries through Instacart’s nationwide network.

- This collaboration highlights Instacart’s increasing role in the food-as-medicine movement, extending its reach into virtual healthcare and addressing key barriers to nutritious food access for vulnerable populations.

- With Instacart’s Fresh Funds program supporting WellTheory’s holistic health initiatives, we’ll now explore how this healthcare partnership influences Maplebear’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Maplebear Investment Narrative Recap

To hold Maplebear stock, you need confidence in Instacart’s ability to drive digital grocery adoption and build durable, high-margin revenue streams through technology and partnerships. The recent WellTheory collaboration expands Instacart’s presence in health-focused grocery delivery but does not materially affect the most important near-term catalyst: accelerating omnichannel retail integrations. The largest risk remains competitive pressure from retailer-led solutions and competing platforms, a factor this healthcare partnership only modestly addresses.

Among recent announcements, Instacart’s expanded agreement with Associated Food Stores stands out. This rollout of white-label e-commerce and retail media products highlights the company’s strategic omnichannel push, directly tied to its critical catalyst of deepening retailer partnerships and unlocking new high-margin revenue streams beyond third-party delivery.

However, unlike the positive headline impacts, investors should be aware that intensifying competition from established retailers and other delivery platforms remains a risk that could...

Read the full narrative on Maplebear (it's free!)

Maplebear's narrative projects $4.6 billion in revenue and $779.9 million in earnings by 2028. This requires 9.3% yearly revenue growth and a $300.9 million earnings increase from $479.0 million today.

Uncover how Maplebear's forecasts yield a $50.67 fair value, a 25% upside to its current price.

Exploring Other Perspectives

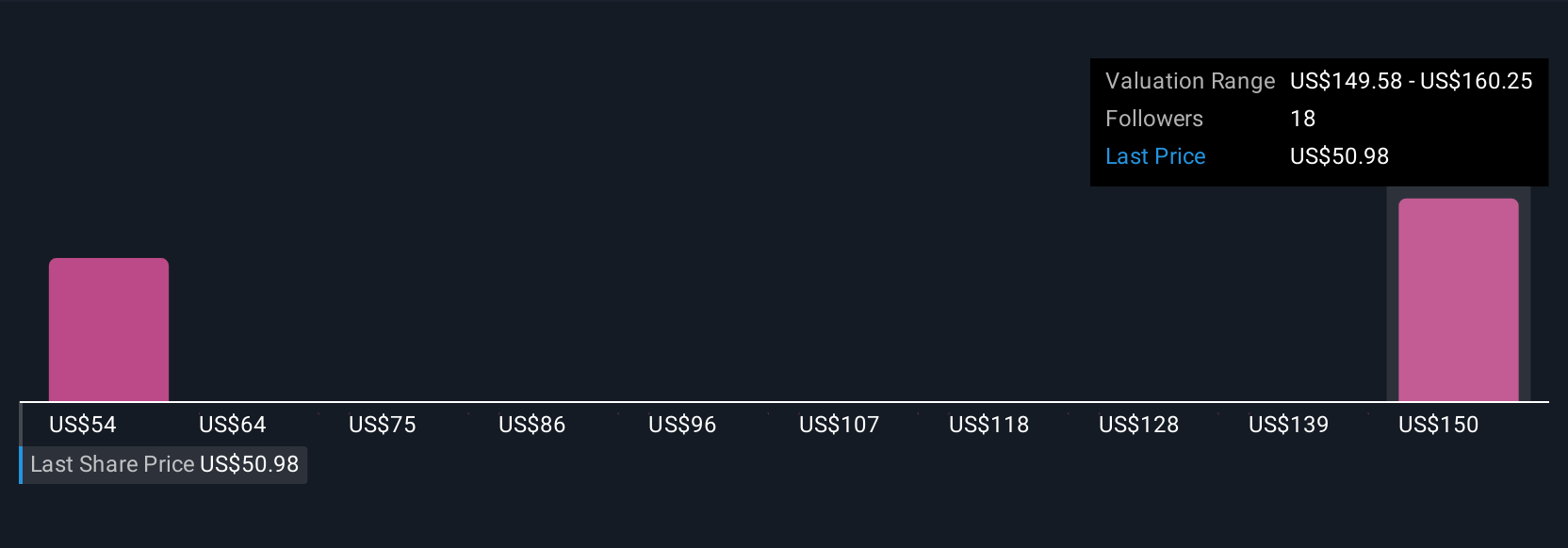

Simply Wall St Community members provided fair value estimates for Maplebear ranging from US$50.67 to US$94.63 based on two unique forecasts. Facing growing competition and ongoing partner negotiations, investor outlooks span a broad spectrum, so consider these perspectives as you shape your own view.

Explore 2 other fair value estimates on Maplebear - why the stock might be worth just $50.67!

Build Your Own Maplebear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Maplebear research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Maplebear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Maplebear's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CART

Maplebear

Maplebear Inc., doing business as Instacart, engages in the provision of online grocery shopping services to households in North America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success