- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:ANDE

Assessing Andersons (ANDE) Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Andersons.

Andersons’ 30-day share price return of nearly 7% stands out alongside an impressive 21% gain year-to-date, reflecting renewed market optimism after a period of steady but modest longer-term performance. While momentum appears to be building, its one-year total shareholder return sits at just 3.5%, which highlights the difference between recent price momentum and the broader rewards for investors.

If Andersons’ latest move has you rethinking what’s possible in the market, now might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares climbing but current prices hovering close to analyst targets, the key question is whether Andersons is still trading at an attractive valuation or if expectations for future growth are already reflected in the price.

Most Popular Narrative: 2.8% Undervalued

With Andersons’ fair value estimate of $50 set above the recent closing price of $48.62, prevailing sentiment suggests there could still be room for upside. The most commonly referenced narrative consolidates competing analyst views and lays out the drivers behind this premium valuation.

Recent acquisition of 100% ownership of ethanol plants positions Andersons to fully capture cash flow, tax credits, and margin upside from regulatory support for renewable fuels and low-carbon intensity ethanol. This directly supports future increases in earnings and net margins. In addition, expansion of Port of Houston for soybean meal exports and ongoing large U.S. harvests are expected to increase grain volumes and create new international market opportunities, improving top-line revenue and asset utilization.

What’s the story behind the optimism? This narrative hinges on a decisive shift in Andersons’ operations, signaling a leap into higher-margin markets and betting on regulatory tailwinds. The forecasts fueling this fair value rest on a bold assumption: earnings and profitability are expected to take off, if all goes to plan. Want to see the bold moves and forecasts analysts are making? Dive in for the key numbers and logic powering this valuation.

Result: Fair Value of $50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected dips in grain demand or policy changes on biofuels could quickly dampen Andersons’ impressive earnings momentum and growth outlook.

Find out about the key risks to this Andersons narrative.

Another View: Multiples Tell a Different Story

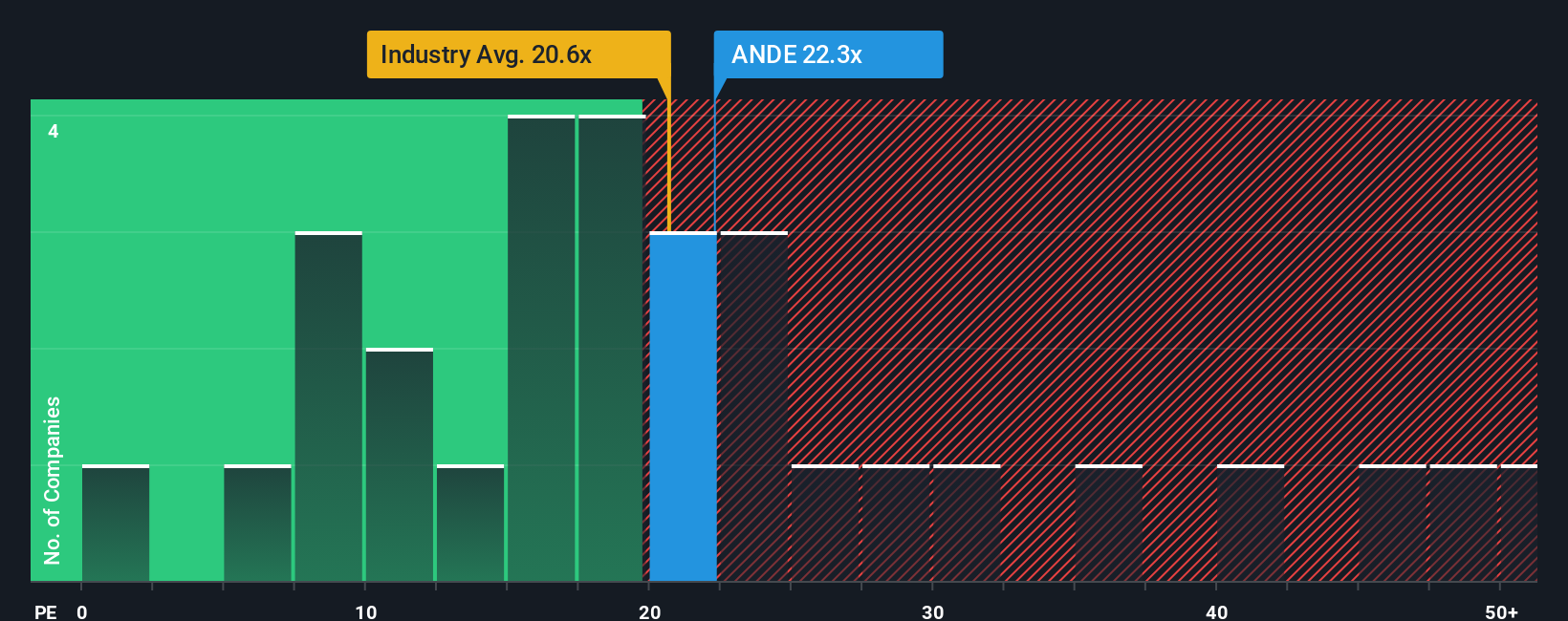

While the fair value model suggests Andersons is undervalued, a look at its price-to-earnings ratio paints a more nuanced picture. The company trades at 22.3x earnings, which is lower than the peer average of 29.1x but higher than the U.S. Consumer Retailing industry average of 20.8x. The fair ratio is estimated at 53.1x. This gap leaves investors weighing both value potential and downside risk. Which signal should guide your next move?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Andersons for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 921 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Andersons Narrative

If you see things differently or would rather follow your own research path, you can put together your own perspective in just a few minutes. Do it your way

A great starting point for your Andersons research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t let opportunities pass you by. The Simply Wall Street Screener gives you an edge to act swiftly and spot smart investments before the crowd catches up.

- Tap into groundbreaking technology themes by reviewing these 25 AI penny stocks, which are shaping tomorrow’s digital landscape and artificial intelligence innovation.

- Unlock steady cash flow options by seeking out these 16 dividend stocks with yields > 3% that offer high yields and proven resilience through market cycles.

- Ride the momentum of digital transformation by scanning these 81 cryptocurrency and blockchain stocks, leaders in blockchain and cryptocurrency adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ANDE

Andersons

Operates in trade, renewables, and nutrient and industrial sectors in the United States, Canada, Mexico, Egypt, Switzerland, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives