- United States

- /

- Luxury

- /

- NYSE:WWW

Wolverine World Wide, Inc.'s (NYSE:WWW) 38% Cheaper Price Remains In Tune With Revenues

The Wolverine World Wide, Inc. (NYSE:WWW) share price has fared very poorly over the last month, falling by a substantial 38%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

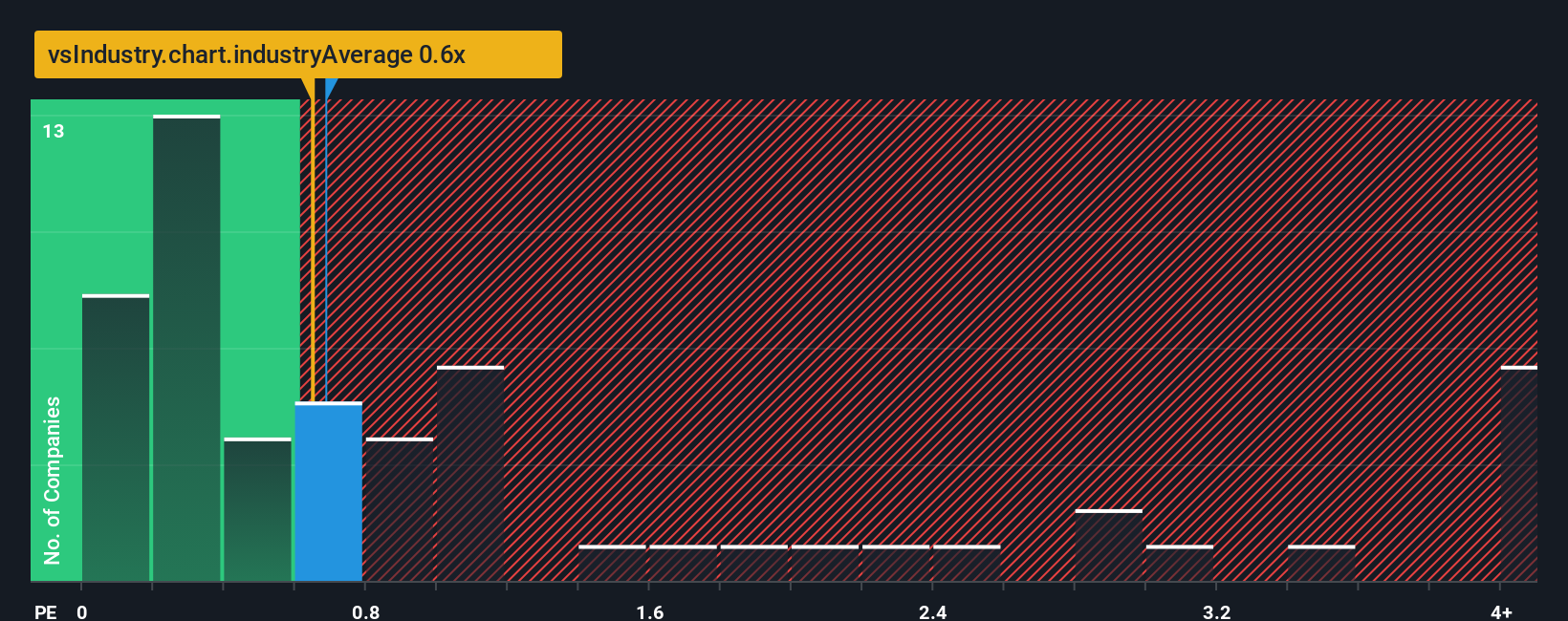

Even after such a large drop in price, it's still not a stretch to say that Wolverine World Wide's price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Luxury industry in the United States, where the median P/S ratio is around 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Wolverine World Wide

How Has Wolverine World Wide Performed Recently?

There hasn't been much to differentiate Wolverine World Wide's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Wolverine World Wide will help you uncover what's on the horizon.How Is Wolverine World Wide's Revenue Growth Trending?

Wolverine World Wide's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.6% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 30% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 5.5% as estimated by the seven analysts watching the company. With the industry predicted to deliver 5.1% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that Wolverine World Wide's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

With its share price dropping off a cliff, the P/S for Wolverine World Wide looks to be in line with the rest of the Luxury industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Wolverine World Wide's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Wolverine World Wide you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wolverine World Wide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WWW

Wolverine World Wide

Designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives